Answered step by step

Verified Expert Solution

Question

1 Approved Answer

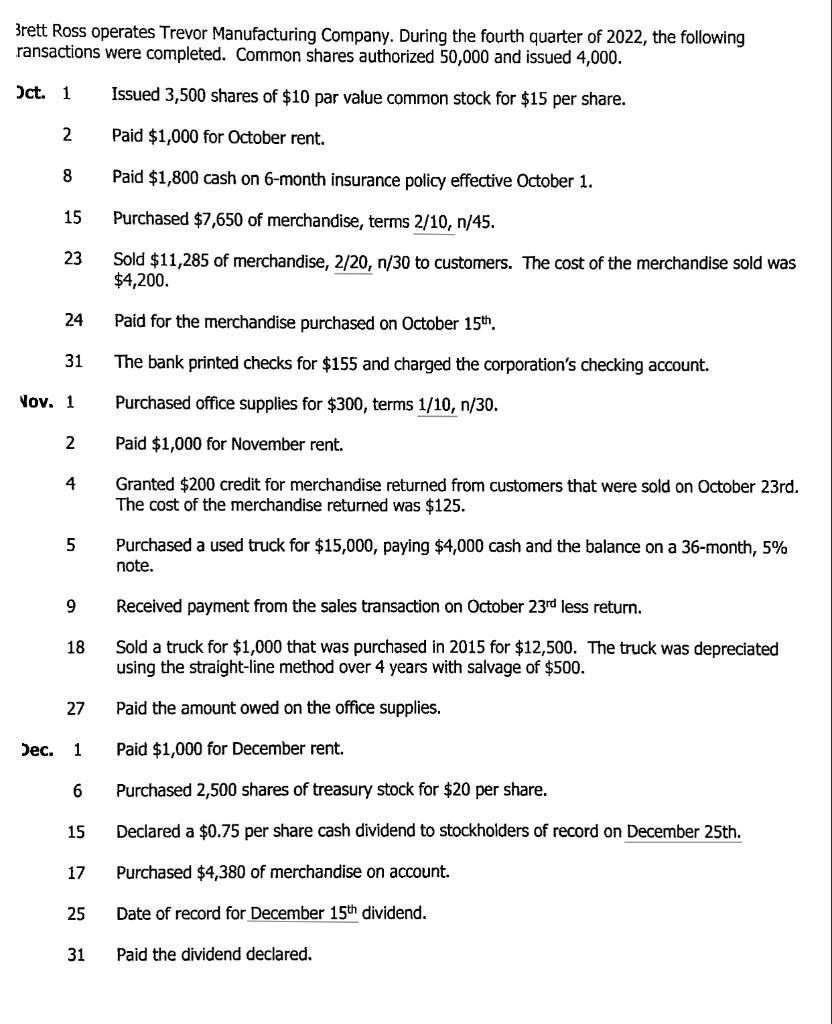

3rett Ross operates Trevor Manufacturing Company. During the fourth quarter of 2022, the following ransactions were completed. Common shares authorized 50,000 and issued 4,000.

