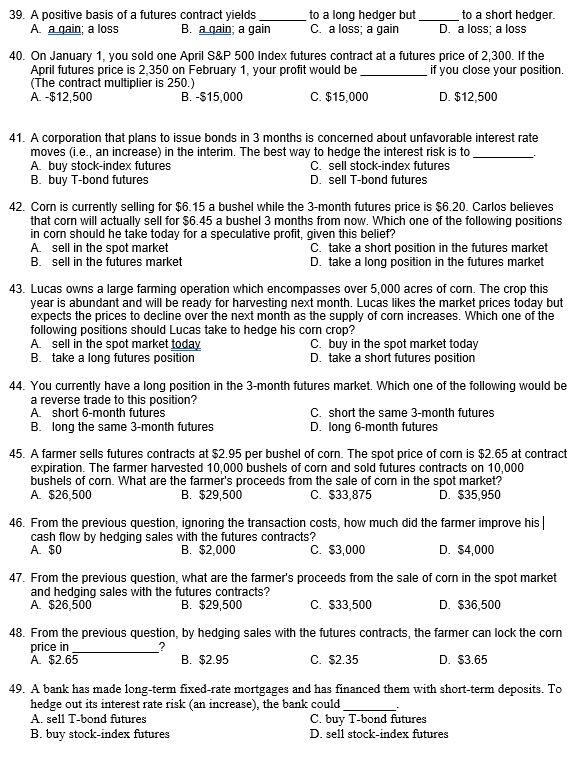

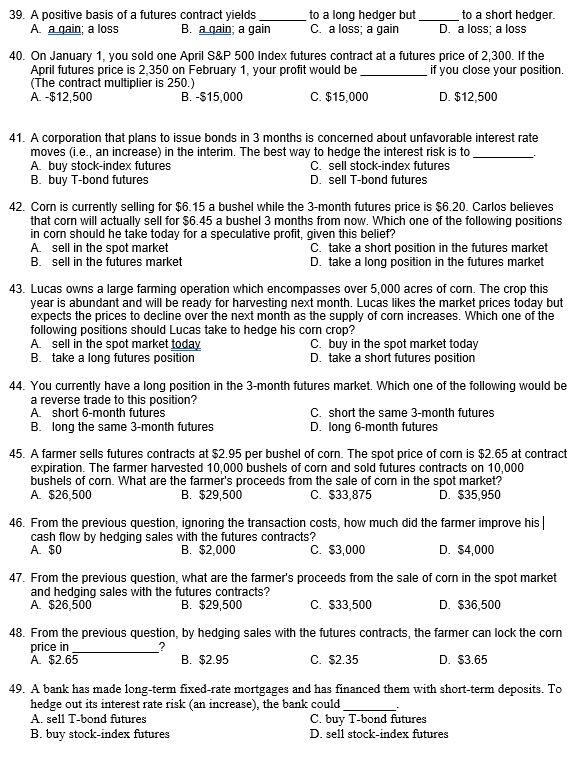

39. A positive basis of a futures contract yields to a long hedger but to a short hedger A a gain; a loss B. a gain; a gain c. a loss, a gain D. a loss; a loss 40. On January 1, you sold one April S&P 500 Index futures contract at a futures price of 2,300. If the April futures price is 2,350 on February 1, your profit would be if you close your position. (The contract multiplier is 250.) A -$12,500 B. -$15,000 C. $15,000 D. $12,500 41. A corporation that plans to issue bonds in 3 months is concerned about unfavorable interest rate moves (i.e., an increase) in the interim. The best way to hedge the interest risk is to A. buy stock-index futures C. sell stock-index futures B. buy T-bond futures D. sell T-bond futures 42. Com is currently selling for $6.15 a bushel while the 3-month futures price is $6.20. Carlos believes that cor will actually sell for $6.45 a bushel 3 months from now. Which one of the following positions in corn should he take today for a speculative profit, given this belief? A sell in the spot market C. take a short position in the futures market B. sell in the futures market D. take a long position in the futures market 43. Lucas owns a large farming operation which encompasses over 5,000 acres of corn. The crop this year is abundant and will be ready for harvesting next month. Lucas likes the market prices today but expects the prices to decline over the next month as the supply of corn increases. Which one of the following positions should Lucas take to hedge his corn crop? A sell in the spot market today C. buy in the spot market today B. take a long futures position D. take a short futures position 44. You currently have a long position in the 3-month futures market. Which one of the following would be a reverse trade to this position? A short 6-month futures C. short the same 3-month futures B. long the same 3-month futures D. long 6-month futures 45. A farmer sells futures contracts at $2.95 per bushel of corn. The spot price of corn is $2.65 at contract expiration. The farmer harvested 10,000 bushels of corn and sold futures contracts on 10,000 bushels of corn. What are the farmer's proceeds from the sale of corn in the spot market? A. $26,500 B. $29,500 C. $33,875 D. $35,950 46. From the previous question, ignoring the transaction costs, how much did the farmer improve his| cash flow by hedging sales with the futures contracts? A. $0 B. $2,000 C. $3,000 D. $4,000 47. From the previous question, what are the farmer's proceeds from the sale of corn in the spot market and hedging sales with the futures contracts? A. $26,500 B. $29,500 C. $33,500 D. $36,500 48. From the previous question, by hedging sales with the futures contracts, the farmer can lock the corn price in A $2.65 B. $2.95 C. $2.35 D. $3.65 49. A bank has made long-term fixed-rate mortgages and has financed them with short-term deposits. To hedge out its interest rate risk (an increase), the bank could A. sell T-bond futures C. buy T-bond futures B. buy stock-index futures D. sell stock-index futures