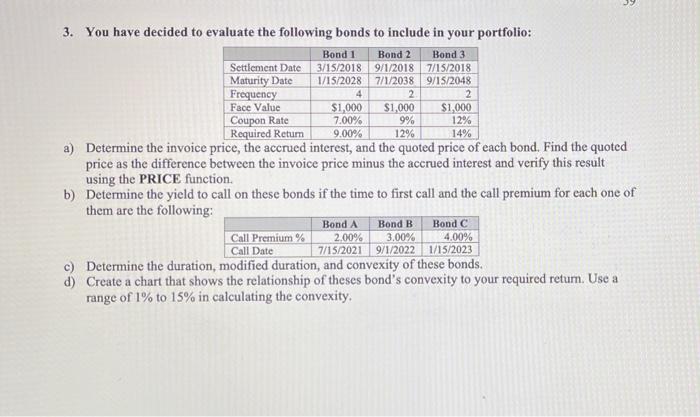

39 Bond 2 Bond 3 3. You have decided to evaluate the following bonds to include in your portfolio: Bond 1 Settlement Date 3/15/2018 9/1/2018 7/15/2018 Maturity Date 1/15/2028 7/1/2038 9/15/2048 Frequency 4 2 2 Face Value $1,000 $1,000 $1,000 Coupon Rate 7.00% 9% 12% Required Retum 9.00% 12% 14% a) Determine the invoice price, the accrued interest, and the quoted price of each bond. Find the quoted price as the difference between the invoice price minus the accrued interest and verify this result using the PRICE function. b) Determine the yield to call on these bonds if the time to first call and the call premium for each one of them are the following: Bond A Bond B Call Premium % 2.00% 3.00% 4.00% Call Date 7/15/2021 9/1/2022 1/15/2023 c) Determine the duration, modified duration, and convexity of these bonds. d) Create a chart that shows the relationship of theses bond's convexity to your required return. Use a range of 1% to 15% in calculating the convexity. Bond C 39 Bond 2 Bond 3 3. You have decided to evaluate the following bonds to include in your portfolio: Bond 1 Settlement Date 3/15/2018 9/1/2018 7/15/2018 Maturity Date 1/15/2028 7/1/2038 9/15/2048 Frequency 4 2 2 Face Value $1,000 $1,000 $1,000 Coupon Rate 7.00% 9% 12% Required Retum 9.00% 12% 14% a) Determine the invoice price, the accrued interest, and the quoted price of each bond. Find the quoted price as the difference between the invoice price minus the accrued interest and verify this result using the PRICE function. b) Determine the yield to call on these bonds if the time to first call and the call premium for each one of them are the following: Bond A Bond B Call Premium % 2.00% 3.00% 4.00% Call Date 7/15/2021 9/1/2022 1/15/2023 c) Determine the duration, modified duration, and convexity of these bonds. d) Create a chart that shows the relationship of theses bond's convexity to your required return. Use a range of 1% to 15% in calculating the convexity. Bond C