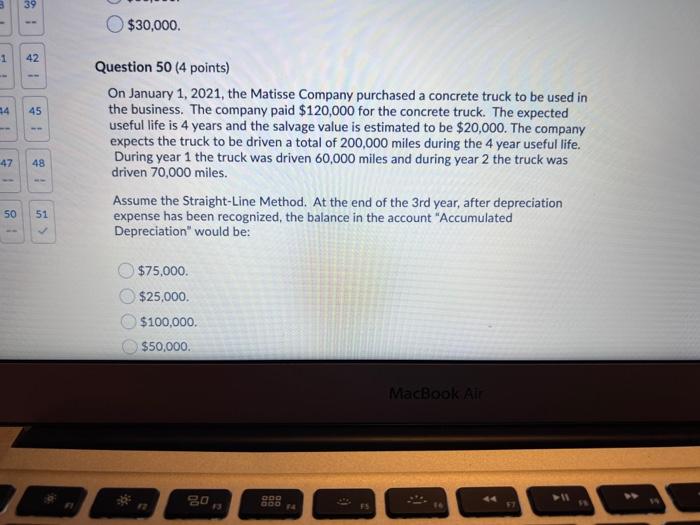

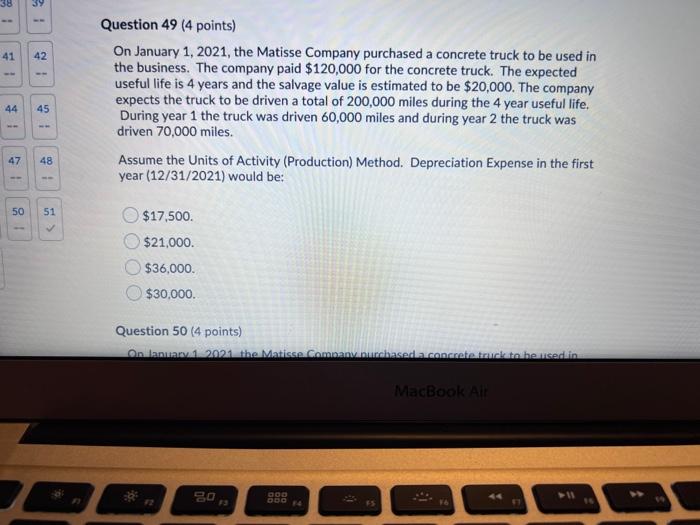

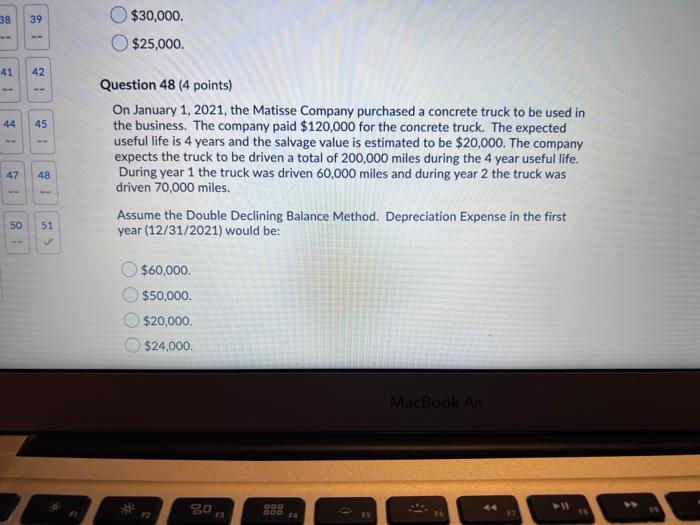

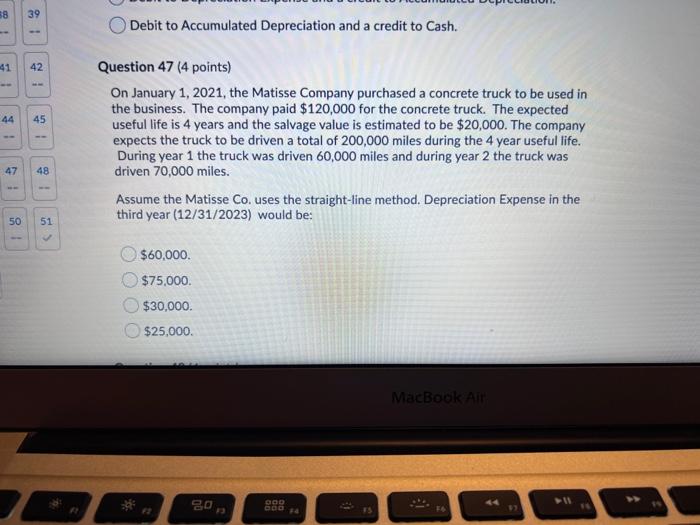

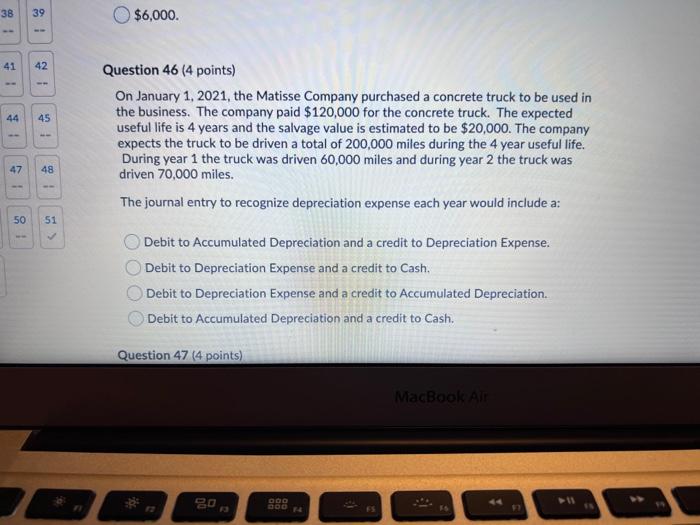

39 $30,000 1 42 24 45 Question 50 (4 points) On January 1, 2021, the Matisse Company purchased a concrete truck to be used in the business. The company paid $120,000 for the concrete truck. The expected useful life is 4 years and the salvage value is estimated to be $20,000. The company expects the truck to be driven a total of 200,000 miles during the 4 year useful life. During year 1 the truck was driven 60,000 miles and during year 2 the truck was driven 70,000 miles. Assume the Straight-Line Method. At the end of the 3rd year, after depreciation expense has been recognized, the balance in the account "Accumulated Depreciation would be: 47 48 50 51 $75,000 $25,000 $100,000. $50,000. MacBook Air 80 000 GODF 41 42 Question 49 (4 points) On January 1, 2021, the Matisse Company purchased a concrete truck to be used in the business. The company paid $120,000 for the concrete truck. The expected useful life is 4 years and the salvage value is estimated to be $20,000. The company expects the truck to be driven a total of 200,000 miles during the 4 year useful life. During year 1 the truck was driven 60,000 miles and during year 2 the truck was driven 70,000 miles. Assume the Units of Activity (Production) Method. Depreciation Expense in the first year (12/31/2021) would be: 44 45 47 48 -- 50 51 $17.500. $21,000. $36,000. $30,000 Question 50 (4 points) Onilanunc1.2021 the Matisse Company.nurchased a concrete tuck to hersedin MacBook Air 80 000 Dora 55 38 39 $30,000. $25,000 41 42 44 45 1 Question 48 (4 points) On January 1, 2021, the Matisse Company purchased a concrete truck to be used in the business. The company paid $120,000 for the concrete truck. The expected useful life is 4 years and the salvage value is estimated to be $20,000. The company expects the truck to be driven a total of 200,000 miles during the 4 year useful life. During year 1 the truck was driven 60,000 miles and during year 2 the truck was driven 70,000 miles. Assume the Double Declining Balance Method. Depreciation Expense in the first year (12/31/2021) would be: 47 48 50 51 $60,000 $50,000. $20,000 $24,000. MacBook Air 80 GOD ra 73 TE 88 39 Debit to Accumulated Depreciation and a credit to Cash. 41 42 44 45 Question 47 (4 points) On January 1, 2021, the Matisse Company purchased a concrete truck to be used in the business. The company paid $120,000 for the concrete truck. The expected useful life is 4 years and the salvage value is estimated to be $20,000. The company expects the truck to be driven a total of 200,000 miles during the 4 year useful life. During year 1 the truck was driven 60,000 miles and during year 2 the truck was driven 70,000 miles. Assume the Matisse Co. uses the straight-line method. Depreciation Expense in the third year (12/31/2023) would be: 47 48 50 51 $60,000. $75,000. $30,000 $25,000. MacBook Air gon 000 doo 38 39 $6,000. 41 42 44 45 Question 46 (4 points) On January 1, 2021, the Matisse Company purchased a concrete truck to be used in the business. The company paid $120,000 for the concrete truck. The expected useful life is 4 years and the salvage value is estimated to be $20,000. The company expects the truck to be driven a total of 200,000 miles during the 4 year useful life. During year 1 the truck was driven 60,000 miles and during year 2 the truck was driven 70,000 miles. The journal entry to recognize depreciation expense each year would include a: 47 48 2 50 51 Debit to Accumulated Depreciation and a credit to Depreciation Expense. Debit to Depreciation Expense and a credit to Cash. Debit to Depreciation Expense and a credit to Accumulated Depreciation. Debit to Accumulated Depreciation and a credit to Cash. Question 47 (4 points) MacBook Air 20 DOO