Answered step by step

Verified Expert Solution

Question

1 Approved Answer

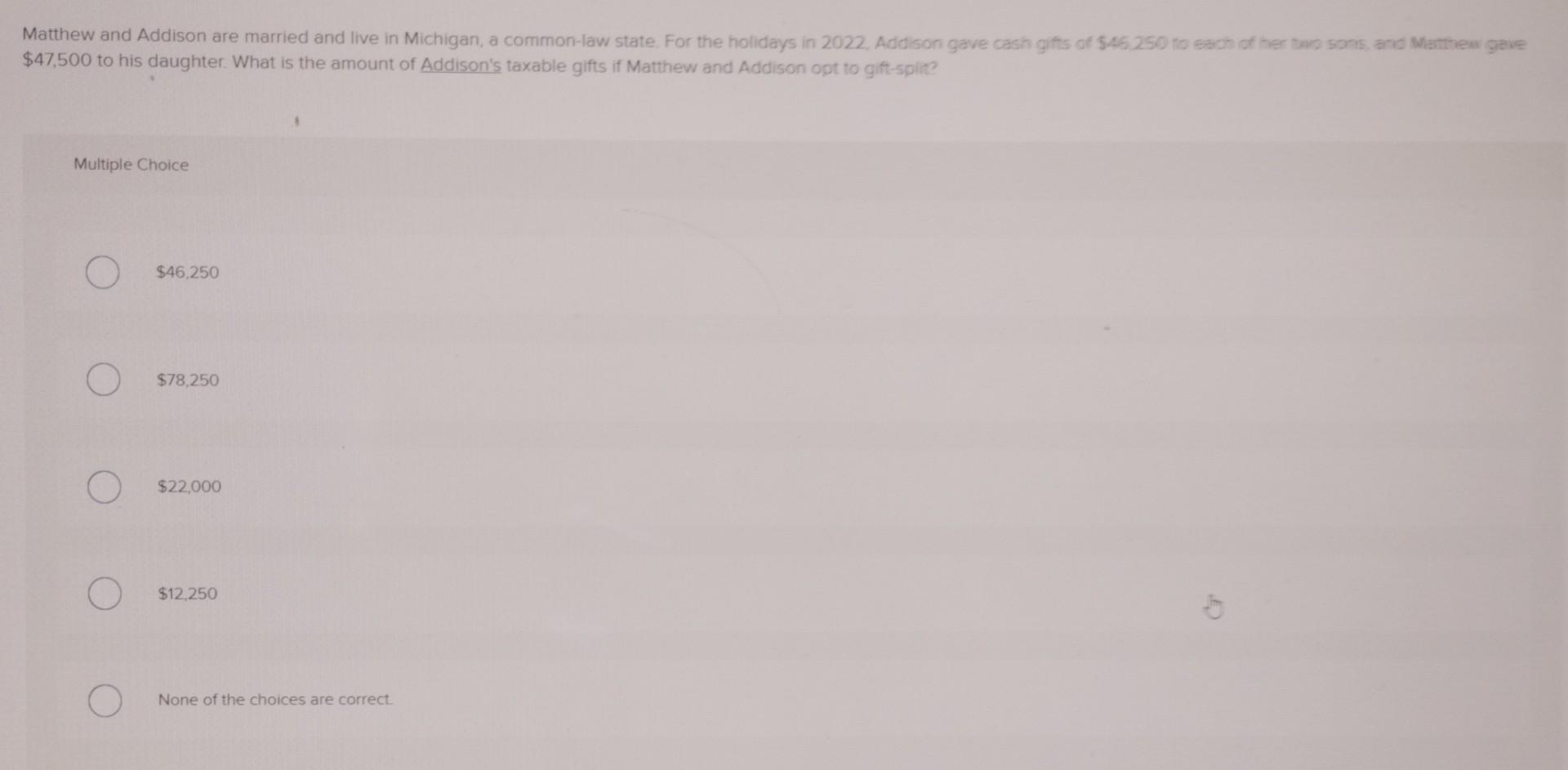

38 Matthew and Addison are married and live in Michigan, a common-law state. For the holidays in 2022 . Addison gave cash gits of 546250

