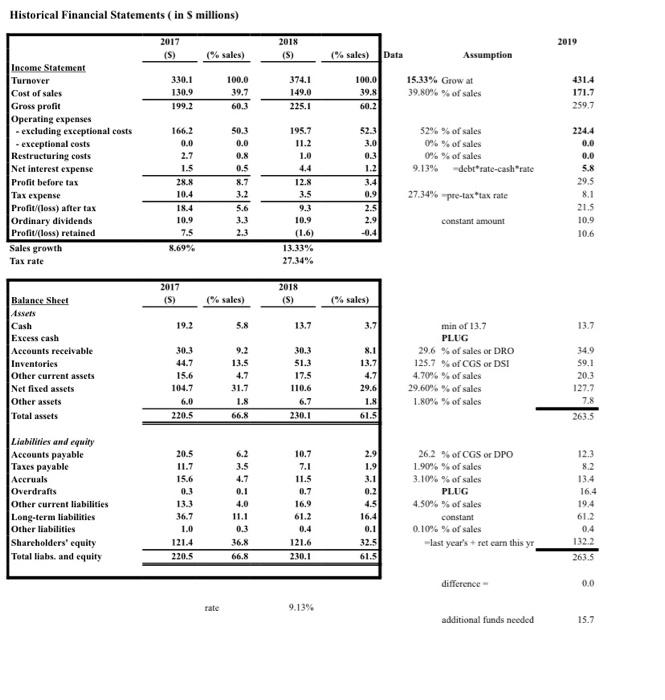

4. (55 points) Prepare proforma forecasts of financial statements of Simple, Inc for 2020 and 2021. Use the 2019 proforma we discussed in class as guidance. What are the company's forecasted Net Earnings (profit/loss after tax) and additional financing requirements (overdrafts) in 2020 and in 2021? Assumptions: in 2020 and 2021, sales will grow at 10% per year, CGS will equal 42% of sales, SGA will equal 48% of sales, DRO and DPO will be maintained at 30 days, while DSI will be maintained at 100 days. All other accounts will be maintained at ratios to sales similar to those during 2019. ANSWER: Historical Financial Statements ( in S millions) 2019 2017 (S) 2018 (S) (% sales) (% sales) Data Assumption 3.30.1 130.9 199.2 100.0 39.7 60.3 374.1 149.0 225.1 100.0 39.8 60.2 15.33% Grow at 39.80% % of sales 171.7 259.7 523 166.2 0.0 Income Statement Turnover Cost of sales Gross profit Operating expenses - excluding exceptional costs - exceptional costs Restructuring costs Net interest expense Profit before tax Tax expense Profit/(loss) after tax Ordinary dividends Profit/(loss) retained Sales growth Tax rate 52% % of sales 0% % of sales 0%% of sales 9.13% debt rate-cashrate 2.7 1.5 195.7 11.2 1.0 4.4 12.8 3.5 50.3 0.0 0.8 0.5 8.7 3.2 5.6 3.3 2.3 0.3 1.2 3.4 0.9 224.4 0.0 0.0 5.8 29.5 8.1 21.5 10.9 10.6 28.8 10.4 18.4 10.9 7.5 8.69% 27.34 pre-taxtax rate 2.5 2.9 -0.4 constant amount 10.9 (1.6) 13.33% 27.34% 2017 (S) 2018 (S) Balance Sheet (% sales) (% sales) 19.2 5.8 13.7 3.7 13.7 30.3 30.3 44.7 $1.3 Cash Excess cash Accounts receivable Inventories Other current assets Net fixed assets Other assets Total assets 9.2 13.5 4.7 31.7 1.8 66.8 15.6 104.7 6.0 min of 13.7 PLUG 29,6 % of sales of DRO 125.7 % of CGS or DSI 4.70% % of sales 29.60% % of sales 1.80% % of sales 8.1 13.7 4.7 29.6 1.8 61.5 17.5 110.6 6.7 230.1 349 59.1 20.3 127.7 7.8 263.5 220.5 20.5 11.7 15.6 0.3 10.7 7.1 11.5 0.7 2.9 1.9 3.1 0.2 Liabilities and equity Accounts payable Taxes payable Aceruals Overdrafts Other current liabilities Long-term liabilities Other liabilities Shareholders' equity Total liabs, and equity 6.2 3.5 4.7 0.1 4.0 11.1 0.3 36,8 26.2 % of CGS or DPO 1.90%% of sales 3.10% % of sales PLUG 4.50% % of sales constant 0.10% % of sales last year's +ret carn this yr 12.3 8.2 134 16.4 19.4 4.5 612 36.7 1.0 121.4 220.5 61.2 0.4 121.6 230.1 16.4 0.1 32.5 0.4 132.2 263.5 66.8 61.3 difference - 00 rats 9.13% additional