Answered step by step

Verified Expert Solution

Question

1 Approved Answer

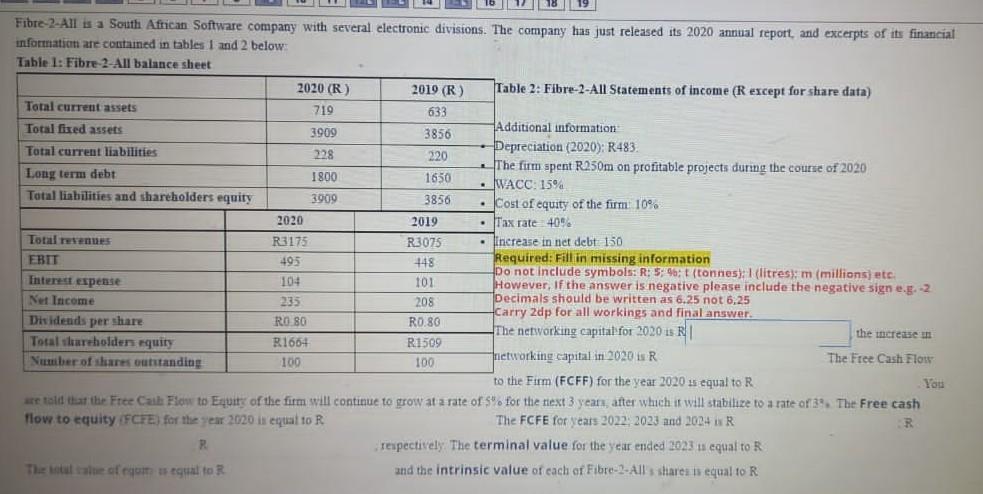

3856 2020 Fibre-2-All is a South African Software company with several electronic divisions. The company has just released its 2020 annual report and excerpts of

3856 2020 Fibre-2-All is a South African Software company with several electronic divisions. The company has just released its 2020 annual report and excerpts of its financial information and contained in tables I and 2 below Table 1: Fibre-2-All balance sheet 2020 (R) 2019 (R) Table 2: Fibre-2-All Statements of income (R except for share data) Total current assets 719 633 Total fixed assets Additional information 3909 3856 Total current liabilities Depreciation (2020): R483. 228 220 The firm spent R250m on profitable projects during the course of 2020 Long term debt 1800 1650 WACC: 15% Total liabilities and shareholders equity 3909 Cost of equity of the firm 10% 2019 Tax rate 409 Total revenues R3175 R3075 . Increase in net debt: 150 EBIT 495 Required: Fill in missing information 148 Do not include symbols: R: 5:46;t (tonnes): 1 (litres) m (millions) etc. Interest expense 104 101 However, If the answer is negative please include the negative signe.g. -2 Net Income 235 208 Decimals should be written as 6.25 not 6.25 Carry Zdp for all workings and final answer. Dividends per share R0 80 R0.80 The networking capital for 2020 13 RI the increase in Total vareholder equity R1664 R1509 Number of shares outstanding 100 100 Jetworking capital in 2020 R The Free Cash Flow to the Firm (FCFF) for the year 2020 us equal to R are told that the Free Cash Flow to Equity of the firm will continue to grow at a rate of sy for the next 3 years after which it will stabilire to a rate of 3. The Free cash flow to equity (FCFE) for the year 2020 is equal to R The FCFE for years 2022 2023 and 2004 IR respectively. The terminal value for the year ended 1023 13 equal to R The state of equus equal to R and the intrinsic value of each of Fibre-2-Alls shares is equal to R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started