Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. (20 points) A snow resort group is considering investing in a ski resort at the Pocono's Mountains. The initial investment required is $3

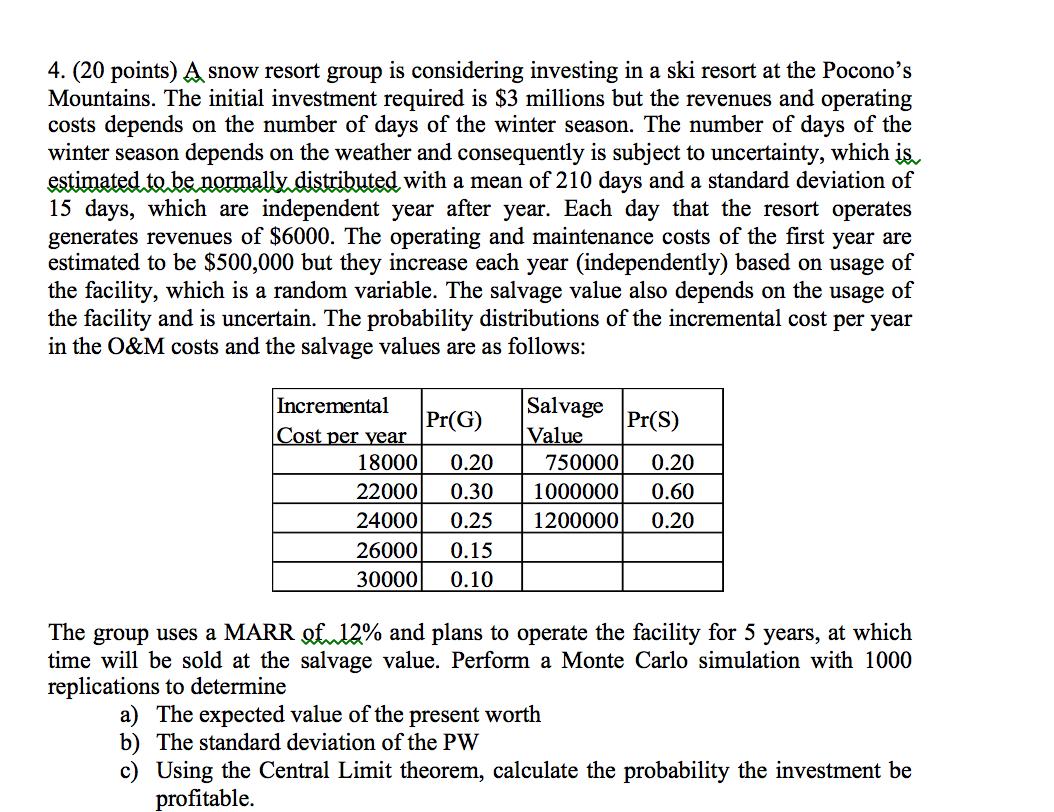

4. (20 points) A snow resort group is considering investing in a ski resort at the Pocono's Mountains. The initial investment required is $3 millions but the revenues and operating costs depends on the number of days of the winter season. The number of days of the winter season depends on the weather and consequently is subject to uncertainty, which is estimated to be normally distributed with a mean of 210 days and a standard deviation of 15 days, which are independent year after year. Each day that the resort operates generates revenues of $6000. The operating and maintenance costs of the first year are estimated to be $500,000 but they increase each year (independently) based on usage of the facility, which is a random variable. The salvage value also depends on the usage of the facility and is uncertain. The probability distributions of the incremental cost per year in the O&M costs and the salvage values are as follows: Incremental Pr(G) Salvage Value Pr(S) Cost per year 18000 0.20 750000 22000 0.30 1000000 0.60 24000 0.25 1200000 0.20 26000 0.15 30000 0.10 The group uses a MARR of 12% and plans to operate the facility for 5 years, at which time will be sold at the salvage value. Perform a Monte Carlo simulation with 1000 replications to determine a) The expected value of the present worth b) The standard deviation of the PW c) Using the Central Limit theorem, calculate the probability the investment be profitable.

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

aThe probability that the present worth will be less than 2 million The probability that the present worth will be greater than 4 million The expected value of the present worth is 2735652 The probabi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started