funds needed 15.7 4. (55 points) Prepare proforma forecasts of financial statements of Simple, Inc for 2020 and 2021. Use the 2019 proforma we discussed in class as guidance. What are the company's forecasted Net Earnings (profit/loss after tax) and additional financing requirements (overdrafts) in 2020 and in 2021? Assumptions: in 2020 and 2021, sales will grow at 10% per year, CGS will equal 42% of sales, SGA will equal 48% of sales, DRO and DPO will be maintained at 30 days, while DSI will be maintained at 100 days. All other accounts will be maintained at ratios to sales similar to those during 2019. ANSWER: Historical Financial Statements ( in S millions) 2019 2017 (S) 2018 (S) (% sales) (% sales) Data Assumption 3.30.1 130.9 199.2 100.0 39.7 60.3 374.1 149.0 225.1 100.0 39.8 60.2 15.33% Grow at 39.80% % of sales 171.7 259.7 523 166.2 0.0 Income Statement Turnover Cost of sales Gross profit Operating expenses - excluding exceptional costs - exceptional costs Restructuring costs Net interest expense Profit before tax Tax expense Profit/(loss) after tax Ordinary dividends Profit/(loss) retained Sales growth Tax rate 52% % of sales 0% % of sales 0%% of sales 9.13% debt rate-cashrate 2.7 1.5 195.7 11.2 1.0 4.4 12.8 3.5 50.3 0.0 0.8 0.5 8.7 3.2 5.6 3.3 2.3 0.3 1.2 3.4 0.9 224.4 0.0 0.0 5.8 29.5 8.1 21.5 10.9 10.6 28.8 10.4 18.4 10.9 7.5 8.69% 27.34 pre-taxtax rate 2.5 2.9 -0.4 constant amount 10.9 (1.6) 13.33% 27.34% 2017 (S) 2018 (S) Balance Sheet (% sales) (% sales) 19.2 5.8 13.7 3.7 13.7 30.3 30.3 44.7 $1.3 Cash Excess cash Accounts receivable Inventories Other current assets Net fixed assets Other assets Total assets 9.2 13.5 4.7 31.7 1.8 66.8 15.6 104.7 6.0 min of 13.7 PLUG 29,6 % of sales of DRO 125.7 % of CGS or DSI 4.70% % of sales 29.60% % of sales 1.80% % of sales 8.1 13.7 4.7 29.6 1.8 61.5 17.5 110.6 6.7 230.1 349 59.1 20.3 127.7 7.8 263.5 220.5 20.5 11.7 15.6 0.3 10.7 7.1 11.5 0.7 2.9 1.9 3.1 0.2 Liabilities and equity Accounts payable Taxes payable Aceruals Overdrafts Other current liabilities Long-term liabilities Other liabilities Shareholders' equity Total liabs, and equity 6.2 3.5 4.7 0.1 4.0 11.1 0.3 36,8 26.2 % of CGS or DPO 1.90%% of sales 3.10% % of sales PLUG 4.50% % of sales constant 0.10% % of sales last year's +ret carn this yr 12.3 8.2 134 16.4 19.4 4.5 612 36.7 1.0 121.4 220.5 61.2 0.4 121.6 230.1 16.4 0.1 32.5 0.4 132.2 263.5 66.8 61.3 difference - 00 rats 9.13% additional funds needed 15.7