Question

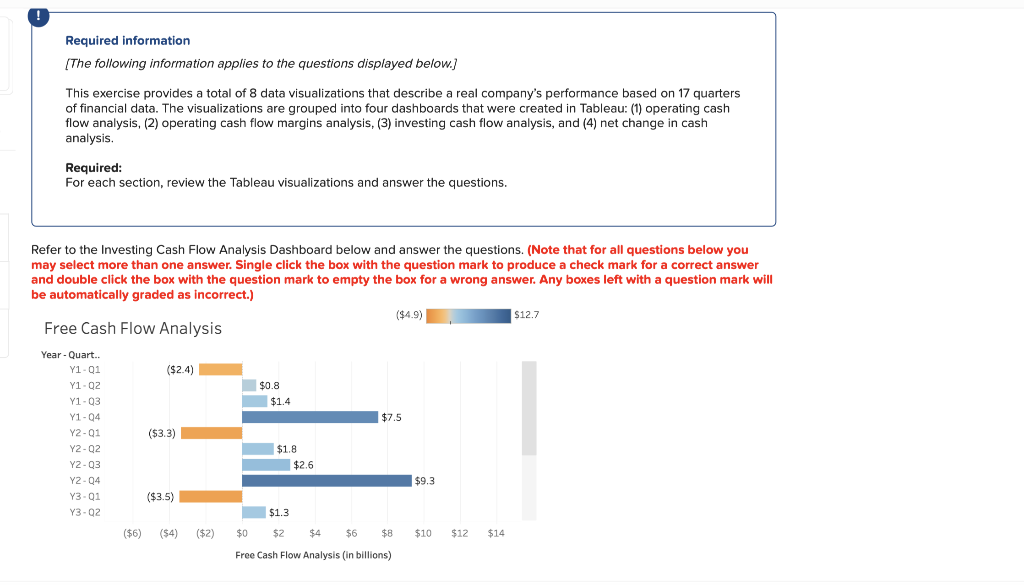

3a. Which of the following statements are true with respect to Visualization 1: Free Cash Flow Analysis? check all that apply 1 The horizontal orange

3a. Which of the following statements are true with respect to Visualization 1: Free Cash Flow Analysis?

check all that apply 1

- The horizontal orange bars arise in any quarter where the free cash flow is negative. The horizontal blue bars arise in any quarter where the free cash flow is positive.unanswered

- It begins with the first quarter of year 5 and runs consecutively and downward through the first quarter of year 1.unanswered

- It compares net income to purchases of property, plant, and equipment on a quarterly basis.unanswered

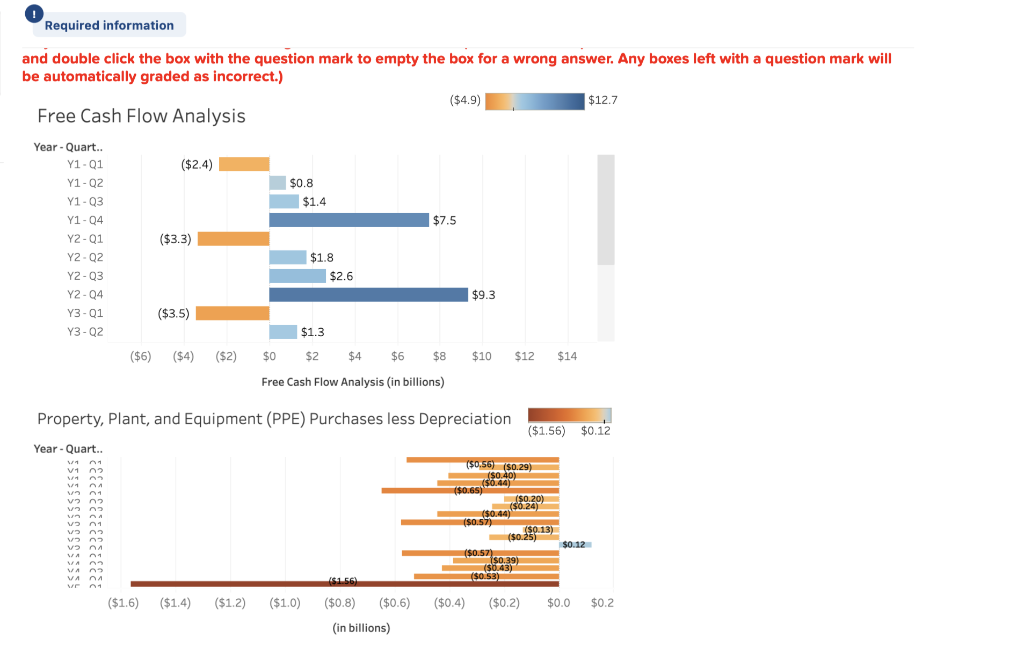

3b. Which of the following statements are true with respect to Visualization 2: Property, Plant, and Equipment Purchases less Depreciation?

check all that apply 2

- The horizontal orange bars arise in any quarter where the purchases of property, plant, and equipment are greater than that quarters depreciation charges.unanswered

- The horizontal blue bars arise in any quarter where the purchases of property, plant, and equipment are greater than that quarters depreciation charges.unanswered

- It depicts purchases of property, plant, and equipment less depreciation charges on a year-over-year basis beginning with the first quarter of years 1-5.unanswered

3c. Which of the following statements are true with respect to Visualization 1: Free Cash Flow Analysis?

check all that apply 3

- The first quarter of every year shows negative free cash flow; however, on an annual basis, the company is generating operating cash flows that far exceed its capital expenditures.unanswered

- The fourth quarter of every year shows negative free cash flow; however, on an annual basis, the company is generating operating cash flows that far exceed its capital expenditures.unanswered

- It indicates that there are a total of five quarters where the free cash flow is negative.unanswered

3d. Which of the following statements are true with respect to Visualization 2: Property, Plant, and Equipment Purchases less Depreciation?

check all that apply 4

- In 16 out of 17 quarters, the companys purchases of property, plant, and equipment are greater than its depreciation charges.unanswered

- In 16 out of 17 quarters, the companys purchases of property, plant, and equipment are less than its depreciation charges.unanswered

- The companys purchases of property, plant, and equipment never exceeded its depreciation charges by more than $200 million in any quarter.unanswered

3e. Which of the following statements are true when comparing Visualizations 1 and 2?

check all that apply 5

- Visualization 1 suggests that the company may not be investing enough money to maintain its noncurrent assets; however, Visualization 2 shows the company is generating sufficient operating cash flows to cover its capital expenditures.unanswered

- Visualization 1 shows that the company is generating sufficient operating cash flows to cover its capital expenditures; however, Visualization 2 suggests the company may not be investing enough money to maintain its noncurrent assets.unanswered

- Visualization 1 does not incorporate depreciation charges whereas Visualization 2 does incorporate depreciation charges.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started