Answered step by step

Verified Expert Solution

Question

1 Approved Answer

39. Effect on consolidated net income of acquisition of affiliate's debt from non-affiliate A Parent Company owns 100 percent of its Subsidiary. During 2021,

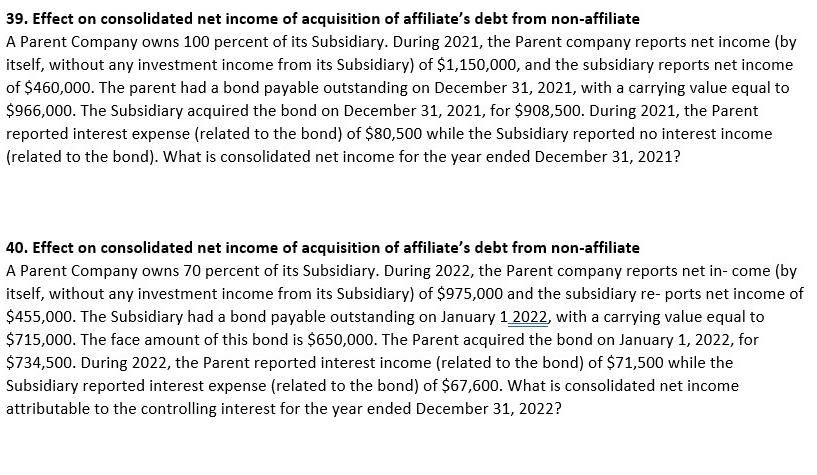

39. Effect on consolidated net income of acquisition of affiliate's debt from non-affiliate A Parent Company owns 100 percent of its Subsidiary. During 2021, the Parent company reports net income (by itself, without any investment income from its Subsidiary) of $1,150,000, and the subsidiary reports net income of $460,000. The parent had a bond payable outstanding on December 31, 2021, with a carrying value equal to $966,000. The Subsidiary acquired the bond on December 31, 2021, for $908,500. During 2021, the Parent reported interest expense (related to the bond) of $80,500 while the Subsidiary reported no interest income (related to the bond). What is consolidated net income for the year ended December 31, 2021? 40. Effect on consolidated net income of acquisition of affiliate's debt from non-affiliate A Parent Company owns 70 percent of its Subsidiary. During 2022, the Parent company reports net in- come (by itself, without any investment income from its Subsidiary) of $975,000 and the subsidiary re- ports net income of $455,000. The Subsidiary had a bond payable outstanding on January 1 2022, with a carrying value equal to $715,000. The face amount of this bond is $650,000. The Parent acquired the bond on January 1, 2022, for $734,500. During 2022, the Parent reported interest income (related to the bond) of $71,500 while the Subsidiary reported interest expense (related to the bond) of $67,600. What is consolidated net income attributable to the controlling interest for the year ended December 31, 2022?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 39 Parent Companys net income 1150000 Subsidiarys net income 460000 Interest expense report...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started