Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 1.33 points Skipped Required Information Problem 8-25 (Algo) Treasury stock transactions LO 6 [The following information applies to the questions displayed below.] On

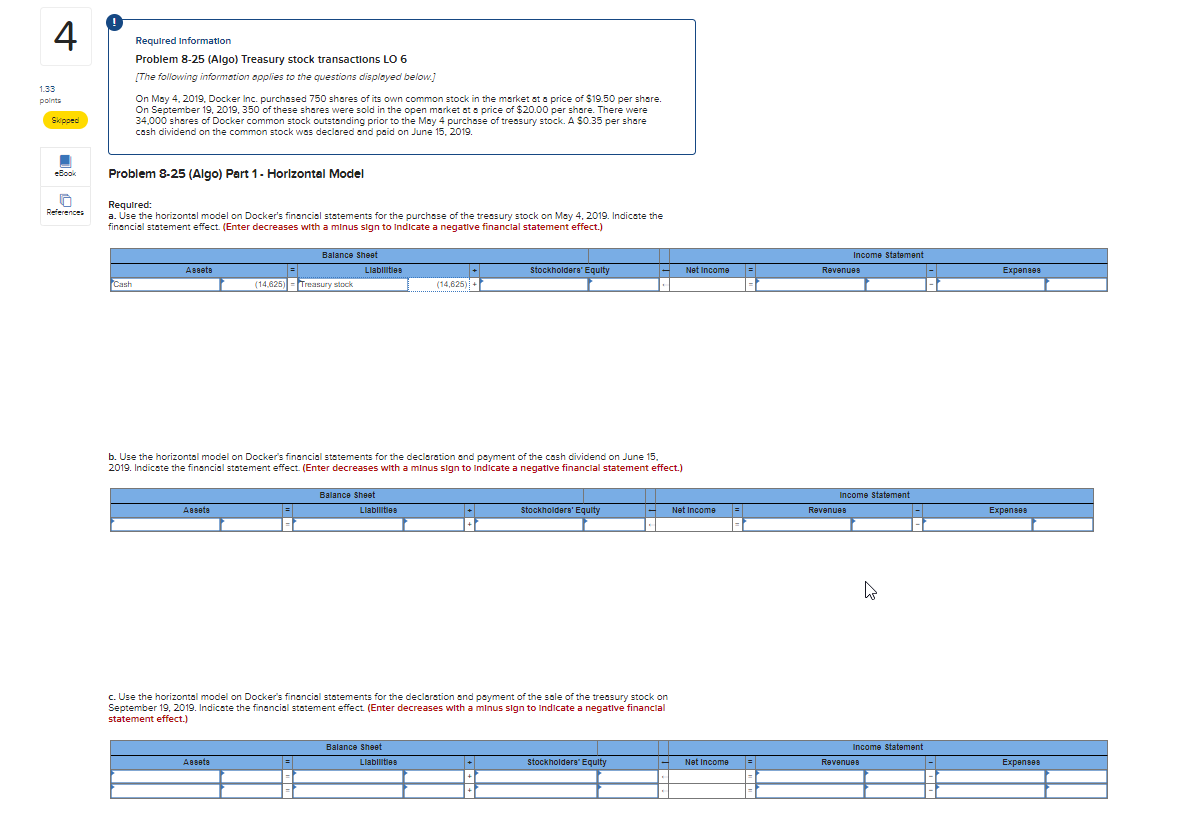

4 1.33 points Skipped Required Information Problem 8-25 (Algo) Treasury stock transactions LO 6 [The following information applies to the questions displayed below.] On May 4, 2019, Docker Inc. purchased 750 shares of its own common stock in the market at a price of $19.50 per share. On September 19, 2019, 350 of these shares were sold in the open market at a price of $20.00 per share. There were 34,000 shares of Docker common stock outstanding prior to the May 4 purchase of treasury stock. A $0.35 per share cash dividend on the common stock was declared and paid on June 15, 2019. eBook Problem 8-25 (Algo) Part 1 - Horizontal Model Required: References a. Use the horizontal model on Docker's financial statements for the purchase of the treasury stock on May 4, 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Balance Sheet Assets Liabilities (14,625) Treasury stock (14,625) Income Statement stockholders' Equity Net Income Revenues Expenses b. Use the horizontal model on Docker's financial statements for the declaration and payment of the cash dividend on June 15, 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Assets Balance Sheet Liabilities Stockholders' Equity c. Use the horizontal model on Docker's financial statements for the declaration and payment of the sale of the treasury stock on September 19, 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Assets Balance Sheet Liabilities Income Statement Net Income Revenues Expenses Income Statement Stockholders' Equity Net Income Revenues Expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started