Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 5. The Wilson Company has an opportunity to invest in one of two new projects. They are mutually exclusive. Project A 10 requires

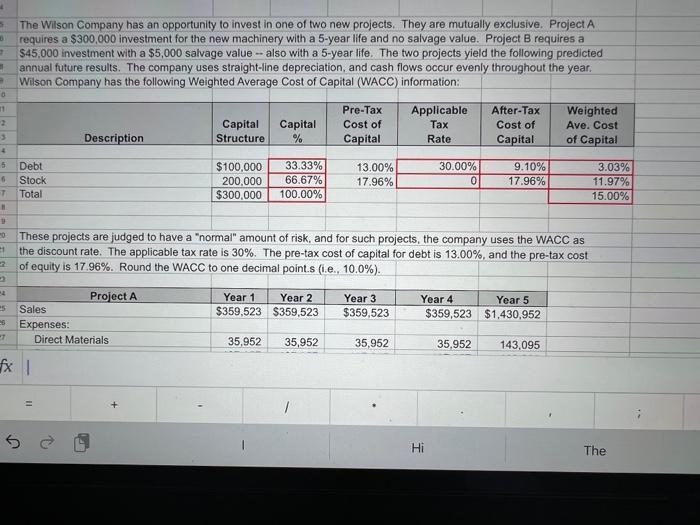

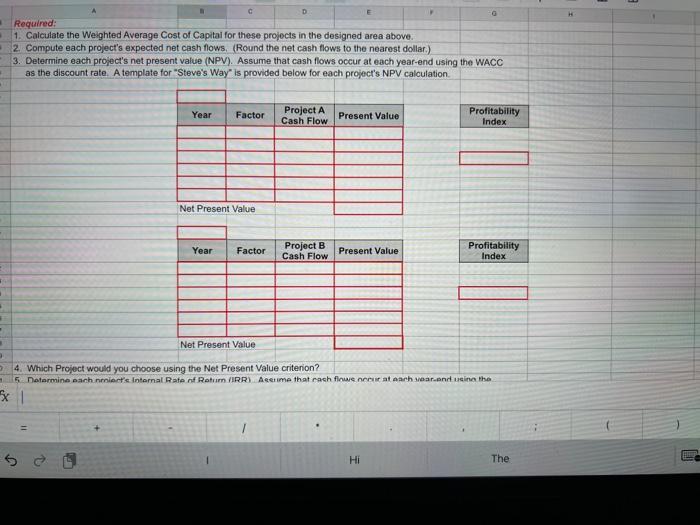

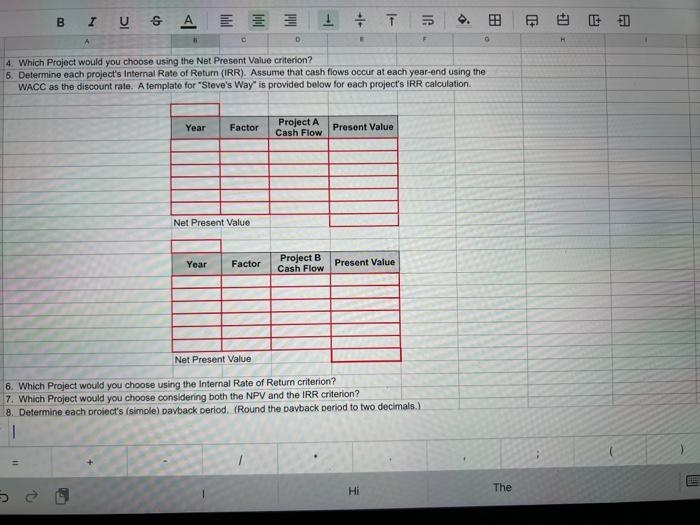

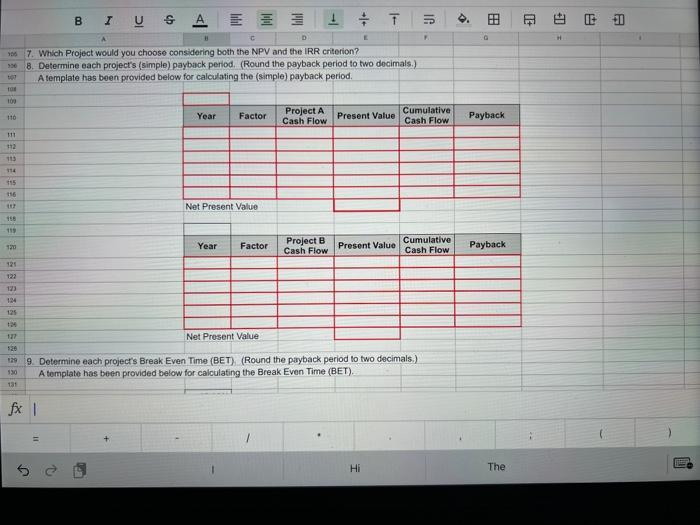

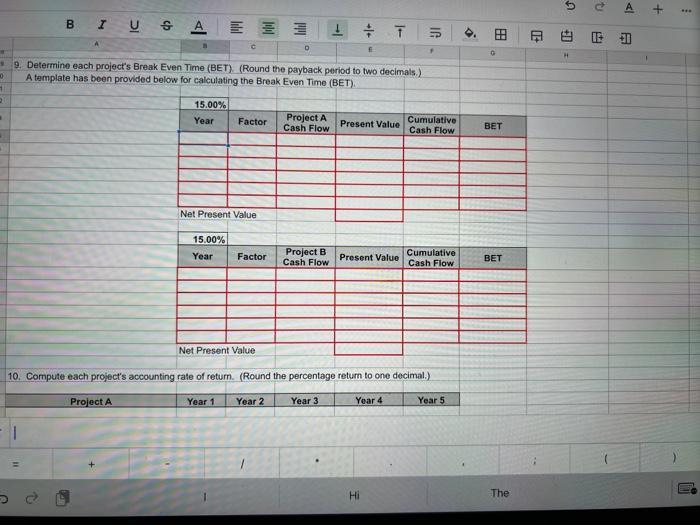

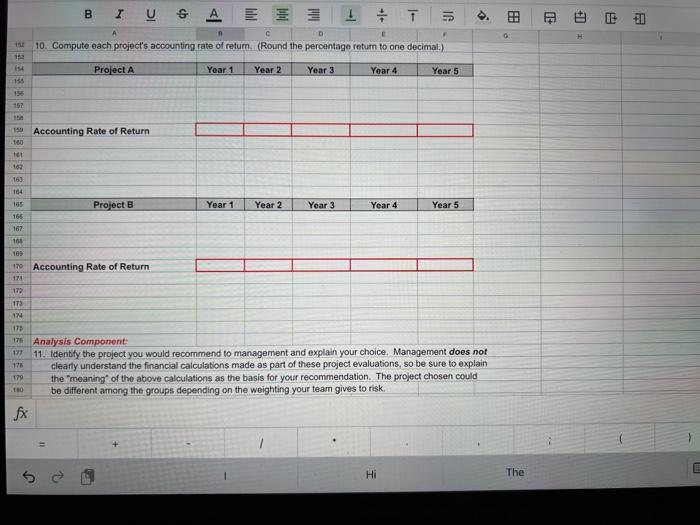

4 5. The Wilson Company has an opportunity to invest in one of two new projects. They are mutually exclusive. Project A 10 requires a $300,000 investment for the new machinery with a 5-year life and no salvage value. Project B requires a 7 $45,000 investment with a $5,000 salvage value- also with a 5-year life. The two projects yield the following predicted # annual future results. The company uses straight-line depreciation, and cash flows occur evenly throughout the year. # Wilson Company has the following Weighted Average Cost of Capital (WACC) information: 0 11 2 3 4 5 6 T " # o 21 2 es 6 27 Debt Stock Total Sales Expenses: fx | = 11 Description Capital Capital Structure % Direct Materials $100,000 200,000 $300,000 33.33% 66.67% 100.00% Year 1 Year 2 $359,523 $359,523 Pre-Tax Cost of Capital These projects are judged to have a "normal" amount of risk, and for such projects, the company uses the WACC as the discount rate. The applicable tax rate is 30%. The pre-tax cost of capital for debt is 13.00%, and the pre-tax cost of equity is 17.96%. Round the WACC to one decimal point.s (i.e., 10.0%). Project A 35,952 35,952 13.00% 17.96% Year 3 $359,523 Applicable Tax Rate 35,952 30.00% 0 Hi After-Tax Cost of Capital 9.10% 17.96% Year 4 Year 5 $359,523 $1,430,952 35,952 Weighted Ave. Cost of Capital 143,095 3.03% 11.97% 15.00% The 29 30 31 Total Expenses 30 Pretax Income M4 38 35 Net Income S 40 41 43 44 46 45 48 10 Direct Labor Overhead (Including Depreciation) Selling and Administrative Expense 51 82 53 *** Income Taxes (30%) Sales Expenses: Direct Materials Direct Labor Overhead (Including Depreciation) Selling and Administrative Expense Total Expenses Project B Pretax Income Income Taxes (30%) Net Income 54 Required: J 107,857 107,857 200,000 200,000 30,000 30,000 373,809 373,809 = (14,286) (14,286) (4.286) (4.286) ($10,000) ($10,000) Year 1 $170,239 Year 2 $170,239 17,024 17,024 51,072 51,072 75,000 75,000 10,000 10,000 153,096 153,096 17.143 