38

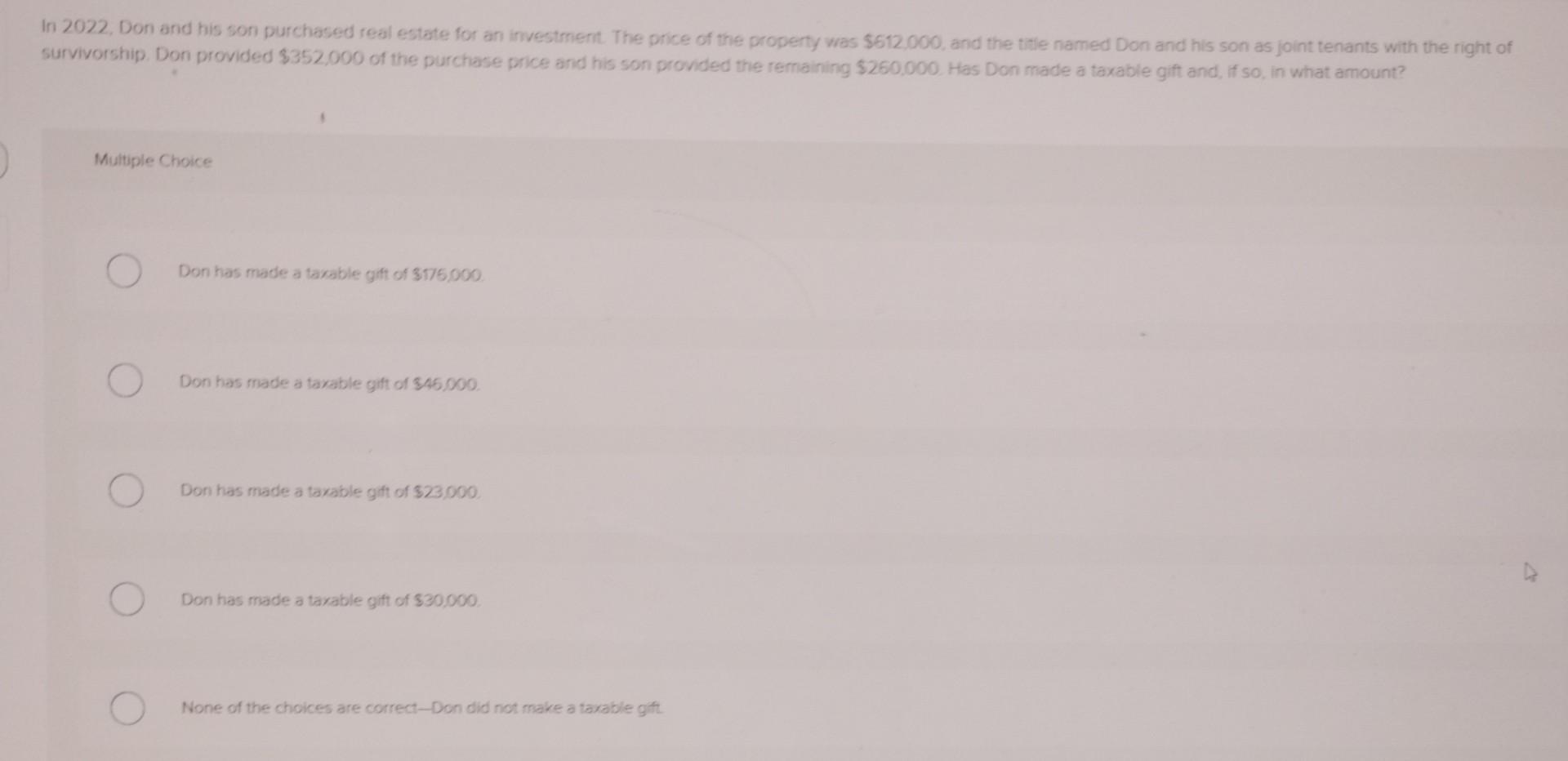

Matthew and Addison are married and live in Michigan, a common-law state. For the holidays in 2022 . Addison gave cash gits of 546250 to each of her two sons, and Marthew gave $47,500 to his daughter. What is the amount of Addison's taxable gifts if Matthew and Addison opt to gift-split? Multiple Choice $46,250 $78,250 $22,000 $12,250 None of the choices are correct. In 2022, Don and his son purchased real estate for an investment. The price of the property was $512,000, and the title named Don and his son as joint tenants with the right of survivorship. Don provided $352,000 of the purchase price and his son provided the remaining $260,000. Has Don made a taxable gift and, if so, in what amount? Multiple Choice Don has made a takable gift of 3175,000 Don has made a taxable gift of 345,000. Don has made a takable gift of $23,000 Don has made a taxable gift of $30,000 None of the choices are correct-Don did not make a taxable githStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started