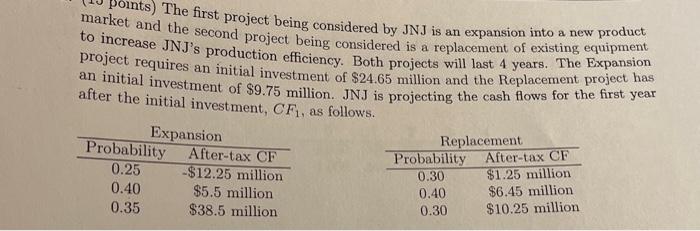

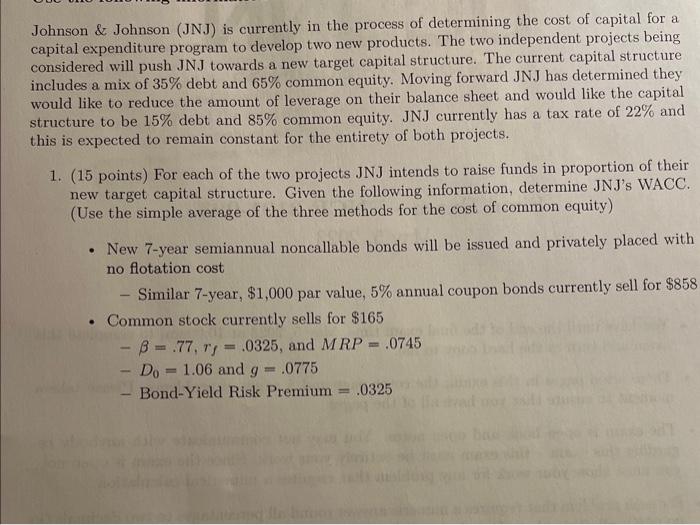

4. (10 points) JNJ wante to make at aifustment for risk and plans to use the WACC calculated in problem 2 for the less-risky project and will add a risk premaium of 2.75% to the WACC uned for the rikkhe project. Calculate the risk-adjusted NPV and IRTR for each project. 5. (10 points) What is the crossover rate for these two projects? 6. (5 points) Which project(s) should JNJ choose to take on given the above analysis and why? market and the first project being considered by JNJ is an expansion into a new product to increase JNJ'cond project being considered is a replacement of existing equipment project requires production efficiency. Both projects will last 4 years. The Expansion an initial inves an initial investment of $24.65 million and the Replacement project has after the investment of $9.75 million. JNJ is projecting the cash flows for the first year after the initial investment, CF1, as follows. Johnson \& Johnson (JNJ) is currently in the process of determining the cost of capital for a capital expenditure program to develop two new products. The two independent projects being considered will push JNJ towards a new target capital structure. The current capital structure includes a mix of 35% debt and 65% common equity. Moving forward JN.J has determined they would like to reduce the amount of leverage on their balance sheet and would like the capital structure to be 15% debt and 85% common equity. JNJ currently has a tax rate of 22% and this is expected to remain constant for the entirety of both projects. 1. (15 points) For each of the two projects JNJ intends to raise funds in proportion of their new target capital structure. Given the following information, determine JNJ's WACC. (Use the simple average of the three methods for the cost of common equity) - New 7-year semiannual noncallable bonds will be issued and privately placed with no flotation cost - Similar 7-year, $1,000 par value, 5% annual coupon bonds currently sell for $858 - Common stock currently sells for $165 =.77,rf=.0325, and MRP=.0745 D0=1.06 and g=.0775 - Bond-Yield Risk Premium =.0325 4. (10 points) JNJ wante to make at aifustment for risk and plans to use the WACC calculated in problem 2 for the less-risky project and will add a risk premaium of 2.75% to the WACC uned for the rikkhe project. Calculate the risk-adjusted NPV and IRTR for each project. 5. (10 points) What is the crossover rate for these two projects? 6. (5 points) Which project(s) should JNJ choose to take on given the above analysis and why? market and the first project being considered by JNJ is an expansion into a new product to increase JNJ'cond project being considered is a replacement of existing equipment project requires production efficiency. Both projects will last 4 years. The Expansion an initial inves an initial investment of $24.65 million and the Replacement project has after the investment of $9.75 million. JNJ is projecting the cash flows for the first year after the initial investment, CF1, as follows. Johnson \& Johnson (JNJ) is currently in the process of determining the cost of capital for a capital expenditure program to develop two new products. The two independent projects being considered will push JNJ towards a new target capital structure. The current capital structure includes a mix of 35% debt and 65% common equity. Moving forward JN.J has determined they would like to reduce the amount of leverage on their balance sheet and would like the capital structure to be 15% debt and 85% common equity. JNJ currently has a tax rate of 22% and this is expected to remain constant for the entirety of both projects. 1. (15 points) For each of the two projects JNJ intends to raise funds in proportion of their new target capital structure. Given the following information, determine JNJ's WACC. (Use the simple average of the three methods for the cost of common equity) - New 7-year semiannual noncallable bonds will be issued and privately placed with no flotation cost - Similar 7-year, $1,000 par value, 5% annual coupon bonds currently sell for $858 - Common stock currently sells for $165 =.77,rf=.0325, and MRP=.0745 D0=1.06 and g=.0775 - Bond-Yield Risk Premium =.0325