5,143 $12,000 107,857 200,000 30,000 373,809 (14,286) (4,286) ($10,000) Year 3 $170,239 17,024 51,072 75,000 10,000 153,096 17,143 17,143 5,143 5,143 $12,000 $12,000 107,857 200,000 30,000 373,809 (14,286) (4.286) ($10,000) Year 4 $170,239 17,024 51,072 Hi 75,000 10,000 153,096 17,143 5,143 $12.000 429,286 200,000 30,000 802,381 628,571 188,571 $440,000 Year 5 $170,239 Whichever project you choose, if any, you require a minimum return of the WACC percent return on your investment. You may elect to use "Steve's Way" or the "Book Way". You may not use Excel functions (i.e., -NPV or =IRR). Show your work. Where templates have been provided, enter your solutions into the red outlined boxes below. 17,024 51,072 75,000 10,000 153,096 1. Calculate the Weighted Average Cost of Capital for these projects in the designed area above. 56 2. Compute each project's expected net cash flows. (Round the net cash flows to the nearest dollar.) fx | 17.143 5,143 $12,000 The Required: J 1. Calculate the Weighted Average Cost of Capital for these projects in the designed area above. 2. Compute each project's expected net cash flows, (Round the net cash flows to the nearest dollar.) 3. Determine each project's net present value (NPV). Assume that cash flows occur at each year-end using the WACC as the discount rate. A template for "Steve's Way" is provided below for each project's NPV calculation. F A 3 P . S . H Year J Factor Net Present Value Year Factor Project A Cash Flow Project B Cash Flow Present Value Present Value G Hi Profitability Index . Net Present Value 9 9 4. Which Project would you choose using the Net Present Value criterion? 1 5 Determine each niert's Internal Rate of Return (IRR) Assume that rash flows neeur at each year and using the * | Profitability Index The H 4 B IUG = A EE Year C Factor Net Present Value D Year Factor L 4. Which Project would you choose using the Net Present Value criterion? 5. Determine each project's Internal Rate of Return (IRR). Assume that cash flows occur at each year-end using the WACC as the discount rate. A template for "Steve's Way" is provided below for each project's IRR calculation. Project A Cash Flow E Project B Cash Flow T Present Value Present Value IG Hi F Net Present Value 6. Which Project would you choose using the Internal Rate of Return criterion? 7. Which Project would you choose considering both the NPV and the IRR criterion? 