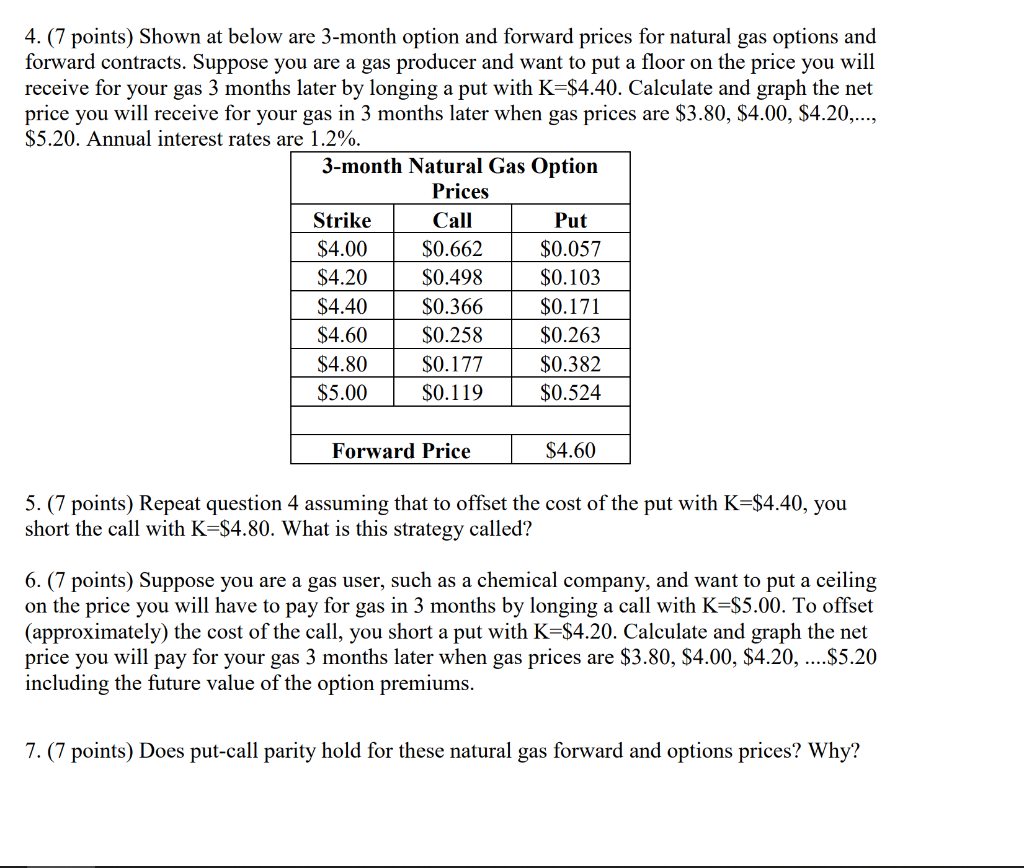

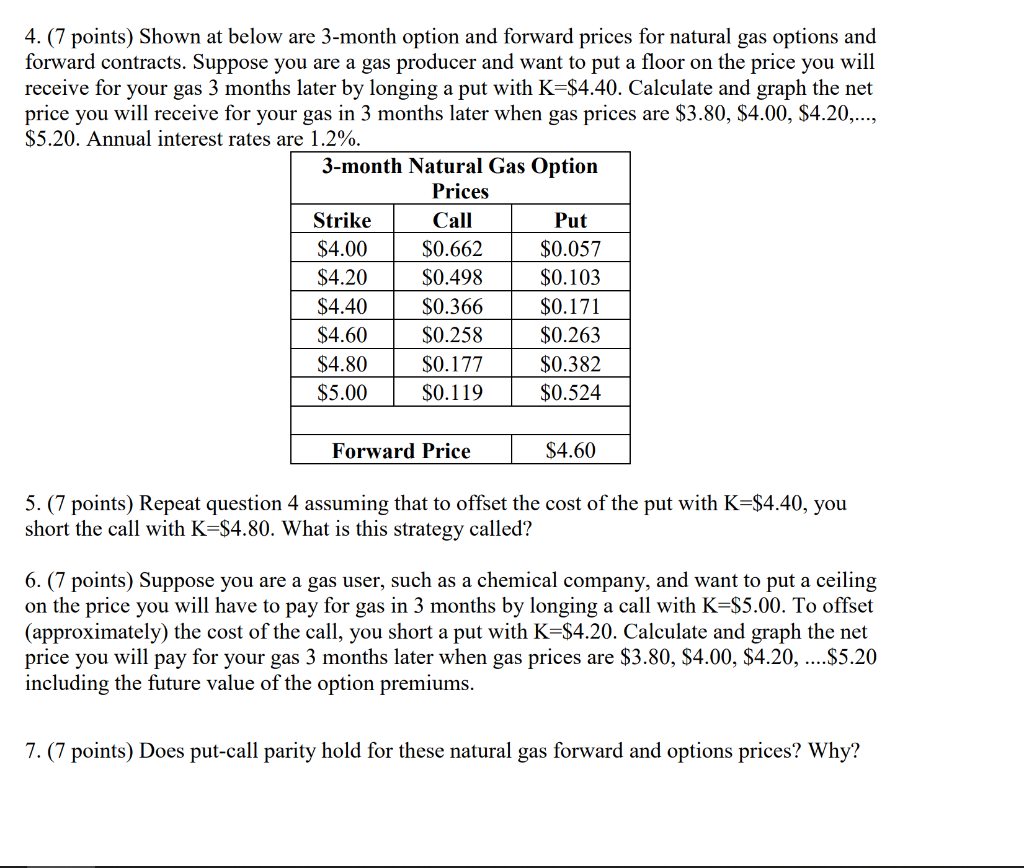

4. (7 points) Shown at below are 3-month option and forward prices for natural gas options and forward contracts. Suppose you are a gas producer and want to put a floor on the price you will receive for your gas 3 months later by longing a put with K=$4.40. Calculate and graph the net price you will receive for your gas in 3 months later when gas prices are $3.80, $4.00, $4.20,..., $5.20. Annual interest rates are 1.2%. 3-month Natural Gas Option Prices Strike Call Put $4.00 $0.662 $0.057 $4.20 $0.498 $0.103 $4.40 $0.366 $0.171 $4.60 $0.258 $0.263 $4.80 $0.177 $0.382 $5.00 $0.119 $0.524 Forward Price $4.60 5.(7 points) Repeat question 4 assuming that to offset the cost of the put with K=$4.40, you short the call with K=$4.80. What is this strategy called? 6. (7 points) Suppose you are a gas user, such as a chemical company, and want to put a ceiling on the price you will have to pay for gas in 3 months by longing a call with K=$5.00. To offset (approximately) the cost of the call, you short a put with K=$4.20. Calculate and graph the net price you will pay for your gas 3 months later when gas prices are $3.80, $4.00, $4.20, ....$5.20 including the future value of the option premiums. 