Answered step by step

Verified Expert Solution

Question

1 Approved Answer

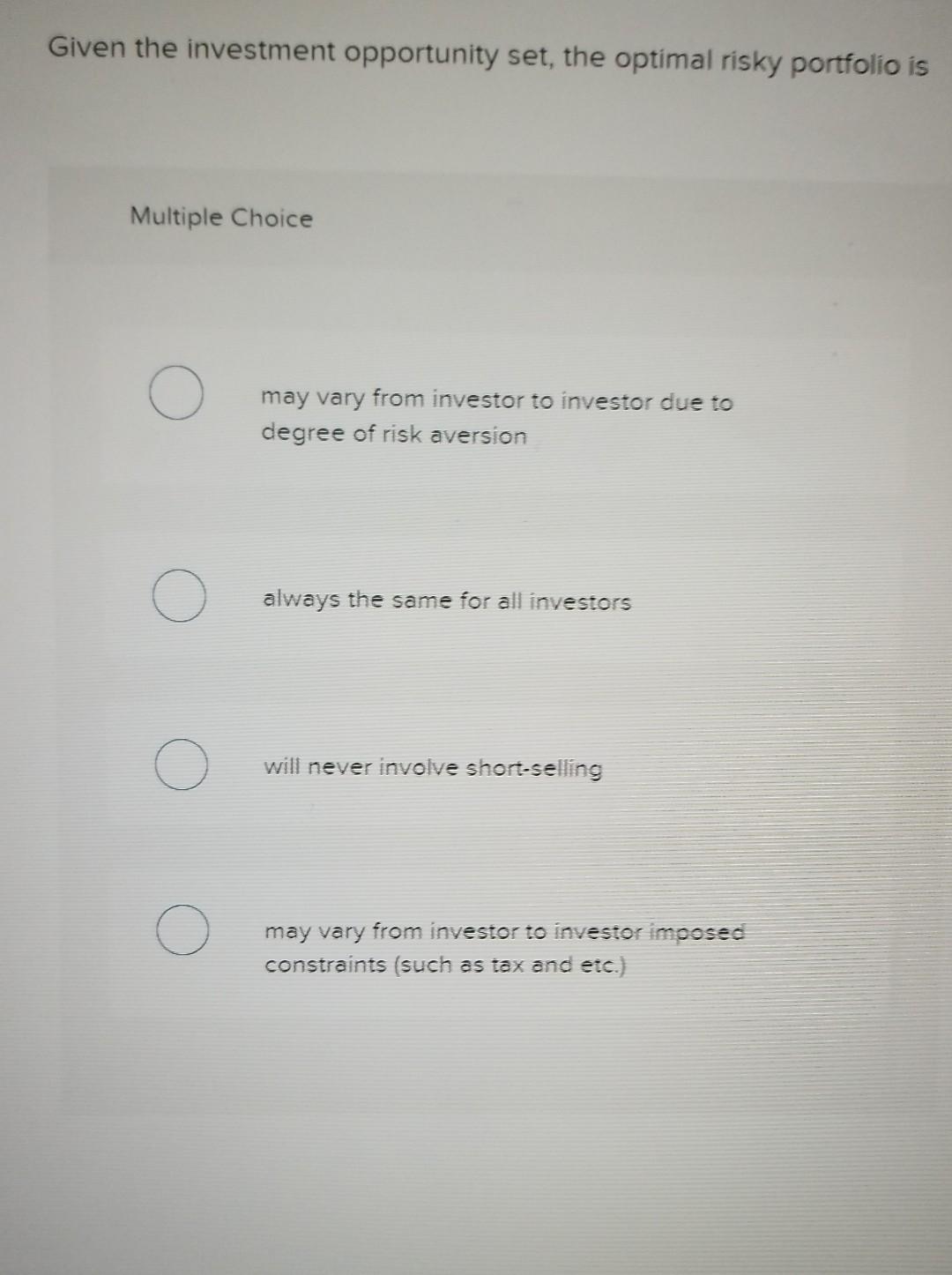

4 2 Given the investment opportunity set, the optimal risky portfolio is Multiple Choice may vary from investor to investor due to degree of risk