8. Determine each project's (simple) payback period. (Round the payback period to two decimals.). 88 G The H F IUG 1+ A D 106 7. Which Project would you choose considering both the NPV and the IRR criterion? 206 8. Determine each project's (simple) payback period. (Round the payback period to two decimals.) A template has been provided below for calculating the (simple) payback period. TON 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 fx | B 2 B Year Factor Net Present Value Year Factor Project A Cash Flow Project B Cash Flow T Present Value Present Value 127 Net Present Value 120 129 9. Determine each project's Break Even Time (BET), (Round the payback period to two decimals.) 130 A template has been provided below for calculating the Break Even Time (BET). 131 Hi 16 F Cumulative Cash Flow Cumulative Cash Flow O 68 Payback Payback The Iitta * 10 1 2 . B IUG 11 A 144 15.00% Year C 9. Determine each project's Break Even Time (BET). (Round the payback period to two decimals.) A template has been provided below for calculating the Break Even Time (BET). L #T Factor Net Present Value 15.00% Year Factor Net Present Value Project A Cash Flow Project B Cash Flow Present Value Present Value F Hi Cumulative Cash Flow 10. Compute each project's accounting rate of return. (Round the percentage return to one decimal.) Project A Year 1 Year 2 Year 3 Year 4 Cumulative Cash Flow Year 5 4 68 G BET BET The 5 U H + A D *** 152 (54 156 157 150 150 Accounting Rate of Return 160 161 162 163 164 165 166 BIUS A + T D E 10. Compute each project's accounting rate of return. (Round the percentage return to one decimal.) Project A Year 4 167 165 109 170 Accounting Rate of Return 171 172 173 174 178 179 180 175 176 Analysis Component: 177 fx Project B S 11 Year 1 Year 1 Year 2 Year 2 3 Year 3 Year 3 L Year 4 16 11. Identify the project you would recommend to management and explain your choice. Management does not clearly understand the financial calculations made as part of these project evaluations, so be sure to explain the "meaning of the above calculations as the basis for your recommendation. The project chosen could be different among the groups depending on the weighting your team gives to risk. Hi Year 5 Year 5 88 G The H 0 E

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Requirementl project y Depreciation using straight ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started