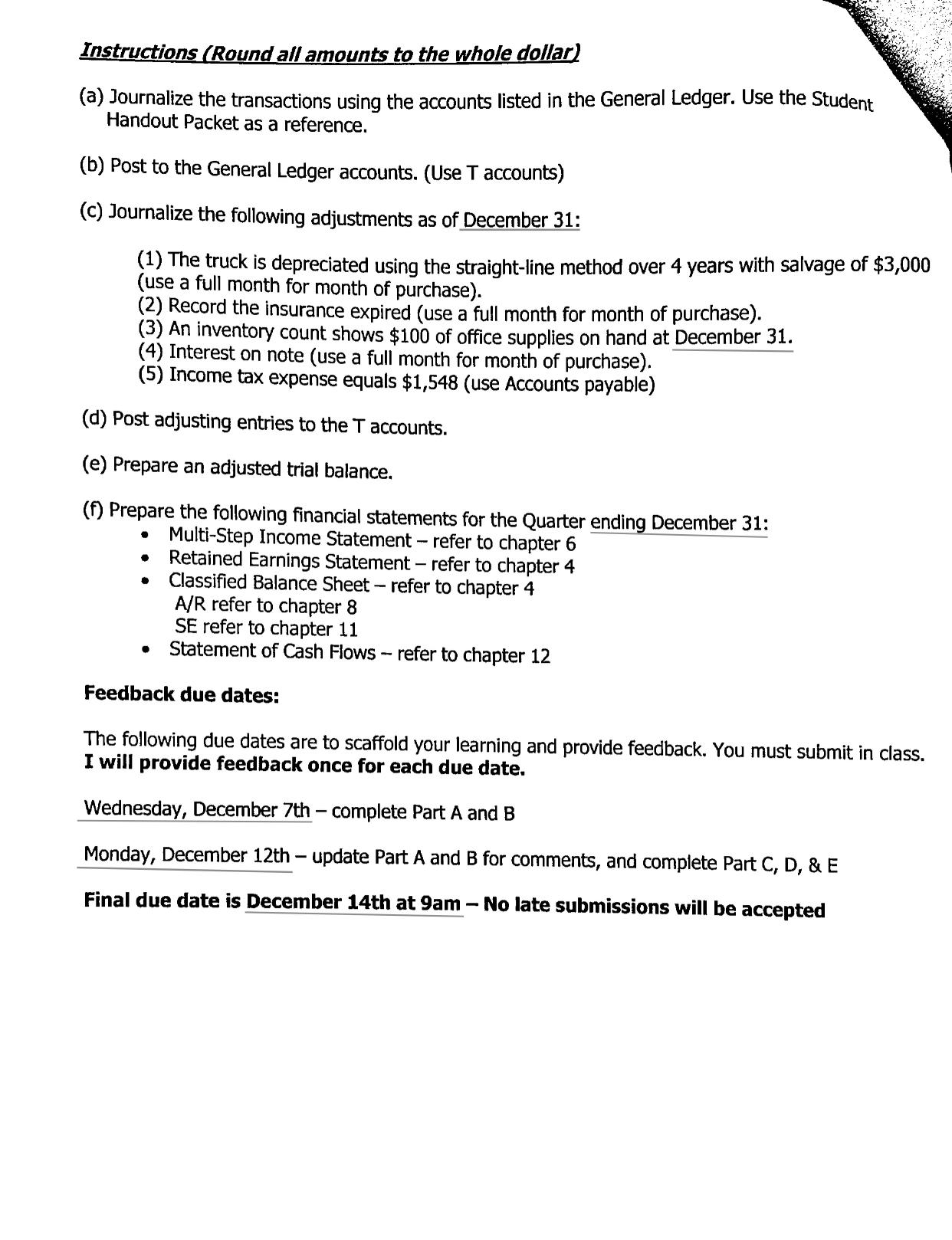

3rett Ross operates Trevor Manufacturing Company. During the fourth quarter of 2022, the following ransactions were completed. Common shares authorized 50,000 and issued 4,000. Oct. 1 Issued 3,500 shares of $10 par value common stock for $15 per share. Paid $1,000 for October rent. Paid $1,800 cash on 6-month insurance policy effective October 1. Purchased $7,650 of merchandise, terms 2/10, n/45. Sold $11,285 of merchandise, 2/20, n/30 to customers. The cost of the merchandise sold was $4,200. Paid for the merchandise purchased on October 15th. The bank printed checks for $155 and charged the corporation's checking account. Purchased office supplies for $300, terms 1/10, n/30. Paid $1,000 for November rent. Granted $200 credit for merchandise returned from customers that were sold on October 23rd. The cost of the merchandise returned was $125. 2 8 15 23 24 31 Nov. 1 2 4 5 9 18 27 Dec. 1 6 15 17 25 31 Purchased a used truck for $15,000, paying $4,000 cash and the balance on a 36-month, 5% note. Received payment from the sales transaction on October 23rd less return. Sold a truck for $1,000 that was purchased in 2015 for $12,500. The truck was depreciated using the straight-line method over 4 years with salvage of $500. Paid the amount owed on the office supplies. Paid $1,000 for December rent. Purchased 2,500 shares of treasury stock for $20 per share. Declared a $0.75 per share cash dividend to stockholders of record on December 25th. Purchased $4,380 of merchandise on account. Date of record for December 15th dividend. Paid the dividend declared. Instructions (Round all amounts to the whole dollar) (a) Journalize the transactions using the accounts listed in the General Ledger. Use the Student Handout Packet as a reference. (b) Post to the General Ledger accounts. (Use T accounts) (c) Journalize the following adjustments as of December 31: (1) The truck is depreciated using the straight-line method over 4 years with salvage of $3,000 (use a full month for month of purchase). (2) Record the insurance expired (use a full month for month of purchase). (3) An inventory count shows $100 of office supplies on hand at December 31. (4) Interest on note (use a full month for month of purchase). (5) Income tax expense equals $1,548 (use Accounts payable) (d) Post adjusting entries to the T accounts. (e) Prepare an adjusted trial balance. (f) Prepare the following financial statements for the Quarter ending December 31: Multi-Step Income Statement - refer to chapter 6 Retained Earnings Statement - refer to chapter 4 Classified Balance Sheet - refer to chapter 4 . A/R refer to chapter 8 SE refer to chapter 11 Statement of Cash Flows - refer to chapter 12 Feedback due dates: The following due dates are to scaffold your learning and provide feedback. You must submit in class. I will provide feedback once for each due date. Wednesday, December 7th - complete Part A and B Monday, December 12th- update Part A and B for comments, and complete Part C, D, & E Final due date is December 14th at 9am No late submissions will be accepted -

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A a Journalize the transactions using the accounts listed in the General Ledger Oct 15 Debit Merchandise Inventory 7650 Credit Accounts Payable 7650 Oct 23 Debit Accounts Receivable 11285 Credit Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started