Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume transaction data from three comparable properties are used in valuing the subject property. The amount of the adjustment for each item has been

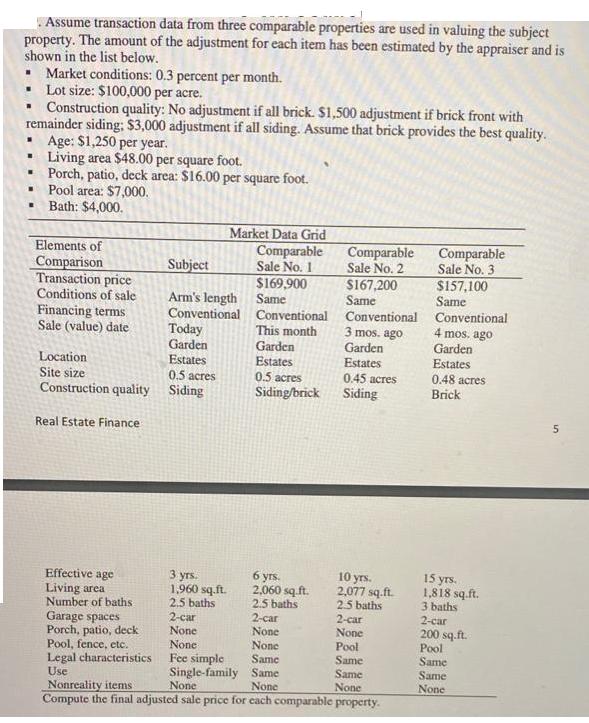

Assume transaction data from three comparable properties are used in valuing the subject property. The amount of the adjustment for each item has been estimated by the appraiser and is shown in the list below. Market conditions: 0.3 percent per month. Lot size: $100,000 per acre. Construction quality: No adjustment if all brick. $1,500 adjustment if brick front with remainder siding: $3,000 adjustment if all siding. Assume that brick provides the best quality. Age: $1,250 per year. Living area $48.00 per square foot. . Porch, patio, deck area: $16.00 per square foot. Pool area: $7,000. Bath: $4,000. . Elements of Comparison Transaction price Conditions of sale Financing terms Sale (value) date Location Site size Construction quality Real Estate Finance: Effective age Living area Number of baths Garage spaces Porch, patio, deck Pool, fence, etc. Legal characteristics Use Subject Arm's length Conventional Today Garden Estates 0.5 acres Siding Market Data Grid Comparable Sale No. 1 $169,900 Same 3 yrs. 1,960 sq.ft. 2.5 baths 2-car None None Fee simple Single-family Conventional This month Garden Estates Comparable Sale No. 2 6 yrs. 2,060 sq.ft. 2.5 baths 2-car None None Same Same None $167,200 Same Conventional 3 mos. ago Garden Estates 0.5 acres Siding/brick Siding 0.45 acres 10 yrs. 2,077 sq.ft. 2.5 baths 2-car None Pool Same Same None Nonreality items None Compute the final adjusted sale price for each comparable property. Comparable Sale No. 3 $157,100 Same Conventional 4 mos, ago Garden Estates 0.48 acres Brick 15 yrs. 1,818 sq.ft. 3 baths 2-car 200 sq.ft. Pool Same Same None 5

Step by Step Solution

★★★★★

3.50 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to compute the final adjusted sale price for each comparable property Comparable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started