Answered step by step

Verified Expert Solution

Question

1 Approved Answer

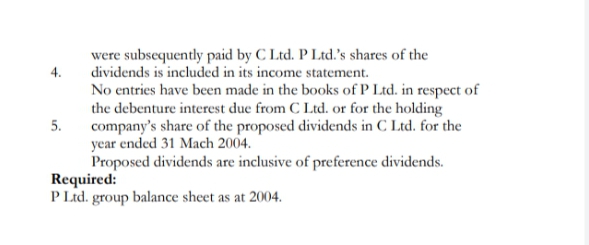

4. 5. were subsequently paid by C Ltd. P Ltd.'s shares of the dividends is included in its income statement. No entries have been

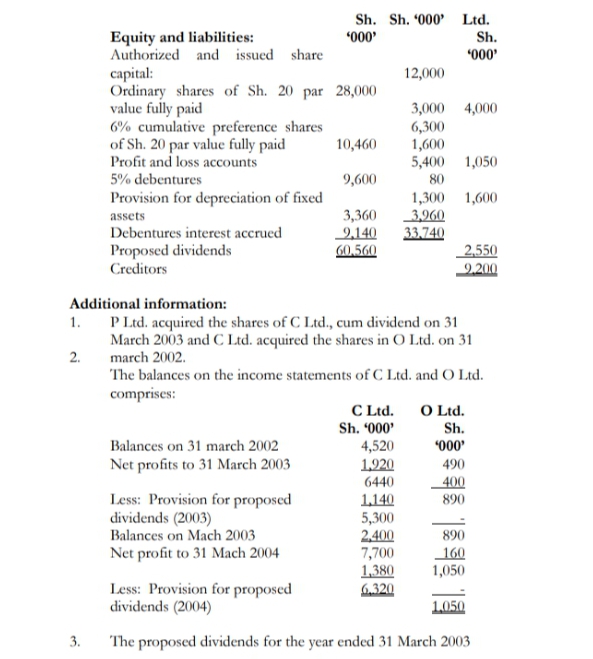

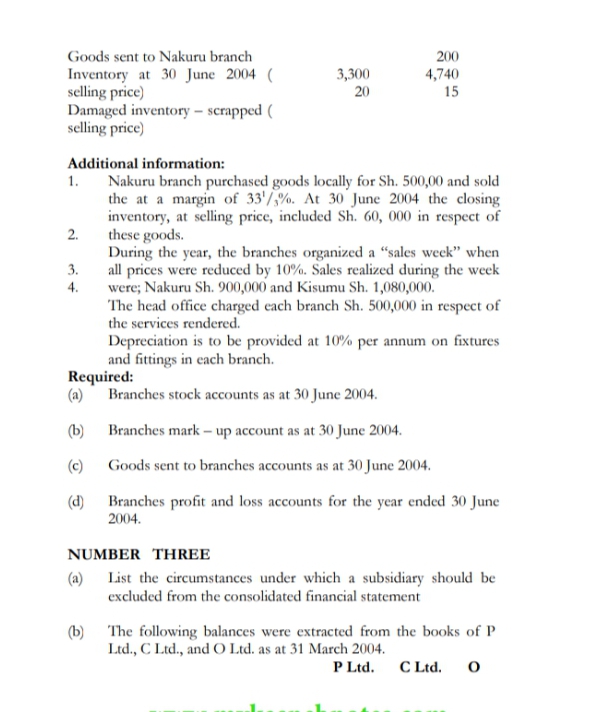

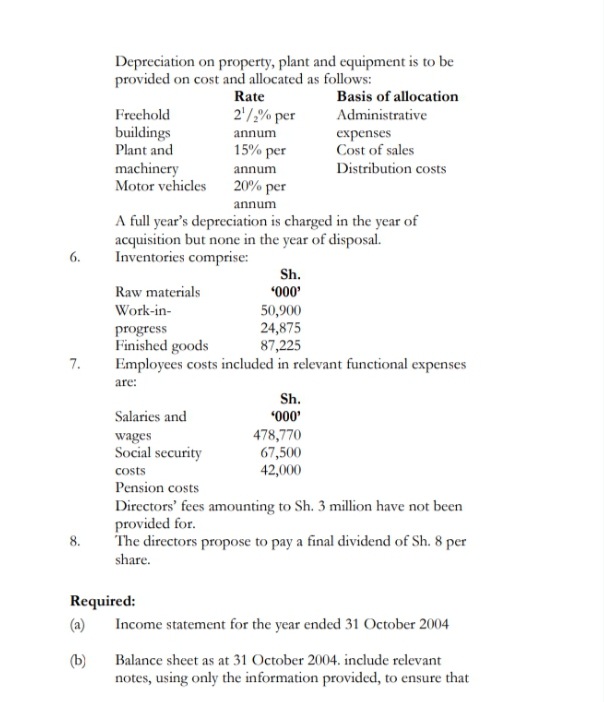

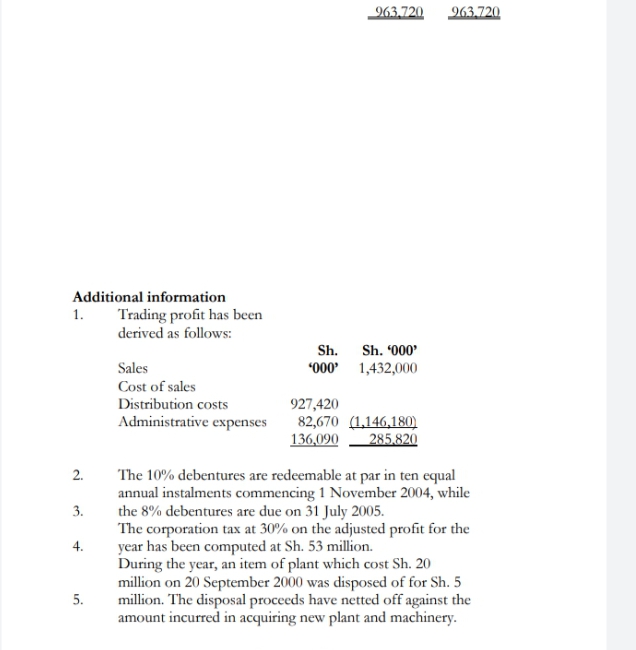

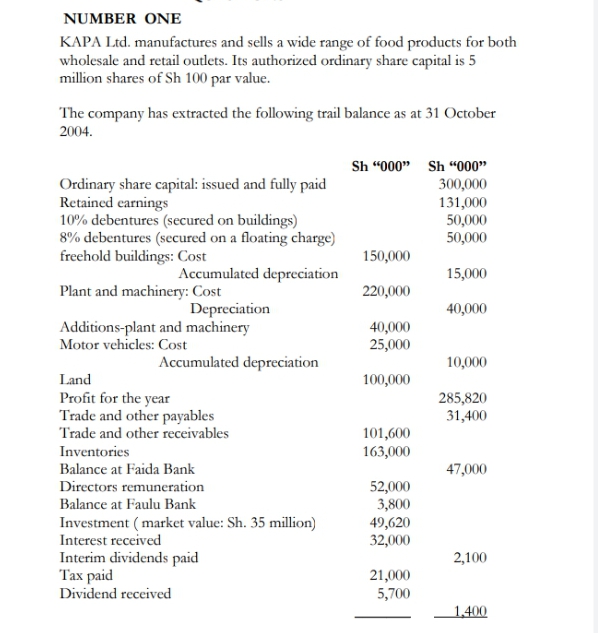

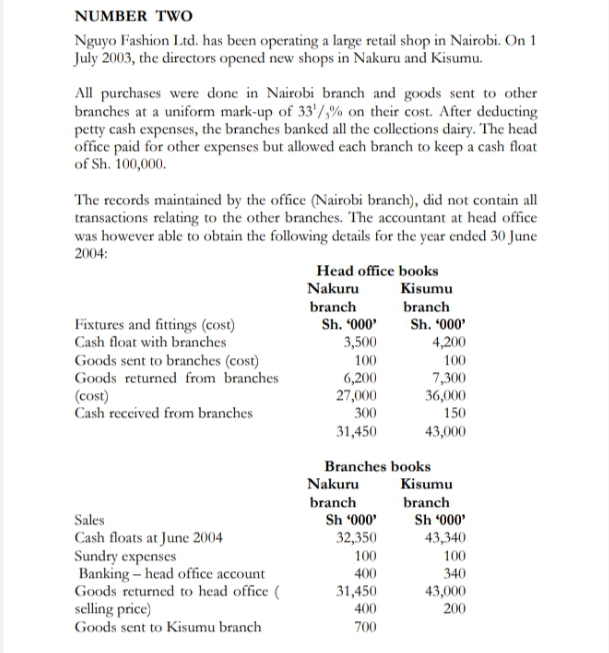

4. 5. were subsequently paid by C Ltd. P Ltd.'s shares of the dividends is included in its income statement. No entries have been made in the books of P Ltd. in respect of the debenture interest due from C Ltd. or for the holding company's share of the proposed dividends in C Ltd. for the year ended 31 Mach 2004. Proposed dividends are inclusive of preference dividends. Required: P Ltd. group balance sheet as at 2004. Sh. Sh. '000' Ltd. Equity and liabilities: '000' Sh. Authorized and issued share capital: Ordinary shares of Sh. 20 par 28,000 '000' 12,000 value fully paid 3,000 4,000 6% cumulative preference shares 6,300 of Sh. 20 par value fully paid 10,460 1,600 Profit and loss accounts 5,400 1,050 5% debentures 9,600 80 Provision for depreciation of fixed 1,300 1,600 assets 3,360 3,960 Debentures interest accrued 9,140 33,740 Proposed dividends 60,560 2,550 9.200 Creditors Additional information: 1. 2. P Ltd. acquired the shares of C Ltd., cum dividend on 31 March 2003 and C Ltd. acquired the shares in O Ltd. on 31 march 2002. The balances on the income statements of C Ltd. and O Ltd. comprises: Balances on 31 march 2002 C Ltd. O Ltd. Sh. '000' Sh. 4,520 '000' Net profits to 31 March 2003 1,920 490 6440 400 Less: Provision for proposed 1,140 890 dividends (2003) 5,300 