7. (7 points) Does put-call parity hold for these natural gas forward and options prices? Why? 4. (7 points) Shown at below are 3-month option and forward prices for natural gas options and forward contracts. Suppose you are a gas producer and want to put a floor on the price you will receive for your gas 3 months later by longing a put with K=$4.40. Calculate and graph the net price you will receive for your gas in 3 months later when gas prices are $3.80, $4.00, $4.20,..., $5.20. Annual interest rates are 1.2%. 3-month Natural Gas Option Prices Strike Call Put $4.00 $0.662 $0.057 $4.20 $0.498 $0.103 $4.40 $0.366 $0.171 $4.60 $0.258 $0.263 $4.80 $0.177 $0.382 $5.00 $0.119 $0.524 Forward Price $4.60 5.(7 points) Repeat question 4 assuming that to offset the cost of the put with K=$4.40, you short the call with K=$4.80. What is this strategy called? 6. (7 points) Suppose you are a gas user, such as a chemical company, and want to put a ceiling on the price you will have to pay for gas in 3 months by longing a call with K=$5.00. To offset (approximately) the cost of the call, you short a put with K=$4.20. Calculate and graph the net price you will pay for your gas 3 months later when gas prices are $3.80, $4.00, $4.20, ....$5.20 including the future value of the option premiums. 7. (7 points) Does put-call parity hold for these natural gas forward and options prices? Why