Question

38. Two years ago, Phutki Corp. issued a $1,000 par value, 11 percent (annual payment) coupon bond. At the time the bond was issued

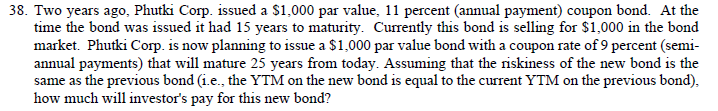

38. Two years ago, Phutki Corp. issued a $1,000 par value, 11 percent (annual payment) coupon bond. At the time the bond was issued it had 15 years to maturity. Currently this bond is selling for $1,000 in the bond market. Phutki Corp. is now planning to issue a $1,000 par value bond with a coupon rate of 9 percent (semi- annual payments) that will mature 25 years from today. Assuming that the riskiness of the new bond is the same as the previous bond (i.e., the YTM on the new bond is equal to the current YTM on the previous bond), how much will investor's pay for this new bond?

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Government and Not for Profit Accounting Concepts and Practices

Authors: Michael H. Granof, Saleha B. Khumawala

6th edition

978-1-119-4958, 9781118473047, 1118155971, 1118473043, 978-1118155974

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App