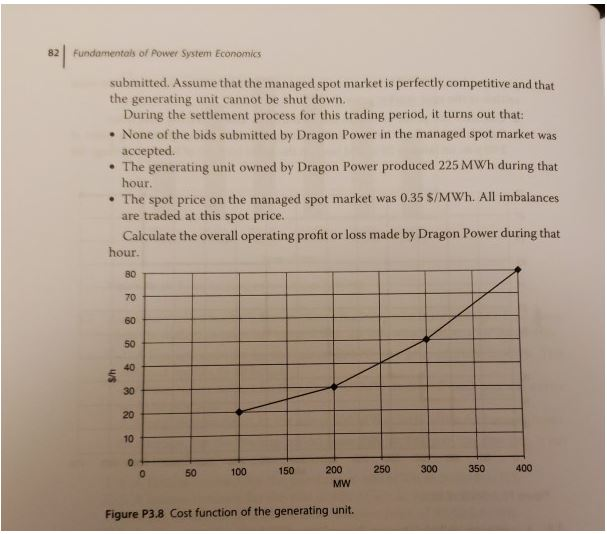

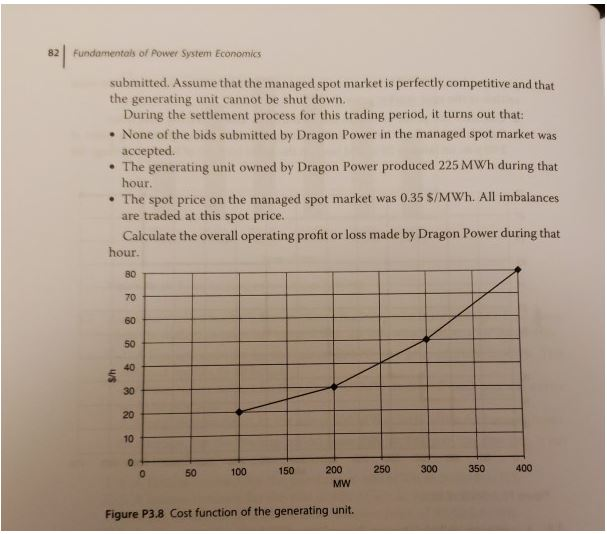

3.8 A company called "Dragon Power" owns a single generating unit whose cost function and operating limits are shown in Figure P3.8. This company participates in the Syldavian electricity market, which consists of bilateral trading followed by a managed spot market. Consider the trading period from 9:00 to 10:00 a.m. on June 11. Prior to gate closure for that trading period, Dragon Power has made the following relevant bilateral trades: Type Sold Sold Sold Bought Sold Reference Al A2 A4 Quantity (MWh) 200 100 Price (S/MWh) 75 125 25 0.22 0.30 0.28 0.25 A5 Dragon Power can submit bids to increase or decrease its energy production in the managed spot market. Considering the bilateral trades that Dragon Power has concluded, determine the quantity and price of competitive bids that could be 82 Fundamentals of Power System Economics submitted. Assume that the managed spot market is perfectly competitive and that the generating unit cannot be shut down. During the settlement process for this trading period, it turns out that: e None of the bids submitted by Dragon Power in the managed spot market was accepted. The generating unit owned by Dragon Power produced 225 MWh during that our . The spot price on the managed spot market was 0.35 S/MWh. All imbalances are traded at this spot price. Calculate the overall operating profit or loss made by Dragon Power during that hour. 80 70 60 50 30 20 10 50 100 150 200 250 300350400 MW Figure P3.8 Cost function of the generating unit. 3.8 A company called "Dragon Power" owns a single generating unit whose cost function and operating limits are shown in Figure P3.8. This company participates in the Syldavian electricity market, which consists of bilateral trading followed by a managed spot market. Consider the trading period from 9:00 to 10:00 a.m. on June 11. Prior to gate closure for that trading period, Dragon Power has made the following relevant bilateral trades: Type Sold Sold Sold Bought Sold Reference Al A2 A4 Quantity (MWh) 200 100 Price (S/MWh) 75 125 25 0.22 0.30 0.28 0.25 A5 Dragon Power can submit bids to increase or decrease its energy production in the managed spot market. Considering the bilateral trades that Dragon Power has concluded, determine the quantity and price of competitive bids that could be 82 Fundamentals of Power System Economics submitted. Assume that the managed spot market is perfectly competitive and that the generating unit cannot be shut down. During the settlement process for this trading period, it turns out that: e None of the bids submitted by Dragon Power in the managed spot market was accepted. The generating unit owned by Dragon Power produced 225 MWh during that our . The spot price on the managed spot market was 0.35 S/MWh. All imbalances are traded at this spot price. Calculate the overall operating profit or loss made by Dragon Power during that hour. 80 70 60 50 30 20 10 50 100 150 200 250 300350400 MW Figure P3.8 Cost function of the generating unit