Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(4) 18.8750% (5) $142.50 (6) 13.1557% (7) $90,000 (4) Stock A has a required return of 8%, and a beta of 0.75; Stock B has

(4) 18.8750%

(5) $142.50

(6) 13.1557%

(7) $90,000

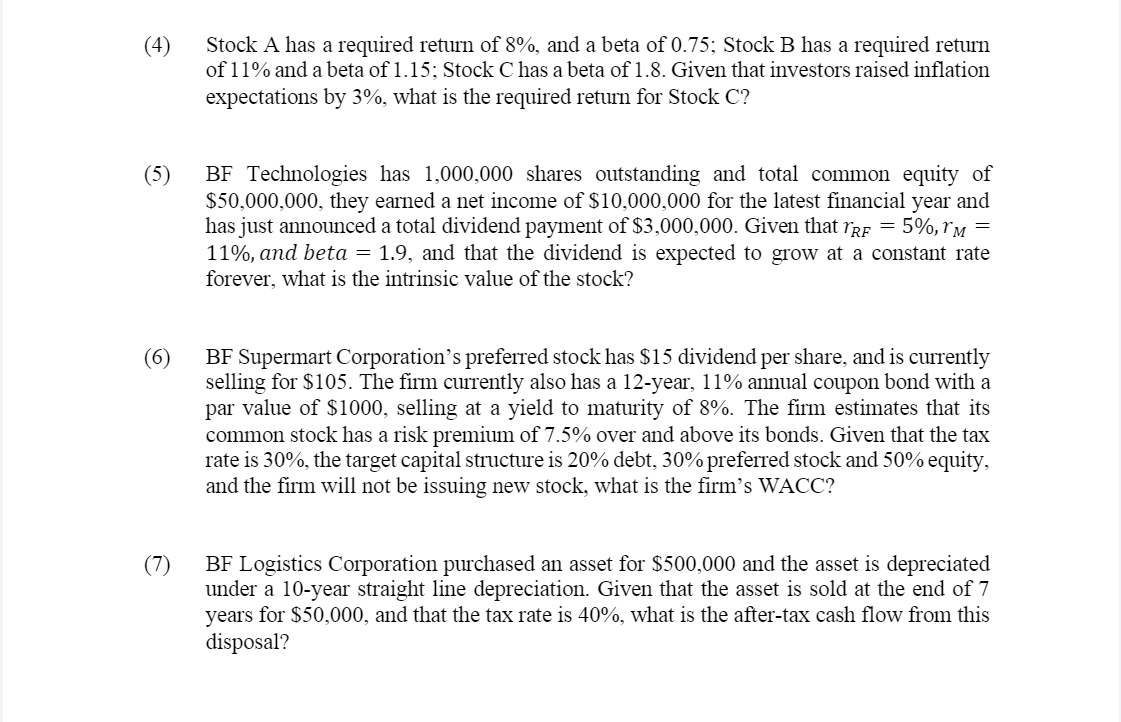

(4) Stock A has a required return of 8%, and a beta of 0.75; Stock B has a required return of 11% and a beta of 1.15; Stock C has a beta of 1.8. Given that investors raised inflation expectations by 3%, what is the required return for Stock C ? (5) BF Technologies has 1,000,000 shares outstanding and total common equity of $50,000,000, they earned a net income of $10,000,000 for the latest financial year and has just announced a total dividend payment of $3,000,000. Given that rRF=5%,rM= 11%, and beta =1.9, and that the dividend is expected to grow at a constant rate forever, what is the intrinsic value of the stock? (6) BF Supermart Corporation's preferred stock has $15 dividend per share, and is currently selling for $105. The firm currently also has a 12 -year, 11% annual coupon bond with a par value of $1000, selling at a yield to maturity of 8%. The firm estimates that its common stock has a risk premium of 7.5% over and above its bonds. Given that the tax rate is 30%, the target capital structure is 20% debt, 30% preferred stock and 50% equity, and the firm will not be issuing new stock, what is the firm's WACC? (7) BF Logistics Corporation purchased an asset for $500,000 and the asset is depreciated under a 10-year straight line depreciation. Given that the asset is sold at the end of 7 years for $50,000, and that the tax rate is 40%, what is the after-tax cash flow from this disposalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started