Answered step by step

Verified Expert Solution

Question

1 Approved Answer

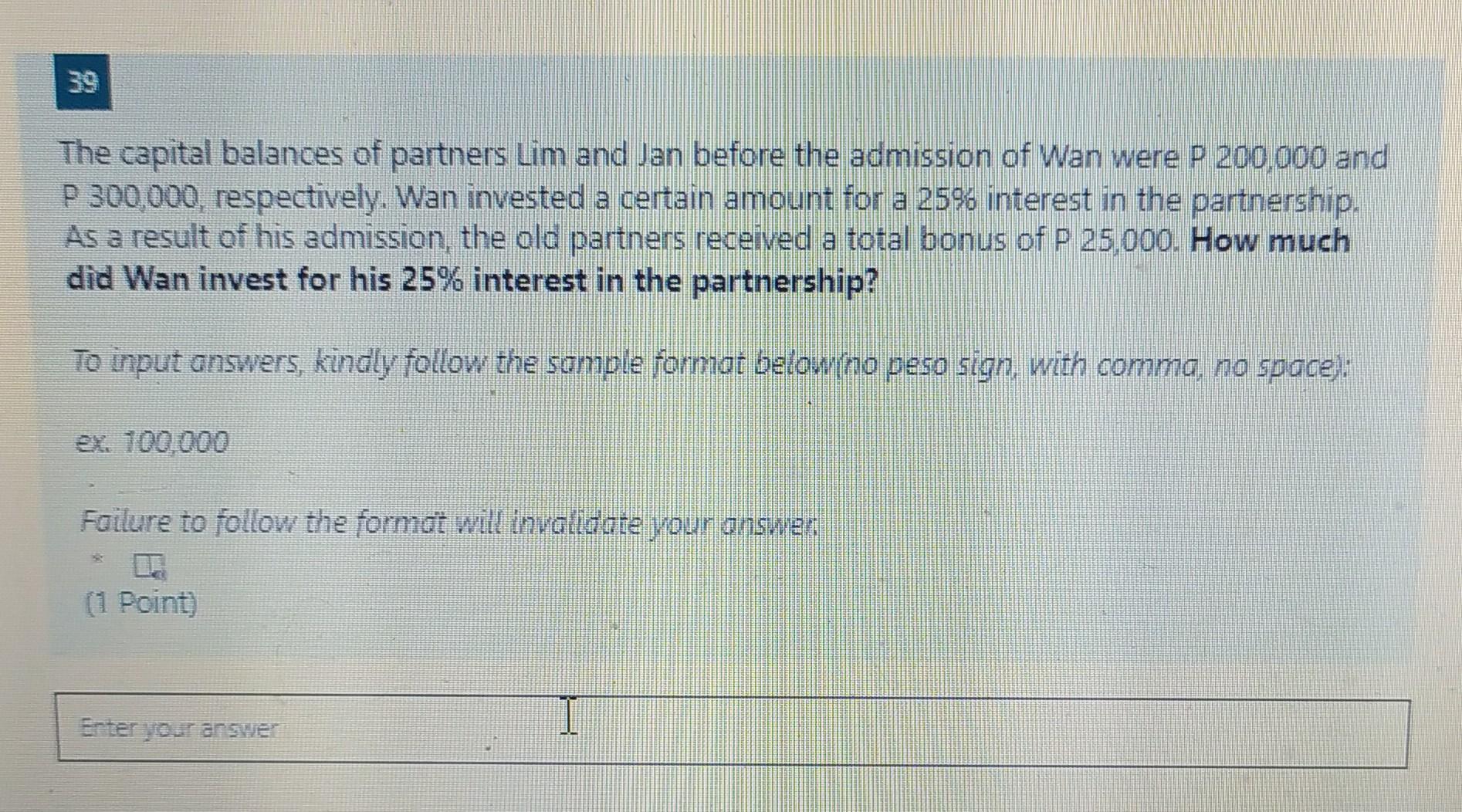

39 The capital balances of partners Lim and Jan before the admission of Wan were P 200,000 and P 300,000, respectively. Wan invested a

