Question

4. (14 points) You are trying to compare the interest rate risks of two bonds: (i) an 8-year 8% bond, and (ii) an 8-year

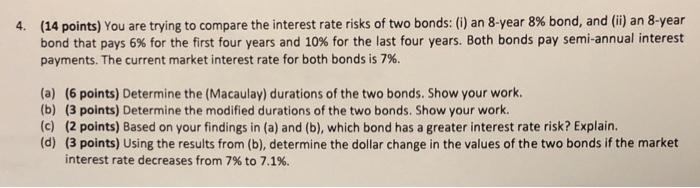

4. (14 points) You are trying to compare the interest rate risks of two bonds: (i) an 8-year 8% bond, and (ii) an 8-year bond that pays 6% for the first four years and 10% for the last four years. Both bonds pay semi-annual interest payments. The current market interest rate for both bonds is 7%. (a) (6 points) Determine the (Macaulay) durations of the two bonds. Show your work. (b) (3 points) Determine the modified durations of the two bonds. Show your work. (c) (2 points) Based on your findings in (a) and (b), which bond has a greater interest rate risk? Explain. (d) (3 points) Using the results from (b), determine the dollar change in the values of the two bonds if the market interest rate decreases from 7% to 7.1%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Macaulay Durations Macaulay Duration is a measure of the weighted average time it takes to receive ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Corporate Finance

Authors: Laurence Booth, Sean Cleary

3rd Edition

978-1118300763, 1118300769

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App