4

2

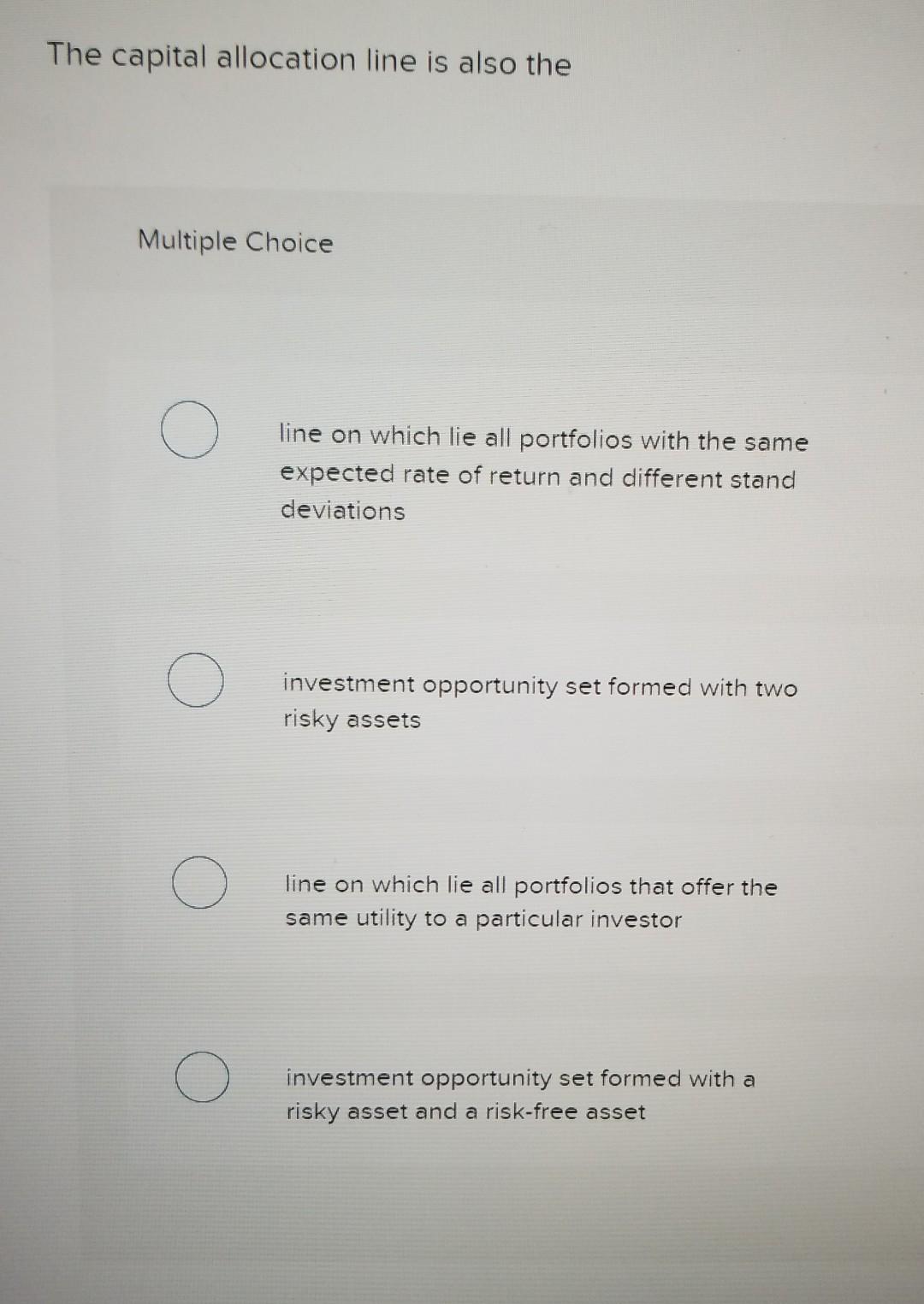

Given the investment opportunity set, the optimal risky portfolio is Multiple Choice may vary from investor to investor due to degree of risk aversion always the same for all investors will never involve short-selling ( ) may vary from investor to investor imposed constraints (such as tax and etc.) The capital allocation line is also the Multiple Choice line on which lie all portfolios with the same expected rate of return and different stand deviations investment opportunity set formed with two risky assets ( ) line on which lie all portfolios that offer the same utility to a particular investor ( ) investment opportunity set formed with a risky asset and a risk-free asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started