Answered step by step

Verified Expert Solution

Question

1 Approved Answer

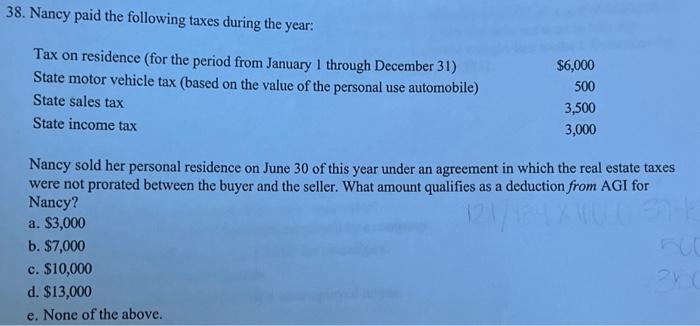

38. Nancy paid the following taxes during the year: Tax on residence (for the period from January 1 through December 31) State motor vehicle

38. Nancy paid the following taxes during the year: Tax on residence (for the period from January 1 through December 31) State motor vehicle tax (based on the value of the personal use automobile) State sales tax State income tax $6,000 500 3,500 3,000 Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller. What amount qualifies as a deduction from AGI for Nancy? a. $3,000 b. $7,000 c. $10,000 d. $13,000 e. None of the above. 121/184 HE FUC 360 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amount that qualifies as a deduction fro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started