Answered step by step

Verified Expert Solution

Question

1 Approved Answer

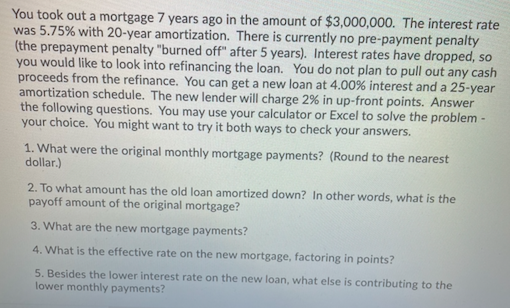

# 4 & 5 if possible! You took out a mortgage 7 years ago in the amount of $3,000,000. The interest rate was 5.75% with

# 4 & 5 if possible!

You took out a mortgage 7 years ago in the amount of $3,000,000. The interest rate was 5.75% with 20-year amortization. There is currently no pre-payment penalty (the prepayment penalty "burned off" after 5 years). Interest rates have dropped, so you would like to look into refinancing the loan. You do not plan to pull out any cash proceeds from the refinance. You can get a new loan at 4.00% interest and a 25-year amortization schedule. The new lender will charge 2% in up-front points. Answer the following questions. You may use your calculator or Excel to solve the problem - your choice. You might want to try it both ways to check your answers. 1. What were the original monthly mortgage payments? (Round to the nearest dollar.) 2. To what amount has the old loan amortized down? In other words, what is the payoff amount of the original mortgage? 3. What are the new mortgage payments? 4. What is the effective rate on the new mortgage, factoring in points? 5. Besides the lower interest rate on the new loan, what else is contributing to the lower monthly payments? You took out a mortgage 7 years ago in the amount of $3,000,000. The interest rate was 5.75% with 20-year amortization. There is currently no pre-payment penalty (the prepayment penalty "burned off" after 5 years). Interest rates have dropped, so you would like to look into refinancing the loan. You do not plan to pull out any cash proceeds from the refinance. You can get a new loan at 4.00% interest and a 25-year amortization schedule. The new lender will charge 2% in up-front points. Answer the following questions. You may use your calculator or Excel to solve the problem - your choice. You might want to try it both ways to check your answers. 1. What were the original monthly mortgage payments? (Round to the nearest dollar.) 2. To what amount has the old loan amortized down? In other words, what is the payoff amount of the original mortgage? 3. What are the new mortgage payments? 4. What is the effective rate on the new mortgage, factoring in points? 5. Besides the lower interest rate on the new loan, what else is contributing to the lower monthly paymentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started