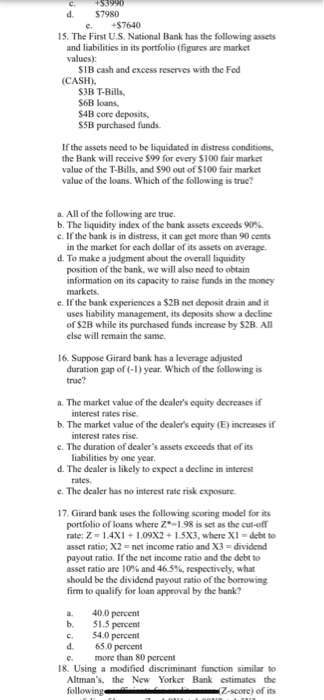

$3990 d. $7980 e. $7640 15. The First U.S. National Bank has the following assets and liabilities in its portfolio (figures are market values SIB cash and excess reserves with the Fed (CASH). S3B T-Bills. S6B loans S4B core deposits SSB purchased funds If the assets need to be liquidated in distress conditions, the Bank will receive 599 for every $100 fair market value of the T-Bills, and 590 out of $100 fair market value of the loans. Which of the following is true? a. All of the following are true. b. The liquidity index of the bank assets exceeds 90% c. If the bank is in distress, it can get more than 90 cents in the market for each dollar of its assets on average. d. To make a judgment about the overall liquidity position of the bank, we will also need to obtain information on its capacity to raise funds in the money markets e. If the bank experiences a $2B net deposit drain and it uses liability management, its deposits show a decline of $2B while its purchased funds increase by S2B. All else will remain the same. 16. Suppose Girard bank has a leverage adjusted duration gap of (-1) year. Which of the following is true? a. The market value of the dealer's equity decreases if interest rates rise. b. The market value of the dealer's equity (E) increases if interest rates rise. c. The duration of dealer's assets exceeds that of its liabilities by one year, d. The dealer is likely to expect a decline in interest rates. c. The dealer has no interest rate risk exposure. 17. Girard bank uses the following scoring model for its portfolio of loans where Z-1.98 is set as the cut-off rate: Z-1.4X1 + 1.09X2 +1.5X3, where XI = debt to asset ratio: X2 = net income ratio and X3=dividend payout ratio. Ir the net income ratio and the debt to asset ratio are 10% and 46.5%, respectively, what should be the dividend payout ratio of the borrowing firm to qualify for loan approval by the bank? a. 40.0 percent b. S1.5 percent c. 54.0 percent d. 65.0 percent e. more than 80 percent 18. Using a modified discriminant function similar to Altman's, the New Yorker Bank estimates the following Z-score) of its $3990 d. $7980 e. $7640 15. The First U.S. National Bank has the following assets and liabilities in its portfolio (figures are market values SIB cash and excess reserves with the Fed (CASH). S3B T-Bills. S6B loans S4B core deposits SSB purchased funds If the assets need to be liquidated in distress conditions, the Bank will receive 599 for every $100 fair market value of the T-Bills, and 590 out of $100 fair market value of the loans. Which of the following is true? a. All of the following are true. b. The liquidity index of the bank assets exceeds 90% c. If the bank is in distress, it can get more than 90 cents in the market for each dollar of its assets on average. d. To make a judgment about the overall liquidity position of the bank, we will also need to obtain information on its capacity to raise funds in the money markets e. If the bank experiences a $2B net deposit drain and it uses liability management, its deposits show a decline of $2B while its purchased funds increase by S2B. All else will remain the same. 16. Suppose Girard bank has a leverage adjusted duration gap of (-1) year. Which of the following is true? a. The market value of the dealer's equity decreases if interest rates rise. b. The market value of the dealer's equity (E) increases if interest rates rise. c. The duration of dealer's assets exceeds that of its liabilities by one year, d. The dealer is likely to expect a decline in interest rates. c. The dealer has no interest rate risk exposure. 17. Girard bank uses the following scoring model for its portfolio of loans where Z-1.98 is set as the cut-off rate: Z-1.4X1 + 1.09X2 +1.5X3, where XI = debt to asset ratio: X2 = net income ratio and X3=dividend payout ratio. Ir the net income ratio and the debt to asset ratio are 10% and 46.5%, respectively, what should be the dividend payout ratio of the borrowing firm to qualify for loan approval by the bank? a. 40.0 percent b. S1.5 percent c. 54.0 percent d. 65.0 percent e. more than 80 percent 18. Using a modified discriminant function similar to Altman's, the New Yorker Bank estimates the following Z-score) of its