Balances on Mach 2003 2,400 890 Net profit to 31 Mach 2004 7,700 160 1,380 1,050 Less: Provision for proposed 6.320 dividends (2004) 1,050 3. The proposed dividends for the year ended 31 March 2003 Goods sent to Nakuru branch Inventory at 30 June 2004 ( selling price) Damaged inventory - scrapped ( selling price) Additional information: 1. 2. 3. 4. 200 3,300 4,740 20 15 Nakuru branch purchased goods locally for Sh. 500,00 and sold the at a margin of 33%. At 30 June 2004 the closing inventory, at selling price, included Sh. 60, 000 in respect of these goods. During the year, the branches organized a "sales week" when all prices were reduced by 10%. Sales realized during the week were; Nakuru Sh. 900,000 and Kisumu Sh. 1,080,000. The head office charged each branch Sh. 500,000 in respect of the services rendered. Depreciation is to be provided at 10% per annum on fixtures and fittings in each branch. Required: (a) Branches stock accounts as at 30 June 2004. (b) Branches mark-up account as at 30 June 2004. (c) Goods sent to branches accounts as at 30 June 2004. (d) Branches profit and loss accounts for the year ended 30 June 2004. NUMBER THREE (a) List the circumstances under which a subsidiary should be excluded from the consolidated financial statement (b) The following balances were extracted from the books of P Ltd., C Ltd., and O Ltd. as at 31 March 2004. P Ltd. C Ltd. O 6. 7. Depreciation on property, plant and equipment is to be provided on cost and allocated as follows: Rate 2/2% per Basis of allocation Administrative expenses Freehold buildings annum Plant and 15% per Cost of sales machinery annum Distribution costs Motor vehicles 20% per annum A full year's depreciation is charged in the year of acquisition but none in the year of disposal. Inventories comprise: Raw materials Work-in- Sh. '000' 50,900 24,875 87,225 progress Finished goods Employees costs included in relevant functional expenses are: Sh. Salaries and '000' wages 478,770 Social security 67,500 costs 42,000 Pension costs 8. Directors' fees amounting to Sh. 3 million have not been provided for. The directors propose to pay a final dividend of Sh. 8 per share. Required: (a) Income statement for the year ended 31 October 2004 (b) Balance sheet as at 31 October 2004. include relevant notes, using only the information provided, to ensure that 963,720 963.720 Additional information 1. Trading profit has been derived as follows: Sales Sh. '000' Sh. '000' 1,432,000 Cost of sales Distribution costs 927,420 Administrative expenses 82,670 (1,146,180) 136,090 285.820 2. 3. 4. 5. The 10% debentures are redeemable at par in ten equal annual instalments commencing 1 November 2004, while the 8% debentures are due on 31 July 2005. The corporation tax at 30% on the adjusted profit for the year has been computed at Sh. 53 million. During the year, an item of plant which cost Sh. 20 million on 20 September 2000 was disposed of for Sh. 5 million. The disposal proceeds have netted off against the amount incurred in acquiring new plant and machinery. NUMBER ONE KAPA Ltd. manufactures and sells a wide range of food products for both wholesale and retail outlets. Its authorized ordinary share capital is 5 million shares of Sh 100 par value. The company has extracted the following trail balance as at 31 October 2004. Sh "000" Sh "000" Ordinary share capital: issued and fully paid Retained earnings 300,000 131,000 10% debentures (secured on buildings) 50,000 8% debentures (secured on a floating charge) 50,000 freehold buildings: Cost 150,000 Accumulated depreciation 15,000 Plant and