Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. (5 points) On April 1, 2018, Y borrowed $900,000 at 6%. Y pays interest every 6 months with interest payments every October 1 and

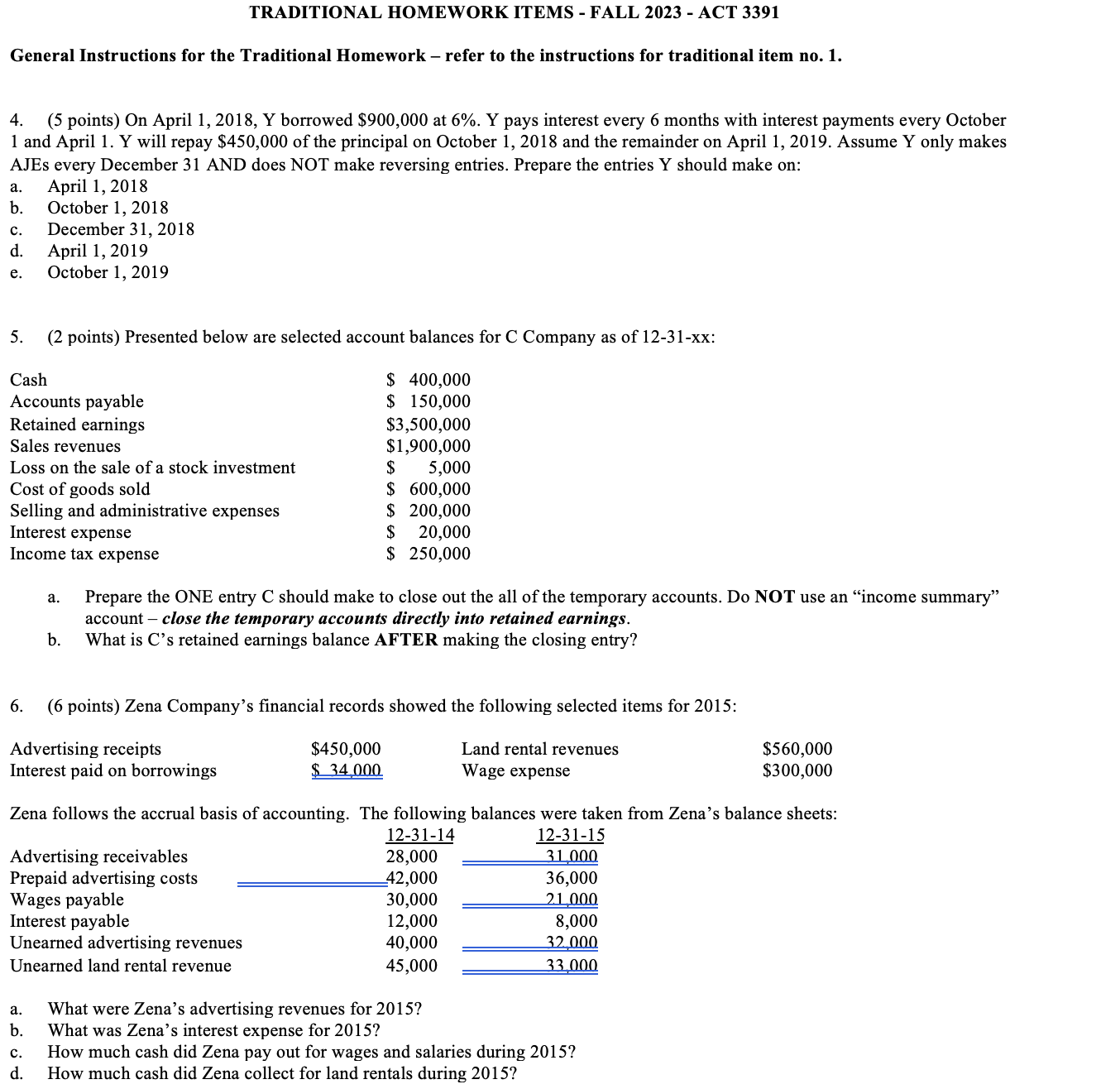

4. (5 points) On April 1, 2018, Y borrowed $900,000 at 6%. Y pays interest every 6 months with interest payments every October 1 and April 1. Y will repay $450,000 of the principal on October 1, 2018 and the remainder on April 1, 2019. Assume Y only makes AJEs every December 31 AND does NOT make reversing entries. Prepare the entries Y should make on: a. April 1, 2018 b. October 1,2018 c. December 31, 2018 d. April 1,2019 e. October 1,2019 5. (2 points) Presented below are selected account balances for C Company as of 12-31-xx: a. Prepare the ONE entry C should make to close out the all of the temporary accounts. Do NOT use an "income summary" account - close the temporary accounts directly into retained earnings. b. What is C's retained earnings balance AFTER making the closing entry? 6. (6 points) Zena Company's financial records showed the following selected items for 2015: Zena follows the accrual basis of accounting. The following balances were taken from Zena's balance sheets: a. What were Zena's advertising revenues for 2015 ? b. What was Zena's interest expense for 2015? c. How much cash did Zena pay out for wages and salaries during 2015? d. How much cash did Zena collect for land rentals during 2015

4. (5 points) On April 1, 2018, Y borrowed $900,000 at 6%. Y pays interest every 6 months with interest payments every October 1 and April 1. Y will repay $450,000 of the principal on October 1, 2018 and the remainder on April 1, 2019. Assume Y only makes AJEs every December 31 AND does NOT make reversing entries. Prepare the entries Y should make on: a. April 1, 2018 b. October 1,2018 c. December 31, 2018 d. April 1,2019 e. October 1,2019 5. (2 points) Presented below are selected account balances for C Company as of 12-31-xx: a. Prepare the ONE entry C should make to close out the all of the temporary accounts. Do NOT use an "income summary" account - close the temporary accounts directly into retained earnings. b. What is C's retained earnings balance AFTER making the closing entry? 6. (6 points) Zena Company's financial records showed the following selected items for 2015: Zena follows the accrual basis of accounting. The following balances were taken from Zena's balance sheets: a. What were Zena's advertising revenues for 2015 ? b. What was Zena's interest expense for 2015? c. How much cash did Zena pay out for wages and salaries during 2015? d. How much cash did Zena collect for land rentals during 2015 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started