Answered step by step

Verified Expert Solution

Question

1 Approved Answer

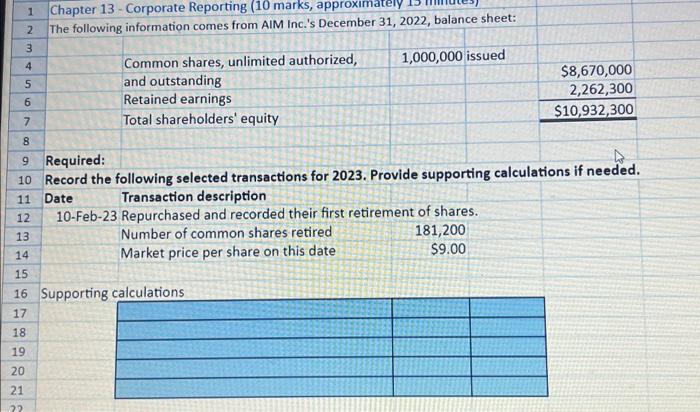

4 5 1 2 3 6 7 in 13 14 25S789872 8 9 Required: 10 Record the following selected transactions for 2023. Provide supporting

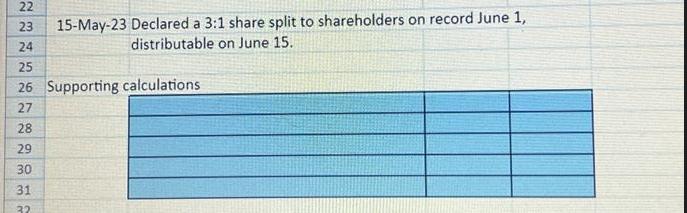

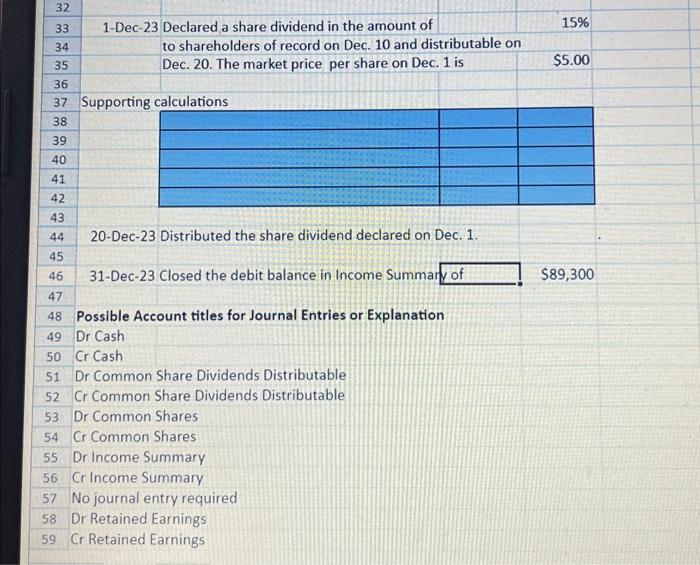

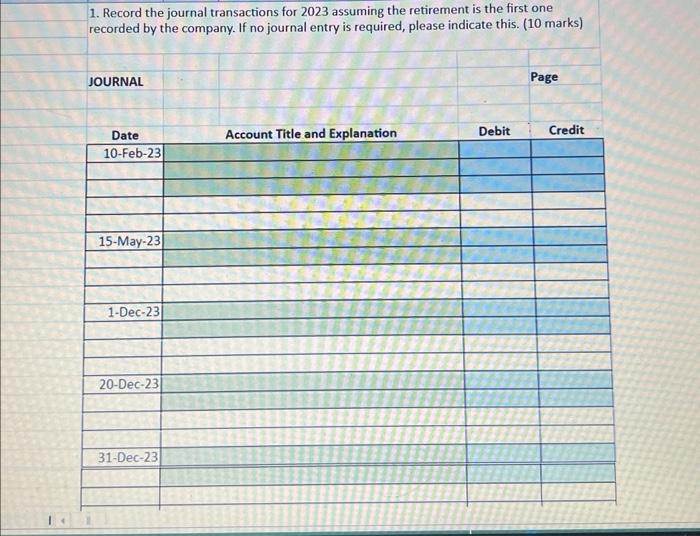

4 5 1 2 3 6 7 in 13 14 25S789872 8 9 Required: 10 Record the following selected transactions for 2023. Provide supporting calculations if needed. 11 Date 12 15 17 18 19 20 21 16 Supporting calculations Chapter 13- Corporate Reporting (10 marks, approximately The following information comes from AIM Inc.'s December 31, 2022, balance sheet: 1,000,000 issued Common shares, unlimited authorized, and outstanding Retained earnings Total shareholders' equity Transaction description 10-Feb-23 Repurchased and recorded their first retirement of shares. Number of common shares retired Market price per share on this date $8,670,000 2,262,300 $10,932,300 181,200 $9.00 22 23 24 15-May-23 Declared a 3:1 share split to shareholders on record June 1, distributable on June 15. 25 26 Supporting calculations 27 28 29 30 31 32 32 33 34 35 1-Dec-23 Declared a share dividend in the amount of to shareholders of record on Dec. 10 and distributable on Dec. 20. The market price per share on Dec. 1 is 36 37 Supporting calculations 38 39 40 41 42 43 44 45 46 20-Dec-23 Distributed the share dividend declared on Dec. 1. 31-Dec-23 Closed the debit balance in Income Summary of 47 48 Possible Account titles for Journal Entries or Explanation 49 Dr Cash 50 Cr Cash 51 Dr Common Share Dividends Distributable 52 Cr Common Share Dividends Distributable 53 Dr Common Shares 54 Cr Common Shares 55 Dr Income Summary 56 Cr Income Summary 57 No journal entry required 58 Dr Retained Earnings 59 Cr Retained Earnings 15% $5.00 $89,300 1. Record the journal transactions for 2023 assuming the retirement is the first one recorded by the company. If no journal entry is required, please indicate this. (10 marks) JOURNAL Date 10-Feb-23 15-May-23 1-Dec-23 20-Dec-23 31-Dec-23 Account Title and Explanation Debit Page Credit

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided lets address each of the required transactions and prepare the supporting calculations and journal entries for AIM Inc for the year 2023 Transaction on 10Feb23 Repurc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started