Answered step by step

Verified Expert Solution

Question

1 Approved Answer

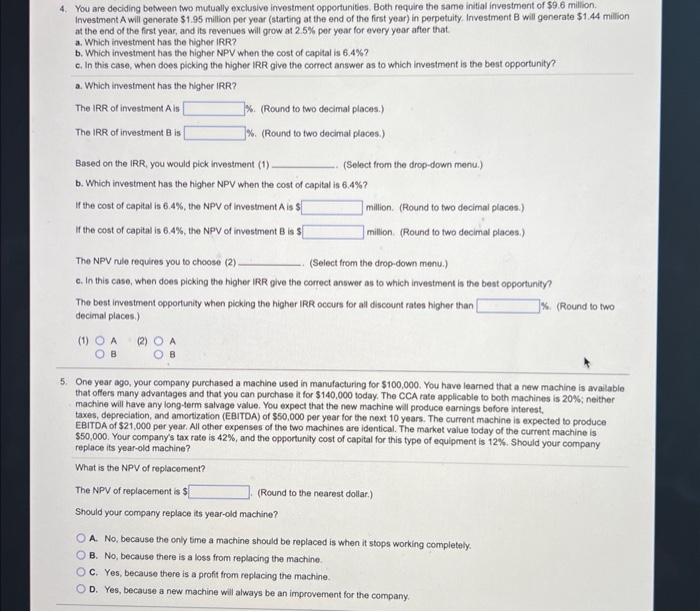

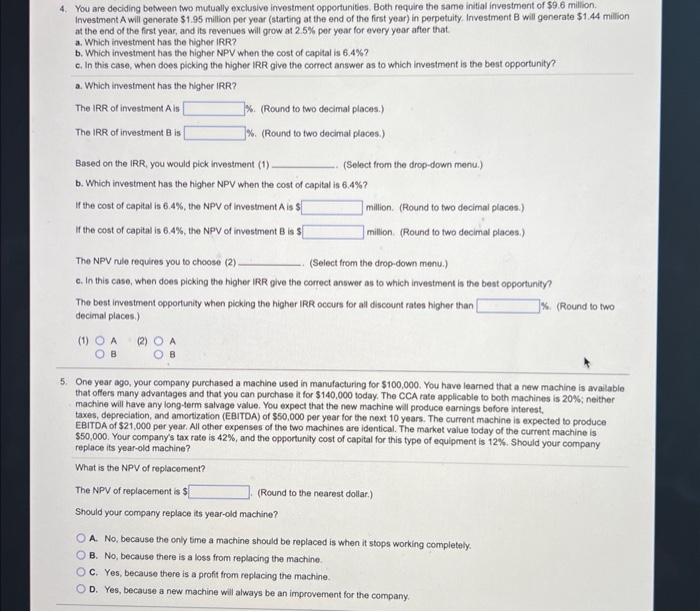

4. 4. You are deciding botween two mulually exclusive investment opportunites. Both require the same initial investment of $9.6 milion. Investment A will generate $1.95

4.

4. You are deciding botween two mulually exclusive investment opportunites. Both require the same initial investment of $9.6 milion. Investment A will generate $1.95 million per year (starting at the end of the first year) in perpetuity, Investment B will generate $1.44 million at the end of the first year, and its revenues will grow at 2.5% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capltal is 6.4% ? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? a. Which investment has the higher IRR? The IRR of investment A is \%. (Round to two decimal places.) The IRR of investment B is \%. (Round to two decimal places.) Based on the IRR, you would pick investment (1) (Select from the drop-down menu.) b. Which investment has the higher NPV when the cost of capital is 6.4% ? If the cost of capital is 6.4%, the NPV of investment A is $ million. (Round to two decimal places.) If the cost of capital is 6.4%, the NPV of investment B is 5 million. (Round to two decimal places.) The NPV nule requires you to choose (2) (Select from the drop-down menu.) c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? The best investment opportunity when picking the higher IRR occurs for all discount rates higher than decimal places.) (1) A (2) A B B 5. One year ago, your company purchased a machine used in manufacturing for $100,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $140,000 today. The CCA rate applicable to both machines is 20%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings bofore interest, taxes, depreciation, and amortization (EBITDA) of $50,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $21,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 42%, and the opportunity cost of capital for this type of equipment is 12%. Should your company replace its year-old machine? What is the NPV of replacoment? The NPV of replacement is $ (Round to the nearest dollar.) Should your company replace its year-old machine? A. No, because the conly time a machine should be replaced is when it stops working completely. B. No, because there is a loss from replacing the machine. C. Yes, because there is a profit from replacing the machine. D. Yes, because a new machine will always be an improvement for the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started