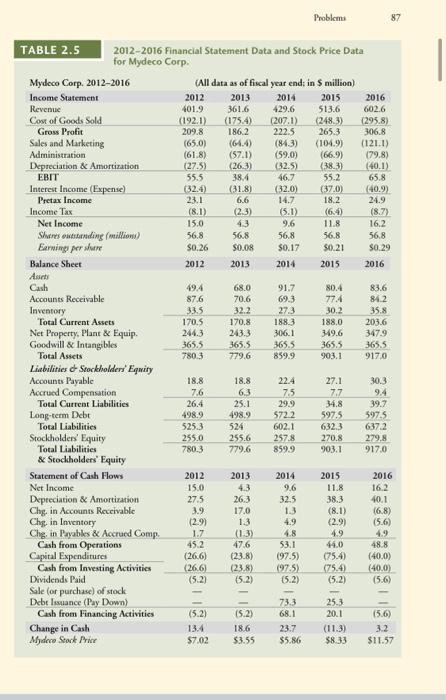

39. See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. a. Compute Mydeco's ROE each year from 2012 to 2016. b. Compute Mydeco's ROA each year from 2012 to 2016, c. Which return is more volatile? Why? ko C.T.L.5L C 1.1 IV. Problema 15.0 TABLE 2.5 2012-2016 Financial Statement Data and Stock Price Data for Mydeco Corp. Mydeco Corp. 2012-2016 (All data as of fiscal year end; in Smillion) Income Statement 2012 2013 2014 2015 2016 Revenus 401.9 361.6 429.6 513.6 602.6 Cost of Goods Sold (192.1) (175.4) (207.1) (2483) (295.8) Gross Profit 209.8 186,2 222.5 265.3 306.8 Sales and Marketing (65.0) (64.4) (843) (104.9) (121.1) Administration (61.8) (571) (59.0) (66.9) (79.8) Depreciation & Amortization (27.5) (263) (32.5) (38.3) (40.1) EBIT 55.5 38.4 46.7 55.2 65.8 Interest Income (Expense) (32.4) (31.8) 2.0) (37.0) (40.9) Pretax Income 23.1 6.6 14.7 18.2 24.9 Income Tax (8.1) (23) (5.1) (64) (8.7) Net Income 43 9.6 11.8 16.2 Sheresentinding million) 56.8 56.8 56.8 56.8 56.8 Earwimp per shume S0.26 S0.08 $0.17 $0.21 $0.29 Balance Sheet 2012 2013 2014 2015 2016 Asin Cash 494 68.0 91.7 80.4 83.6 Accounts Receivable 87.6 70.6 69.3 77.4 84.2 Inventory 33.5 32.2 273 30.2 35.8 Total Current Assets 170.5 170.8 1883 188,0 203.6 Net Property. Plant & Equip 244.3 243.3 306.1 349.6 347.9 Goodwill & Intangibles 365.5 365.5 365.5 365.5 3655 Total Assets 7803 779.6 859.9 903.1 917.0 Liabilities - Stockholders' Equity Accounts Payable 18.8 18.8 22.4 27.1 30.3 Accrued Compensation 7.6 6,3 7.5 7.7 9.4 Total Current Liabilities 26.4 25.1 29.9 34.8 39.7 Long-term Debt 498.9 498.9 5722 597.5 5975 Total Liabilities 525.3 524 602.1 632.3 637.2 Stockholders' Equity 255.0 255.6 257.8 270.8 279,8 Total Liabilities 780.3 779.6 859.9 903.1 917.0 & Stockholders' Equity Statement of Cash Flows 2012 2013 2014 2015 2016 Net Income 15.0 4.3 9.6 11.8 16.2 Depreciation & Amortization 27.5 26.3 32.5 38.3 10.1 Chg in Accounts Receivable 3.9 17.0 1.3 (8.1) 16.8) Chg. in Inventory (2.9) 1.3 4.9 (2.9) (5.6) Chg, in Payables & Accrued Comp 1.7 (1:3) 4.8 4.9 4.9 Cash from Operations 45.2 47.6 53.1 44.0 48.8 Capital Expenditures (26.6) (23.8) 197.5) (754) (40.0) Cash from Investing Activities (266) (23.8) 1975) (75.4 (400) Dividends Paid (5.21 (5.2) (5.2) (5.2) (5.6) Sale (or purchase) of stock Debe Issuance (Pay Down) 73.3 25.3 Cash from Financing Activities (5.2) (5.2) 68.1 20.1 (5.6) Change in Cash 13.4 18.6 23.7 (11.3) 3.2 Mydeco Stock Price 57.02 $3.55 $5.86 $8.33 $11.57