Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. 5. 6. The business sub-lets a portion of the building and earns a rental income of R4,800 per month. The rental for February

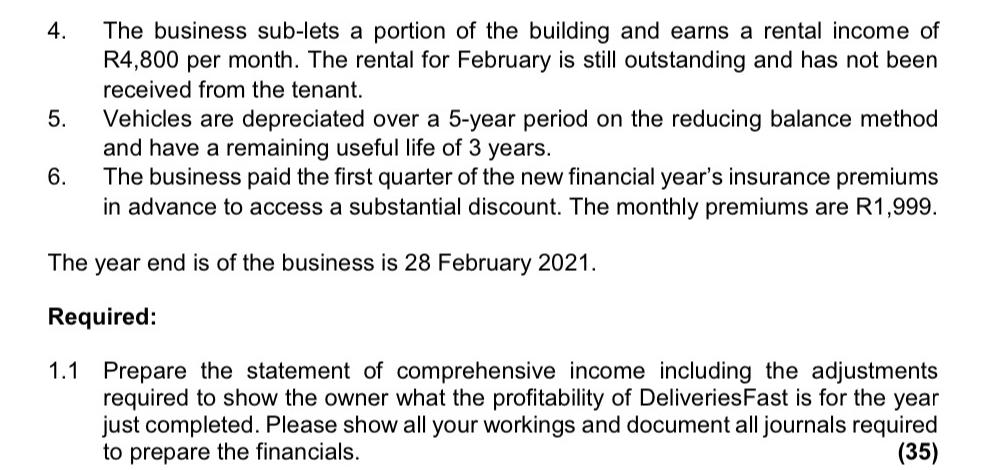

4. 5. 6. The business sub-lets a portion of the building and earns a rental income of R4,800 per month. The rental for February is still outstanding and has not been received from the tenant. Vehicles are depreciated over a 5-year period on the reducing balance method and have a remaining useful life of 3 years. The business paid the first quarter of the new financial year's insurance premiums in advance to access a substantial discount. The monthly premiums are R1,999. The year end is of the business is 28 February 2021. Required: 1.1 Prepare the statement of comprehensive income including the adjustments required to show the owner what the profitability of DeliveriesFast is for the year just completed. Please show all your workings and document all journals required to prepare the financials. (35)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the statement of comprehensive income for DeliveriesFast for the year ended 28 February 2021 including required adjustments DeliveriesFast Sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started