Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3(i) Prakash, an engineer, who earns a monthly salary of RM8,000, was transferred to Kuala Lumpur with effect from 1 January 2020. As his

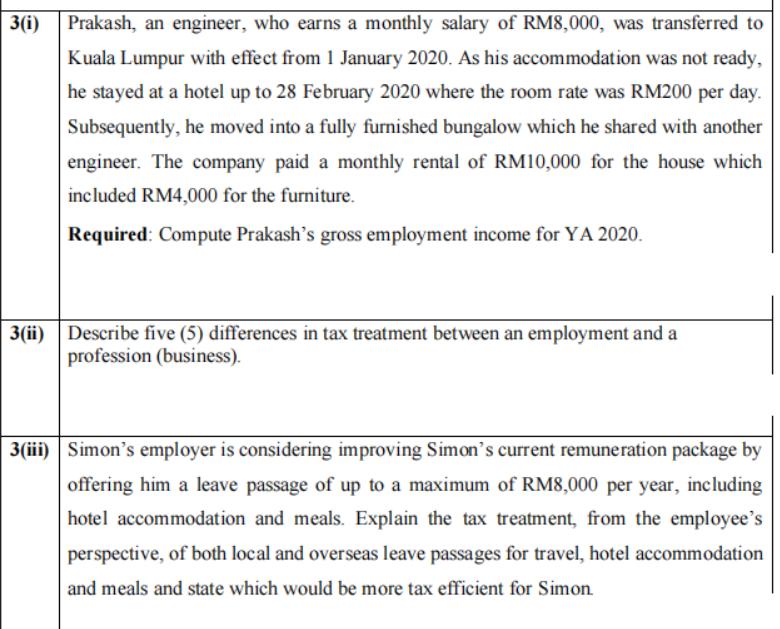

3(i) Prakash, an engineer, who earns a monthly salary of RM8,000, was transferred to Kuala Lumpur with effect from 1 January 2020. As his accommodation was not ready, he stayed at a hotel up to 28 February 2020 where the room rate was RM200 per day. Subsequently, he moved into a fully furnished bungalow which he shared with another engineer. The company paid a monthly rental of RM10,000 for the house which included RM4,000 for the furniture. Required: Compute Prakash's gross employment income for YA 2020. 3(ii) Describe five (5) differences in tax treatment between an employment and a profession (business). 3(iii) Simon's employer is considering improving Simon's current remuneration package by offering him a leave passage of up to a maximum of RM8,000 per year, including hotel accommodation and meals. Explain the tax treatment, from the employee's perspective, of both local and overseas leave passages for travel, hotel accommodation and meals and state which would be more tax efficient for Simon.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Business Differences in tax treatement between an employment and profession business Refers generally to all financial activity including the producti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started