Answered step by step

Verified Expert Solution

Question

1 Approved Answer

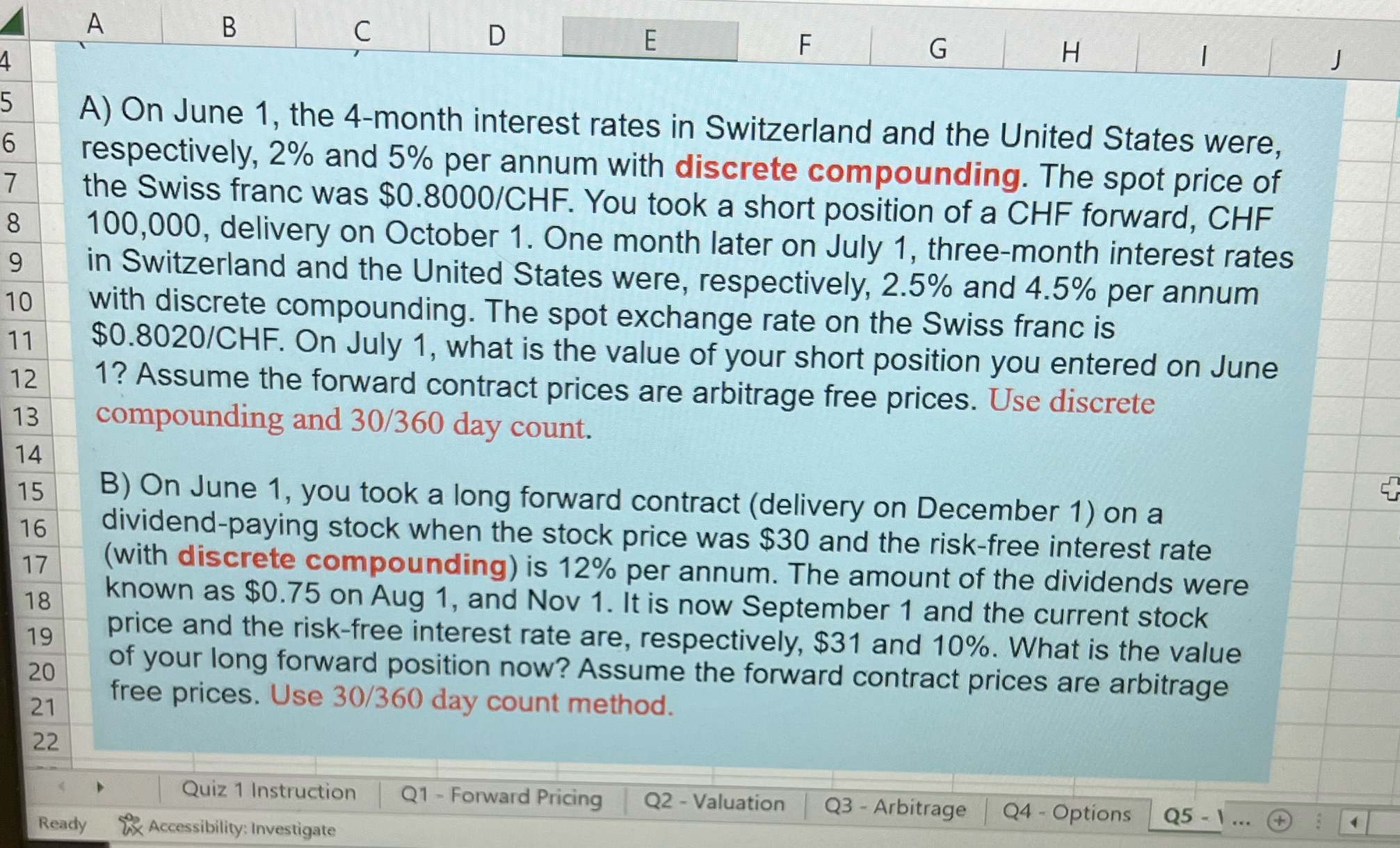

A B C D E F G H I J 4 5 6 7 8 9 10 11 12 13 14 15 16 17

A B C D E F G H I J 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 A) On June 1, the 4-month interest rates in Switzerland and the United States were, respectively, 2% and 5% per annum with discrete compounding. The spot price of the Swiss franc was $0.8000/CHF. You took a short position of a CHF forward, CHF 100,000, delivery on October 1. One month later on July 1, three-month interest rates in Switzerland and the United States were, respectively, 2.5% and 4.5% per annum with discrete compounding. The spot exchange rate on the Swiss franc is $0.8020/CHF. On July 1, what is the value of your short position you entered on June 1? Assume the forward contract prices are arbitrage free prices. Use discrete compounding and 30/360 day count. B) On June 1, you took a long forward contract (delivery on December 1) on a dividend-paying stock when the stock price was $30 and the risk-free interest rate (with discrete compounding) is 12% per annum. The amount of the dividends were known as $0.75 on Aug 1, and Nov 1. It is now September 1 and the current stock price and the risk-free interest rate are, respectively, $31 and 10%. What is the value of your long forward position now? Assume the forward contract prices are arbitrage free prices. Use 30/360 day count method. Quiz 1 Instruction Q1 - Forward Pricing Q2 - Valuation Q3 - Arbitrage Q4 Options Q5-1... + Ready Accessibility: Investigate +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To calculate the value of your short position on July 1 we need to take into account the changes i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started