Answered step by step

Verified Expert Solution

Question

1 Approved Answer

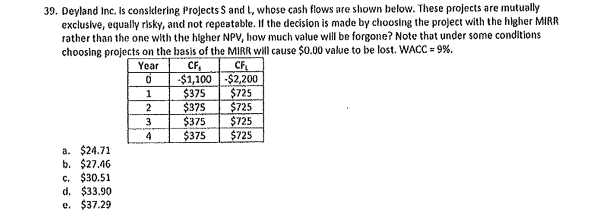

39. Deyland inc, is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable.

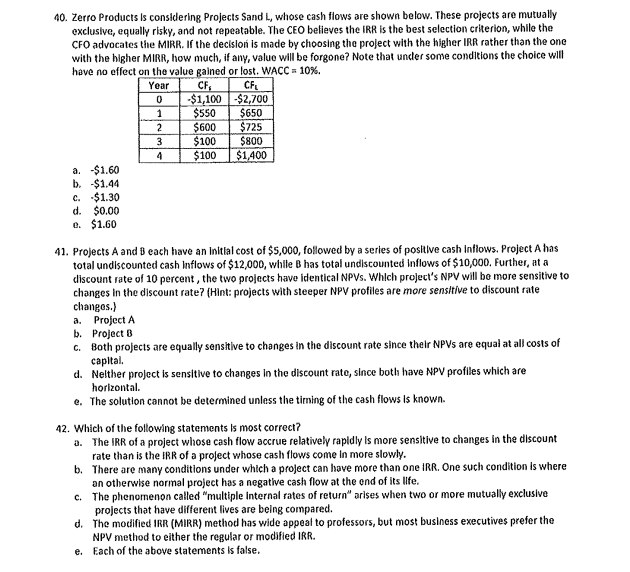

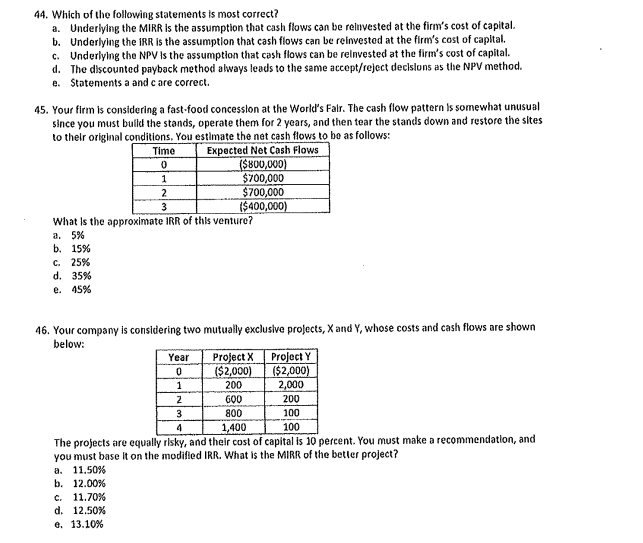

39. Deyland inc, is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the hlgher MIRR rather than the one whth the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0,00 value to be lost. WACC =9%. a. $24.71 . $27.46 c. $30.51 d. $33.90 e. $37.29 10. Zerro Products is considering Projects Sand L, whose cash flows are shown below. These projects are mutually excluslve, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone? Note that under some conditions the choice will have no effect on the value alined or lost. WACC =10%. a. $1.60 b. $1.44 c. $1.30 d. $0,00 e. $1.60 41. Projects A and B each have an initlal cost of $5,000, followed by a series of postive cash inflows. Project A has total undiscounted cash inflows of $12,000, while B has total undiscounted inflows of $10,000, further, at a discount rate of 10 percent, the two projects have identical NPVs. Which project's NPV will bo more sensitive to changes in the discount rate? (Hint: projects with steeper NPV profiles are more sensitive to discount rate changes.) a. Project A b. Project B c. Both projects are equally sensitive to changes in the discount rate since their NPVs are equal at all costs of capltal. d. Neither project is sensitive to changes in the discount rate, since both have NPV profiles which are horizontal. e. The solution cannot be determined unless the timing of the cash flows is known. 42. Which of the following statements is most correct? a. The IRR of a project whose cash flow accrue relatively rapldly is more sensitive to changes in the discount rate than is the IRR of a project whose cash flows come in more slowly. b. There are many conditions under which a project can have more than one IRR. One such condition is where on otherwtse normal project has a negative cash flow at the end of its llfe. c. The phenomenon called "multiple internal rates of return" arises when two or more mutually exclusive projects that have different lives are being compared. d. The modified IRR (MIRR) method has wide appeal to professors, but most business executives prefer the NPV method to either the regular or modified IRR. e. Each of the above statements is false. A4. Which of the following statements is most correct? a. Underlying the MIRR is the assumption that cash flows can be relnvested at the firm's cost of capital. b. Underlying the IRR is the assumption that cash flows can be reinvestod at the firm's cost of capital. c. Underlylng the NPV is the assumption that cash flows can be relnvested at the firm's cost of capital. d. The discounted payback method always leads to the same accept/reject declslons as the NPV method. e. Statements a and c are correct. 45. Your firm is considering a fast-food concession at the World's Falr. The cash flow pattern is somewhat unusual since you must buld the stands, operate them for 2 years, and then tear the stands down and restore the sites to their original conditions. You estimate the net cash flows to bo as follows: What is the approximate IRR of this venture? a. 5% b. 15% c. 25% d. 35% e. 45% 46. Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below: The projects are equally risky, and their cost of capital is 10 percent. You must make a recommendation, and you must base it on the modified IRR. What is the MIRR of the betler project? a. 11.50% b. 12.00% c. 11.70% d. 12,50% e. 13.10%

