Answered step by step

Verified Expert Solution

Question

1 Approved Answer

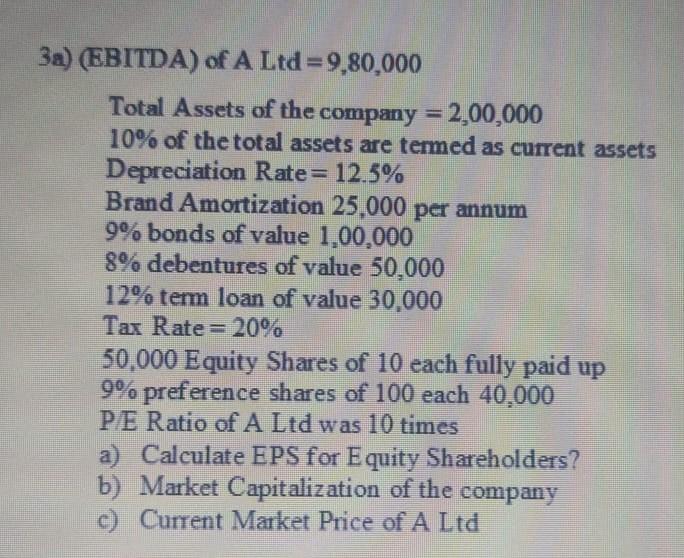

3a) (EBITDA) of A Ltd=9,80,000 Total Assets of the company = 2,00,000 10% of the total assets are termed as current assets Depreciation Rate =

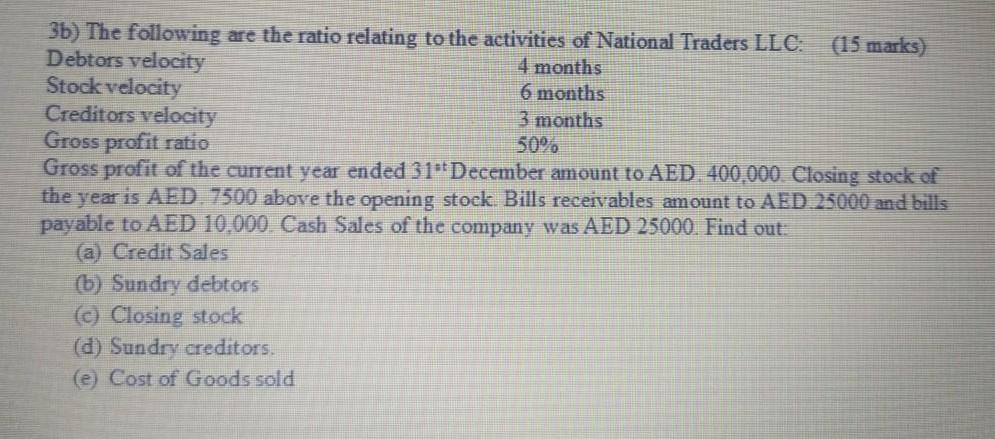

3a) (EBITDA) of A Ltd=9,80,000 Total Assets of the company = 2,00,000 10% of the total assets are termed as current assets Depreciation Rate = 12.5% Brand Amortization 25,000 pa annum 9% bonds of value 1,00,000 8% debentures of value 50,000 12% term loan of value 30,000 Tax Rate = 20% 50,000 Equity Shares of 10 each fully paid up 9% preference shares of 100 each 40.000 P/E Ratio of A Ltd was 10 times a) Calculate EPS for Equity Shareholders? b) Market Capitalization of the company c) Current Market Price of A Ltd 3b) The following are the ratio relating to the activities of National Traders LLC (15 marks) Debtors velocity 4 months Stock velocity 6 months Creditors velocity 3 months Gross profit ratio 50% Gross profit of the current year ended 31-December amount to AED. 400,000. Closing stock of the year is AED 7500 above the opening stock Bills receivables amount to AED 25000 and bills payable to AED 10,000. Cash Sales of the company was AED 25000. Find out: (a) Credit Sales (b) Sundry debtors () Closing stock (d) Sundry creditors. (e) Cost of Goods sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started