Answered step by step

Verified Expert Solution

Question

1 Approved Answer

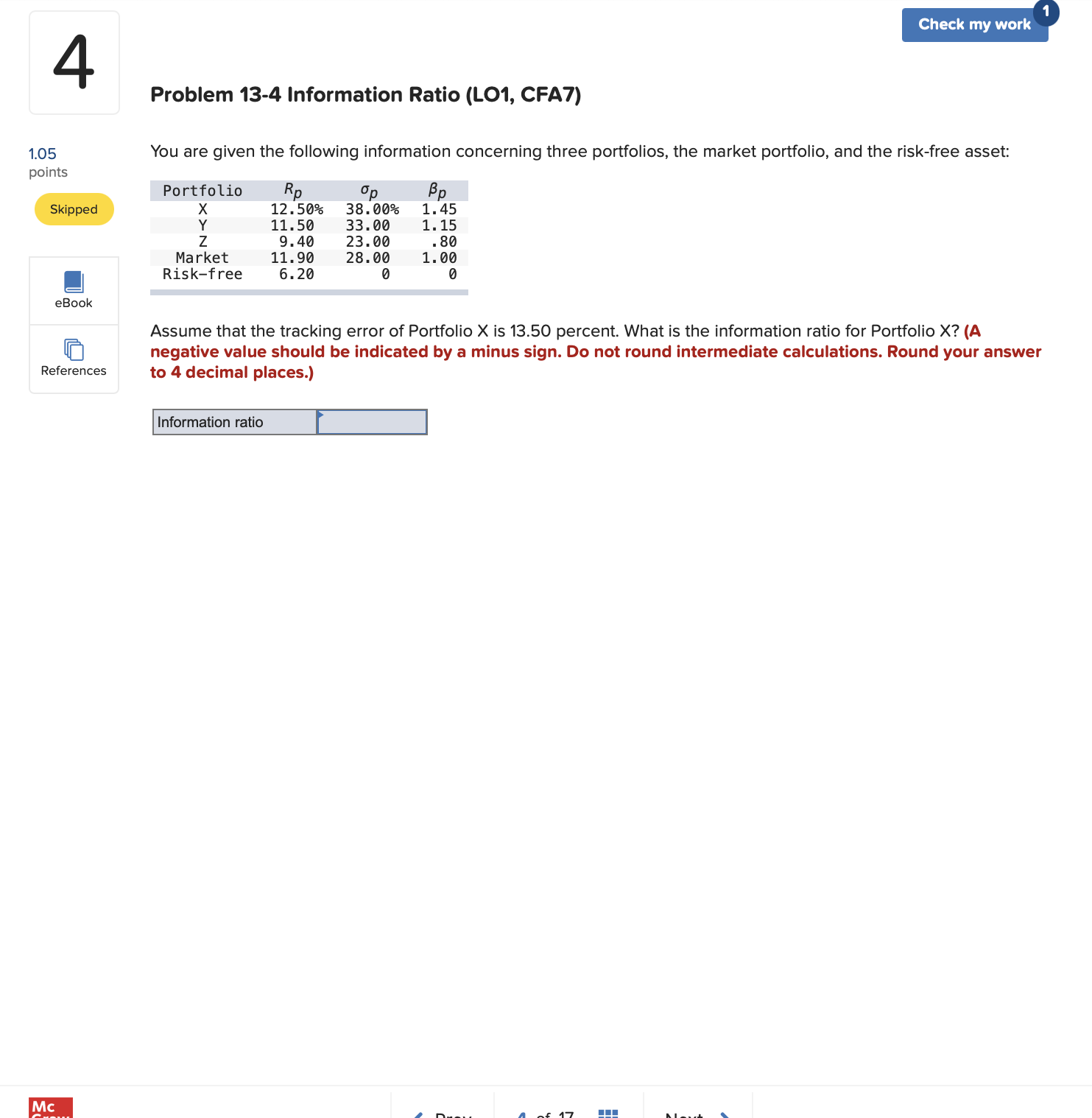

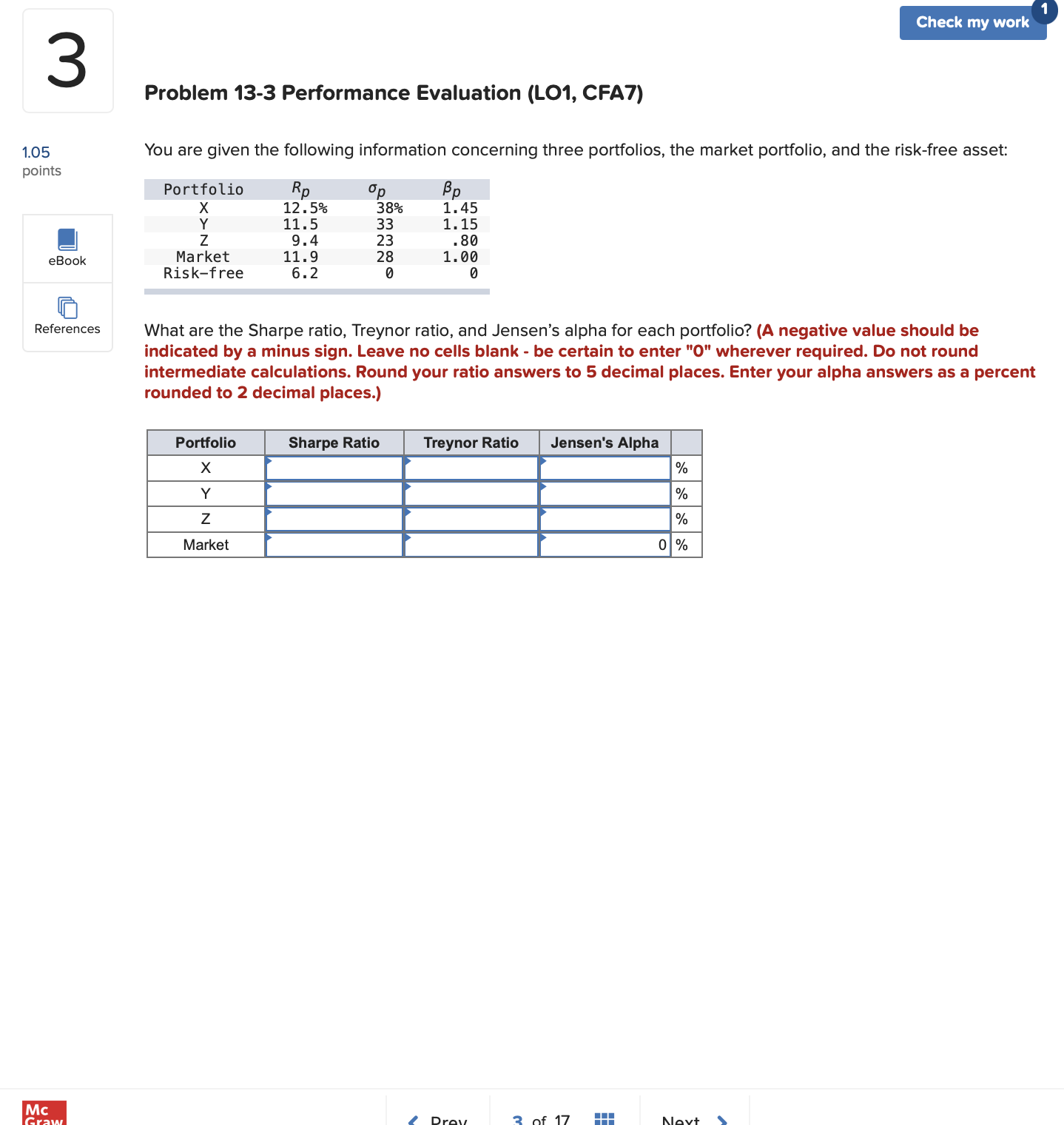

4 1.05 points Skipped eBook References Mc Problem 13-4 Information Ratio (LO1, CFA7) You are given the following information concerning three portfolios, the market

