3rd time posting plz i need answer

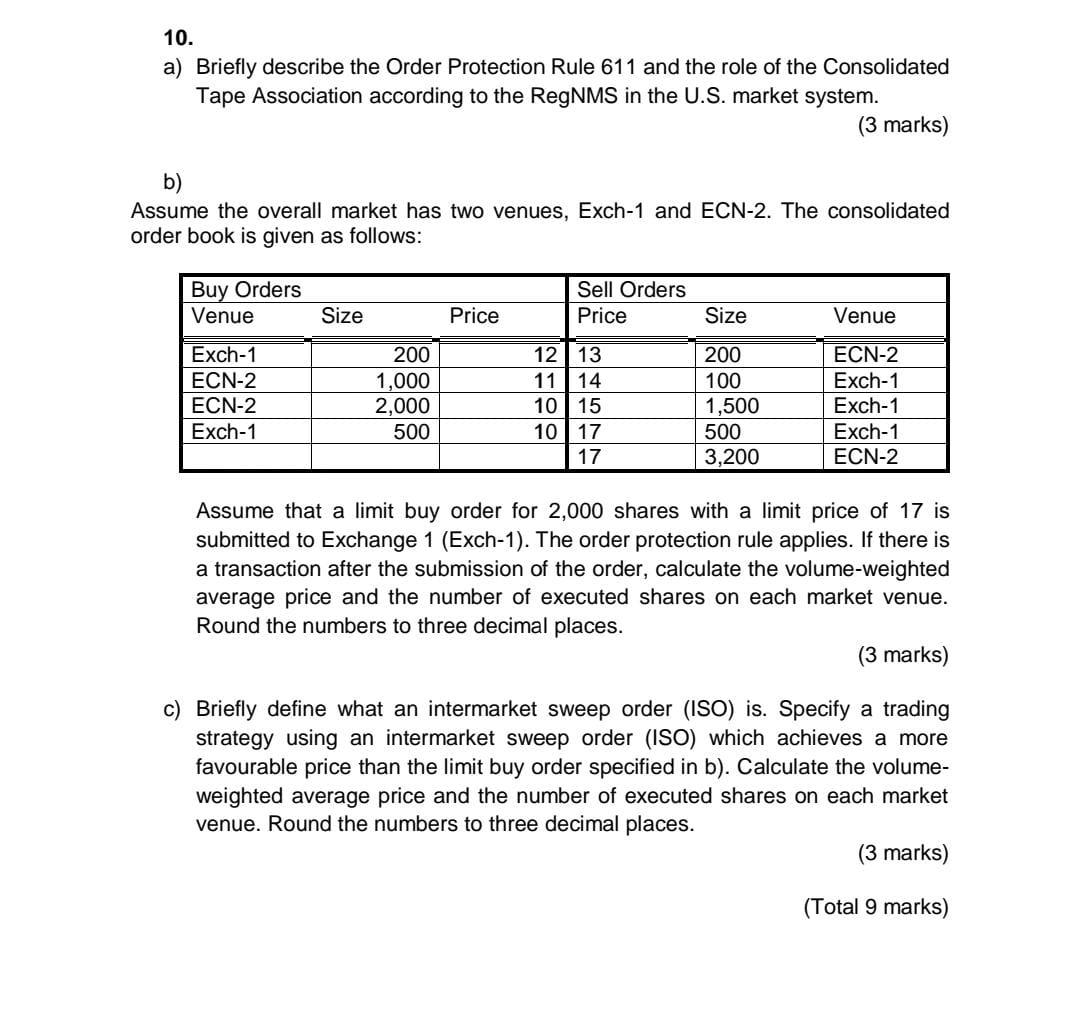

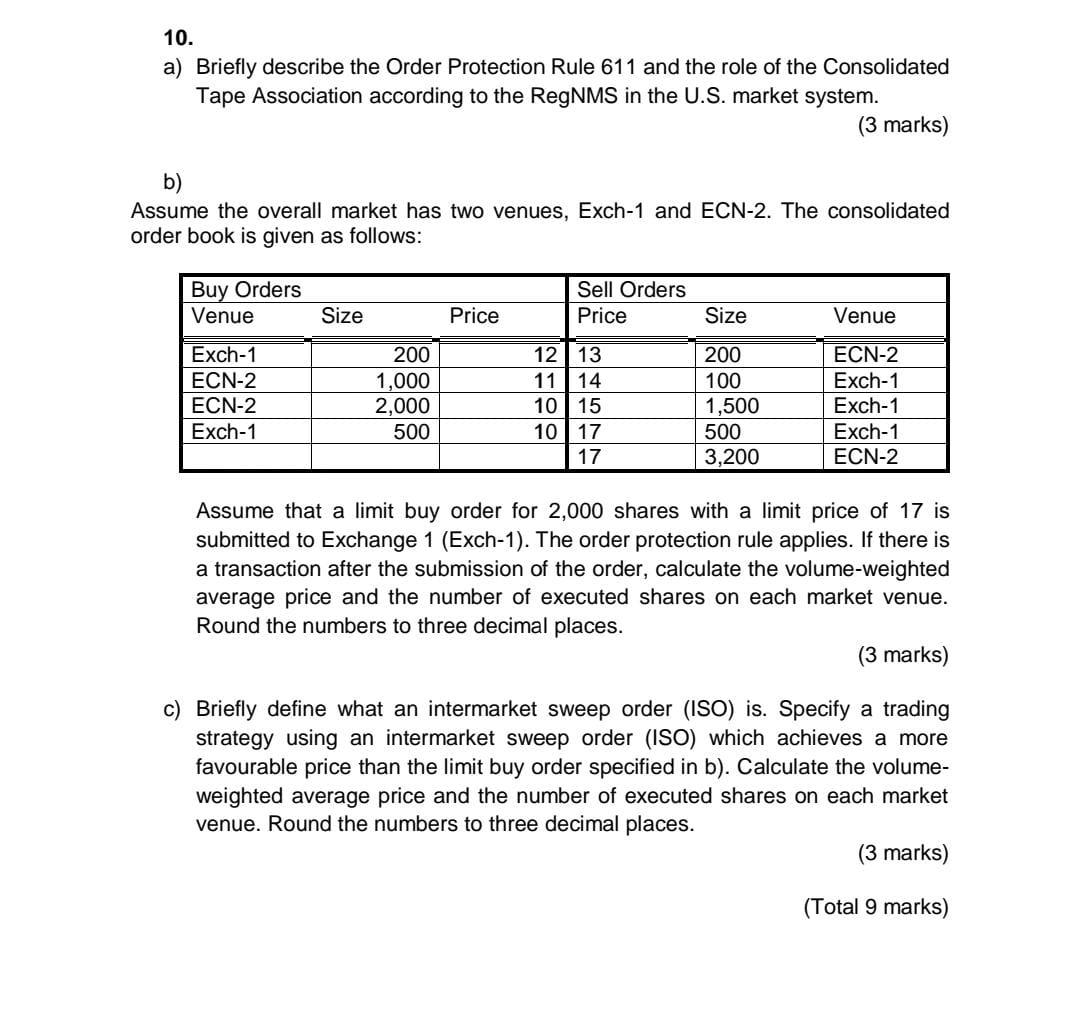

10. a) Briefly describe the Order Protection Rule 611 and the role of the Consolidated Tape Association according to the RegNMS in the U.S. market system. (3 marks) b) Assume the overall market has two venues, Exch-1 and ECN-2. The consolidated order book is given as follows: Buy Orders Venue Sell Orders Price Size Price Size Venue Exch-1 ECN-2 ECN-2 Exch-1 200 1,000 2,000 500 12 13 1114 1015 1017 17 200 100 1,500 500 3,200 ECN-2 Exch-1 Exch-1 Exch-1 ECN-2 Assume that a limit buy order for 2,000 shares with a limit price of 17 is submitted to Exchange 1 (Exch-1). The order protection rule applies. If there is a transaction after the submission of the order, calculate the volume-weighted average price and the number of executed shares on each market venue. Round the numbers to three decimal places. (3 marks) c) Briefly define what an intermarket sweep order (ISO) is. Specify a trading strategy using an intermarket sweep order (ISO) which achieves a more favourable price than the limit buy order specified in b). Calculate the volume- weighted average price and the number of executed shares on each market venue. Round the numbers to three decimal places. (3 marks) (Total 9 marks) 10. a) Briefly describe the Order Protection Rule 611 and the role of the Consolidated Tape Association according to the RegNMS in the U.S. market system. (3 marks) b) Assume the overall market has two venues, Exch-1 and ECN-2. The consolidated order book is given as follows: Buy Orders Venue Sell Orders Price Size Price Size Venue Exch-1 ECN-2 ECN-2 Exch-1 200 1,000 2,000 500 12 13 1114 1015 1017 17 200 100 1,500 500 3,200 ECN-2 Exch-1 Exch-1 Exch-1 ECN-2 Assume that a limit buy order for 2,000 shares with a limit price of 17 is submitted to Exchange 1 (Exch-1). The order protection rule applies. If there is a transaction after the submission of the order, calculate the volume-weighted average price and the number of executed shares on each market venue. Round the numbers to three decimal places. (3 marks) c) Briefly define what an intermarket sweep order (ISO) is. Specify a trading strategy using an intermarket sweep order (ISO) which achieves a more favourable price than the limit buy order specified in b). Calculate the volume- weighted average price and the number of executed shares on each market venue. Round the numbers to three decimal places. (3 marks) (Total 9 marks)