machinery: Cost 220,000 Depreciation 40,000 Additions-plant and machinery 40,000 Motor vehicles: Cost 25,000 Accumulated depreciation 10,000 Land 100,000 Profit for the year 285,820 Trade and other payables 31,400 Trade and other receivables 101,600 Inventories 163,000 Balance at Faida Bank 47,000 Directors remuneration 52,000 Balance at Faulu Bank 3,800 Investment (market value: Sh. 35 million) 49,620 Interest received 32,000 Interim dividends paid 2,100 Tax paid 21,000 Dividend received 5,700 1,400 NUMBER TWO Nguyo Fashion Ltd. has been operating a large retail shop in Nairobi. On 1 July 2003, the directors opened new shops in Nakuru and Kisumu. All purchases were done in Nairobi branch and goods sent to other branches at a uniform mark-up of 33% on their cost. After deducting petty cash expenses, the branches banked all the collections dairy. The head office paid for other expenses but allowed each branch to keep a cash float of Sh. 100,000. The records maintained by the office (Nairobi branch), did not contain all transactions relating to the other branches. The accountant at head office was however able to obtain the following details for the year ended 30 June 2004: Head office books Nakuru Kisumu branch branch Fixtures and fittings (cost) Sh. '000' Sh. '000' Cash float with branches 3,500 4,200 Goods sent to branches (cost) 100 100 Goods returned from branches 6,200 7,300 (cost) 27,000 36,000 Cash received from branches 300 150 31,450 43,000 Branches books Nakuru Kisumu branch branch Sales Sh '000' Sh '000' Cash floats at June 2004 32,350 43,340 Sundry expenses 100 100 Banking-head office account 400 340 Goods returned to head office ( 31,450 43,000 selling price) 400 200 Goods sent to Kisumu branch 700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started