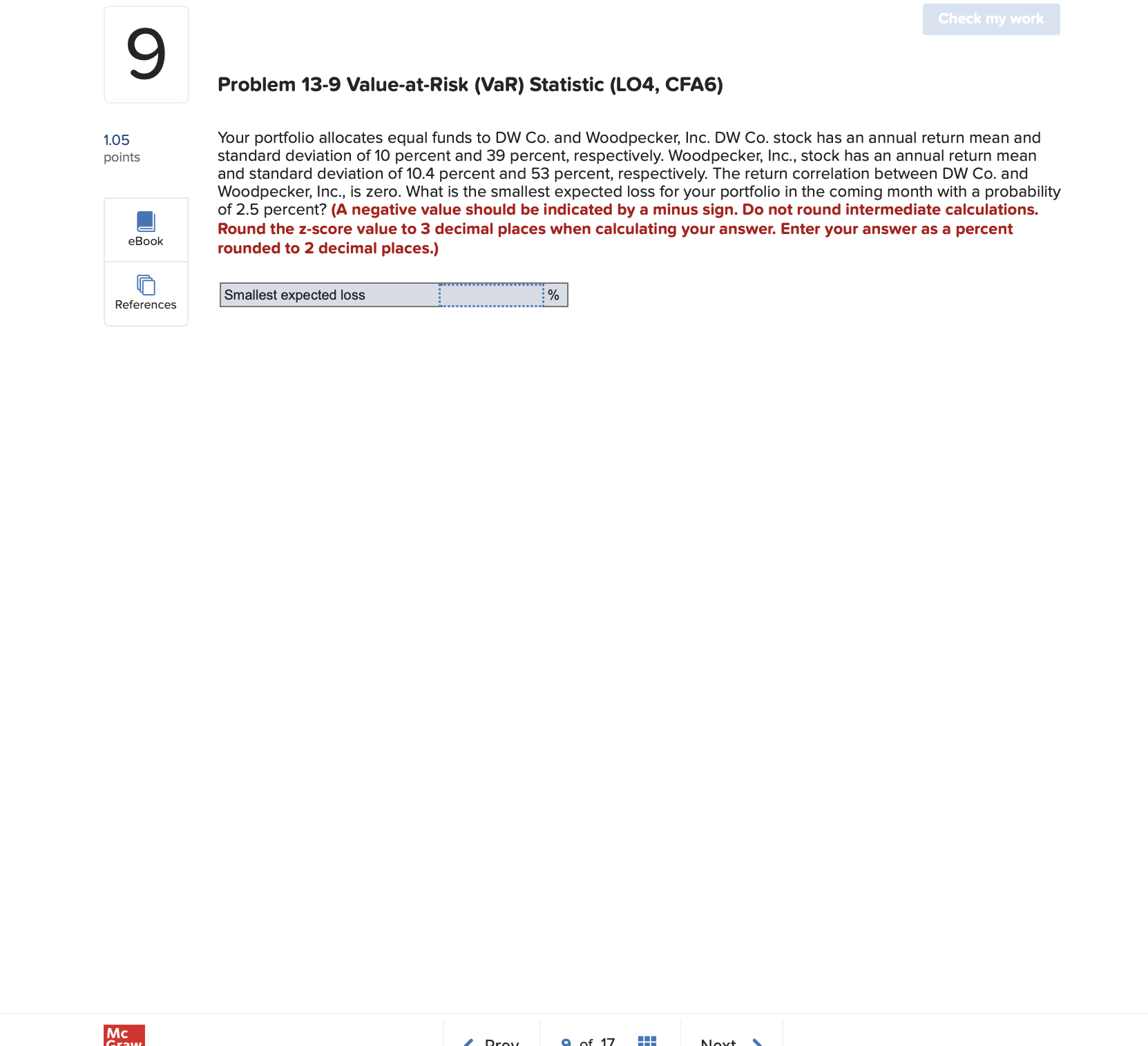

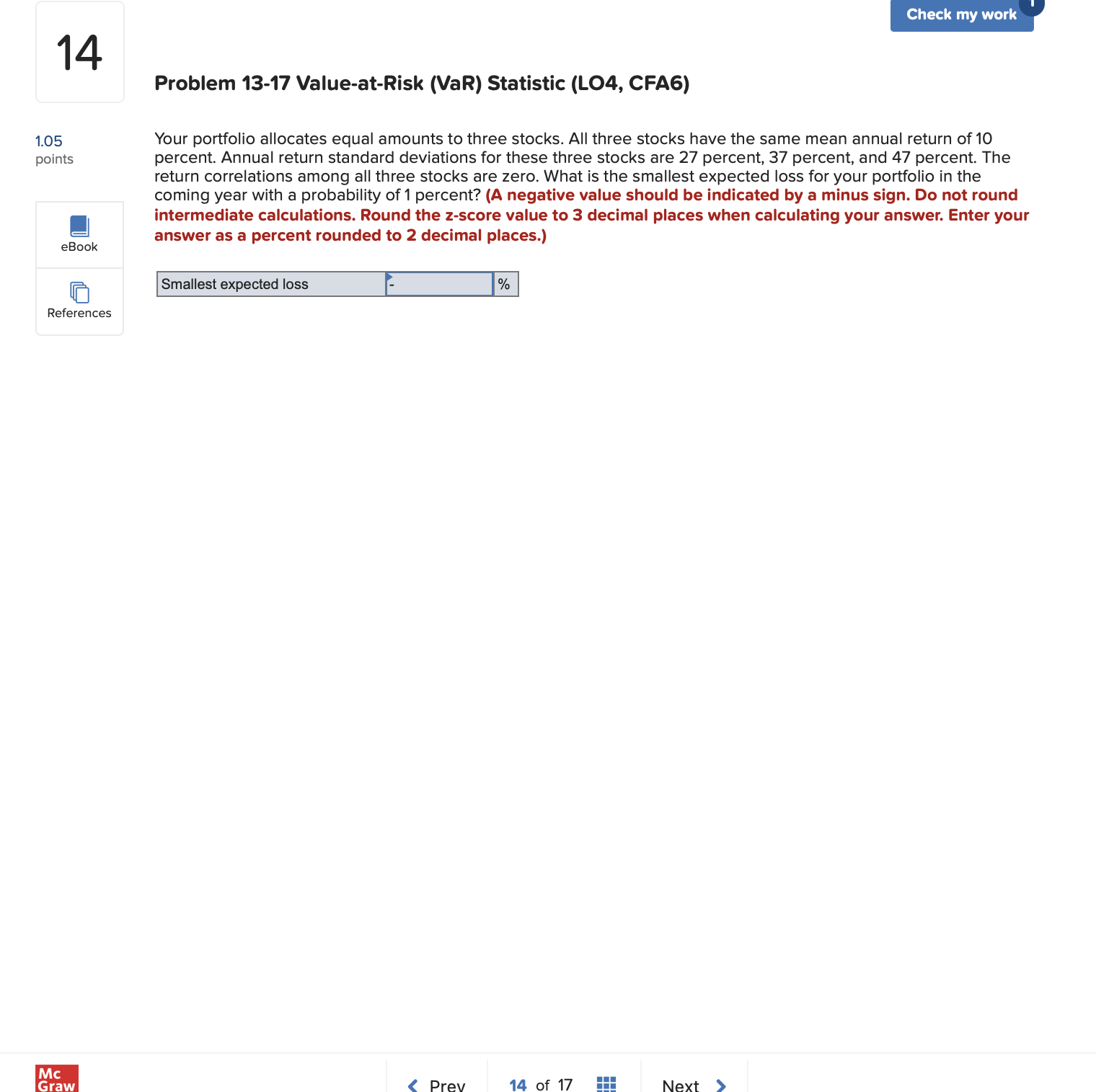

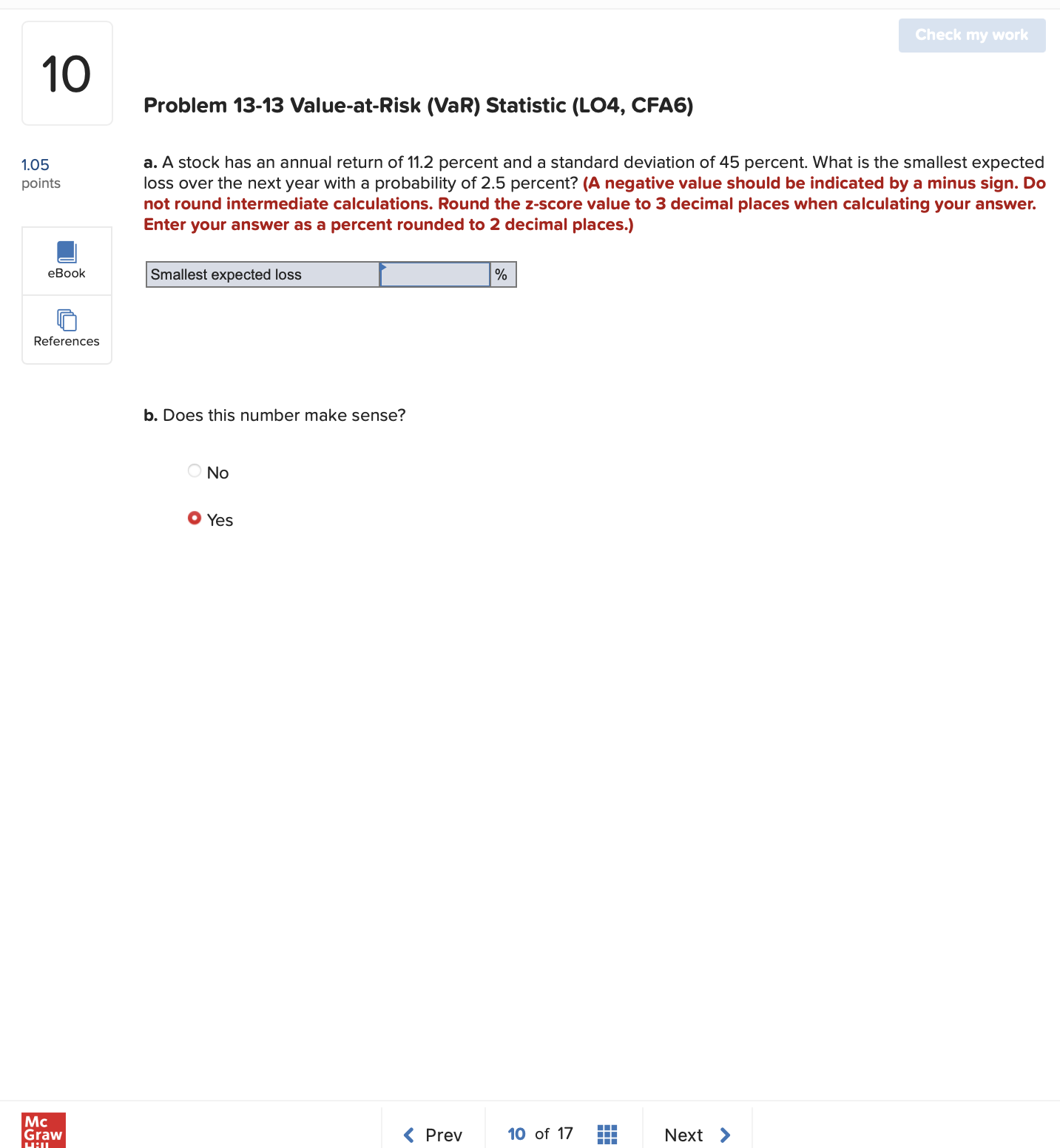

4 1.05 points Skipped eBook References Mc Problem 13-4 Information Ratio (LO1, CFA7) You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio X Y Z Market Risk-free Rp op 38.00% 12.50% 11.50 33.00 9.40 23.00 11.90 28.00 6.20 0 Information ratio Bp 1.45 1.15 .80 1.00 0 Assume that the tracking error of Portfolio X is 13.50 percent. What is the information ratio for Portfolio X? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 4 decimal places.) DISL Check my work 1 of 17 Mout 3 Problem 13-3 Performance Evaluation (LO1, CFA7) 1.05 points 1 Check my work You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio Rp X 12.5% 38% 1.45 Y 11.5 33 1.15 Z 9.4 23 .80 eBook Market Risk-free 11.9 6.2 28 0 1.00 0 References Mc What are the Sharpe ratio, Treynor ratio, and Jensen's alpha for each portfolio? (A negative value should be indicated by a minus sign. Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Round your ratio answers to 5 decimal places. Enter your alpha answers as a percent rounded to 2 decimal places.) Portfolio X Sharpe Ratio Treynor Ratio Jensen's Alpha % Y % Z % Market 0% Graw Prev 3 of 17 Next 1.05 9 points eBook References Mc Problem 13-9 Value-at-Risk (VaR) Statistic (LO4, CFA6) Check my work Your portfolio allocates equal funds to DW Co. and Woodpecker, Inc. DW Co. stock has an annual return mean and standard deviation of 10 percent and 39 percent, respectively. Woodpecker, Inc., stock has an annual return mean and standard deviation of 10.4 percent and 53 percent, respectively. The return correlation between DW Co. and Woodpecker, Inc., is zero. What is the smallest expected loss for your portfolio in the coming month with a probability of 2.5 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places.) Smallest expected loss % Graw Drov 9 of 17 H Novt 14 Problem 13-17 Value-at-Risk (VaR) Statistic (LO4, CFA6) Check my work 1.05 points eBook Your portfolio allocates equal amounts to three stocks. All three stocks have the same mean annual return of 10 percent. Annual return standard deviations for these three stocks are 27 percent, 37 percent, and 47 percent. The return correlations among all three stocks are zero. What is the smallest expected loss for your portfolio in the coming year with a probability of 1 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places.) Smallest expected loss % References Mc Graw < Prev 14 of 17 --- Next > 10 1.05 points eBook References Mc Graw Will Problem 13-13 Value-at-Risk (VaR) Statistic (LO4, CFA6) a. A stock has an annual return of 11.2 percent and a standard deviation of 45 percent. What is the smallest expected loss over the next year with a probability of 2.5 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places.) Smallest expected loss b. Does this number make sense? No Yes < Prev % 10 of 17 Check my work Next >

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Information Ratio for Portfolio X yo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started