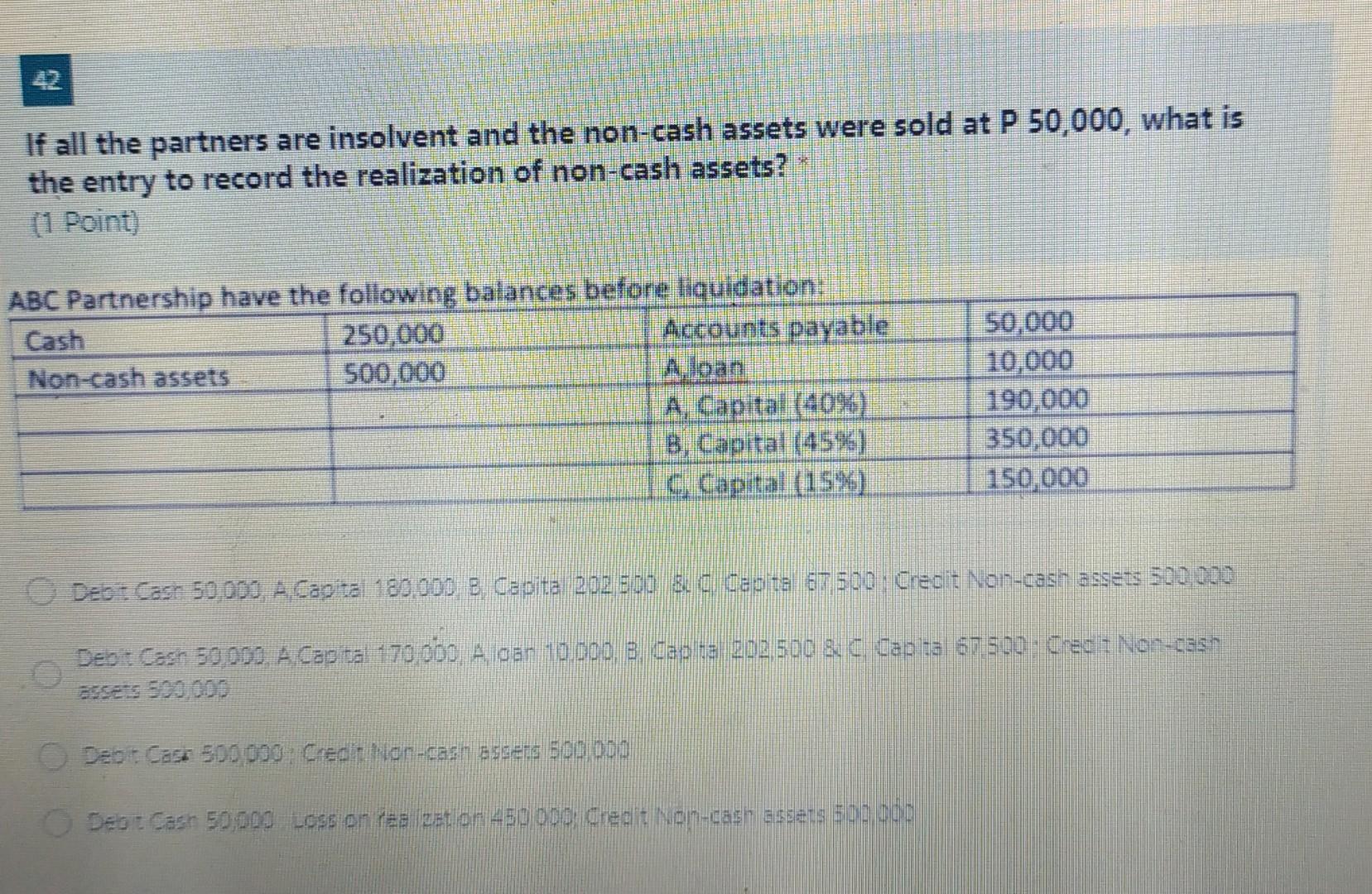

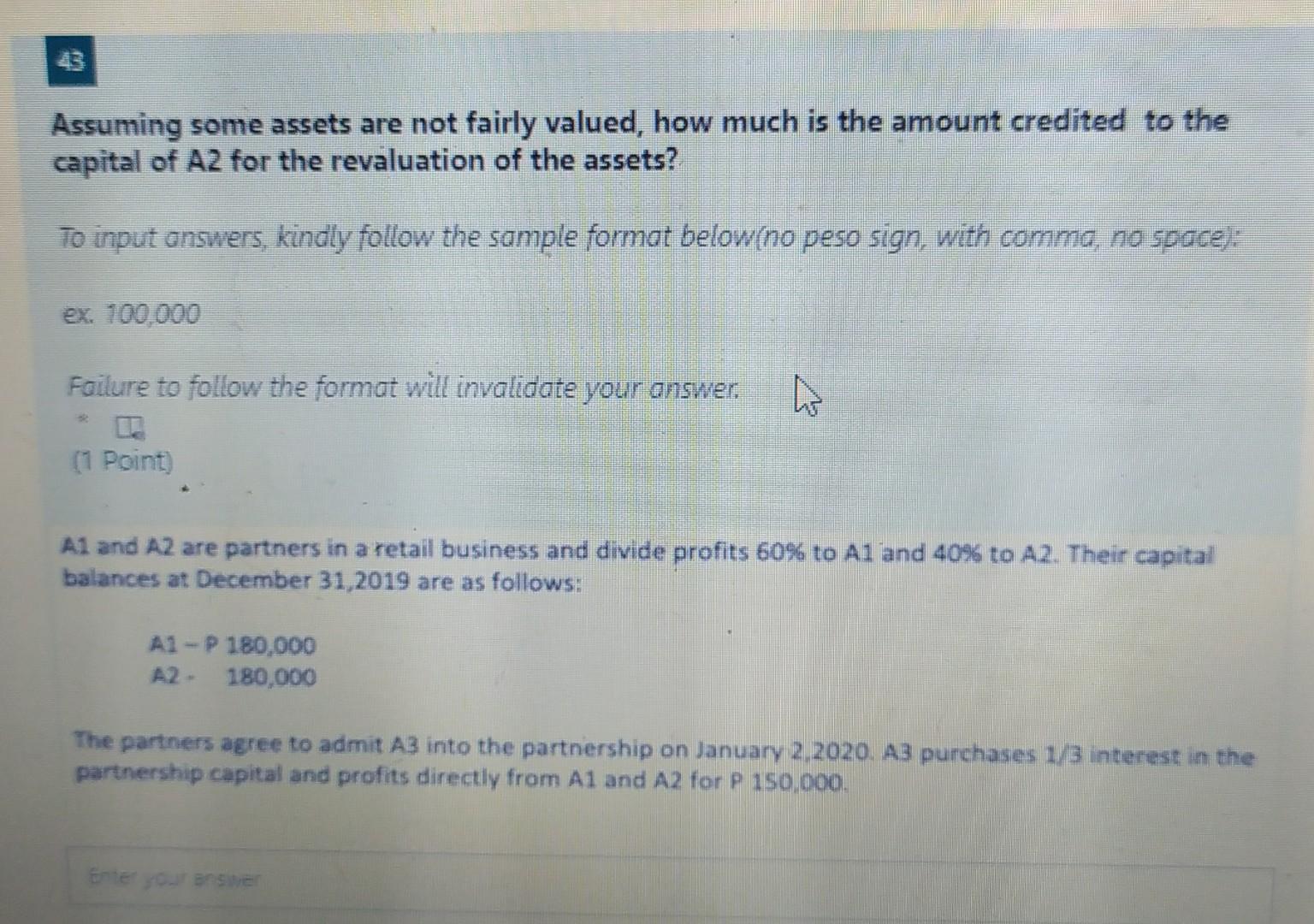

39 The capital balances of partners Lim and Jan before the admission of Wan were P 200,000 and P 300,000, respectively. Wan invested a certain amount for a 25% interest in the partnership. As a result of his admission, the old partners received a total bonus of P 25,000. How much did Wan invest for his 25% interest in the partnership? To input answers, kindly follow the sample format belowino peso sign, with comma, no space). ex. 100,000 Failure to follow the format will invalidate your answer. 0 (1 Point) Enter your answer If all the partners are insolvent and the non-cash assets were sold at P 50,000, what is the entry to record the realization of non-cash assets? (1 Point) ABC Partnership have the following balances before liquidation: Cash 250,000 Accounts payable Non-cash assets 500,000 A, Capital (40%) B, Capital (45%) C. Capital (15%) 50,000 10,000 190,000 350,000 150,000 O Debit Cash 50,000, A Capital 180,000 B Capita 202,300 &. C. Capital 67,500: Credit Non-cash assets 500,000 Debit Cash 50,000, A Capital 170,000, Algar 10,000, B. Capital 202,500 & C. Capital 67.500- Credit Non-cash Debit Cask 500,000: Credit Non-cash assets 500,000 O Debit Cash 50,000 Loss on realization 450 000; Credit Non-cash assets 500 000 Assuming some assets are not fairly valued, how much is the amount credited to the capital of A2 for the revaluation of the assets? To input answers, kindly follow the sample format below(no peso sign, with comma, no space): ex. 100,000 Failure to follow the format will invalidate your answer. (1 Point) A1 and A2 are partners in a retail business and divide profits 60% to A1 and 40% to A2. Their capital balances at December 31,2019 are as follows: A1-P 180,000 A2- 180,000 4 The partners agree to admit A3 into the partnership on January 2,2020. A3 purchases 1/3 interest in the partnership capital and profits directly from A1 and A2 for P 150,000. Enter your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 43 39 42 Existing Partners Capital Balance P 200000 300000 500000 Lim Jan Total Admission of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started