39. Deyland inc, is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the hlgher MIRR rather than the one whth the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0,00 value to be lost. WACC =9%. a. $24.71 . $27.46 c. $30.51 d. $33.90 e. $37.29 10. Zerro Products is considering Projects Sand L, whose cash flows are shown below. These projects are mutually excluslve, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone? Note that under some conditions the choice will have no effect on the value alined or lost. WACC =10%. a. $1.60 b. $1.44 c. $1.30 d. $0,00 e. $1.60 41. Projects A and B each have an initlal cost of $5,000, followed by a series of postive cash inflows. Project A has total undiscounted cash inflows of $12,000, while B has total undiscounted inflows of $10,000, further, at a discount rate of 10 percent, the two projects have identical NPVs. Which project's NPV will bo more sensitive to changes in the discount rate? (Hint: projects with steeper NPV profiles are more sensitive to discount rate changes.) a. Project A b. Project B c. Both projects are equally sensitive to changes in the discount rate since their NPVs are equal at all costs of capltal. d. Neither project is sensitive to changes in the discount rate, since both have NPV profiles which are horizontal. e. The solution cannot be determined unless the timing of the cash flows is known. 42. Which of the following statements is most correct? a. The IRR of a project whose cash flow accrue relatively rapldly is more sensitive to changes in the discount rate than is the IRR of a project whose cash flows come in more slowly. b. There are many conditions under which a project can have more than one IRR. One such condition is where on otherwtse normal project has a negative cash flow at the end of its llfe. c. The phenomenon called "multiple internal rates of return" arises when two or more mutually exclusive projects that have different lives are being compared. d. The modified IRR (MIRR) method has wide appeal to professors, but most business executives prefer the NPV method to either the regular or modified IRR. e. Each of the above statements is false. A4. Which of the following statements is most correct? a. Underlying the MIRR is the assumption that cash flows can be relnvested at the firm's cost of capital. b. Underlying the IRR is the assumption that cash flows can be reinvestod at the firm's cost of capital. c. Underlylng the NPV is the assumption that cash flows can be relnvested at the firm's cost of capital. d. The discounted payback method always leads to the same accept/reject declslons as the NPV method. e. Statements a and c are correct. 45. Your firm is considering a fast-food concession at the World's Falr. The cash flow pattern is somewhat unusual since you must buld the stands, operate them for 2 years, and then tear the stands down and restore the sites to their original conditions. You estimate the net cash flows to bo as follows: What is the approximate IRR of this venture? a. 5% b. 15% c. 25% d. 35% e. 45% 46. Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below: The projects are equally risky, and their cost of capital is 10 percent. You must make a recommendation, and you must base it on the modified IRR. What is the MIRR of the betler project? a. 11.50% b. 12.00% c. 11.70% d. 12,50% e. 13.10% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started