Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. A 50,000-square-foot parcel of land (which has equal value per square foot) is purchased by a developer who pays $10,000 in cash, takes title

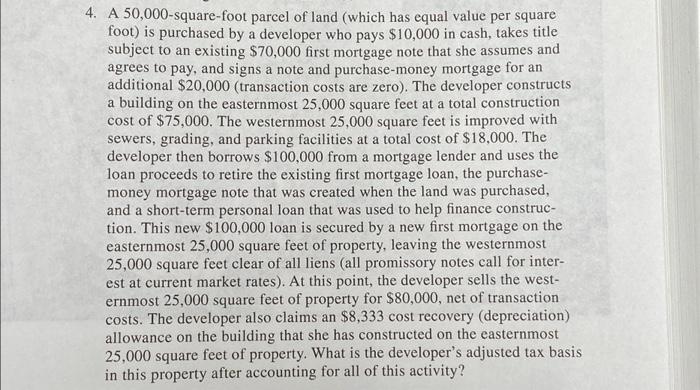

4. A 50,000-square-foot parcel of land (which has equal value per square foot) is purchased by a developer who pays $10,000 in cash, takes title subject to an existing $70,000 first mortgage note that she assumes and agrees to pay, and signs a note and purchase-money mortgage for an additional $20,000 (transaction costs are zero). The developer constructs a building on the easternmost 25,000 square feet at a total construction cost of $75,000. The westernmost 25,000 square feet is improved with sewers, grading, and parking facilities at a total cost of $18,000. The developer then borrows $100,000 from a mortgage lender and uses the loan proceeds to retire the existing first mortgage loan, the purchase- money mortgage note that was created when the land was purchased, and a short-term personal loan that was used to help finance construc- tion. This new $100,000 loan is secured by a new first mortgage on the easternmost 25,000 square feet of property, leaving the westernmost 25,000 square feet clear of all liens (all promissory notes call for inter- est at current market rates). At this point, the developer sells the west- ernmost 25,000 square feet of property for $80,000, net of transaction costs. The developer also claims an $8,333 cost recovery (depreciation) allowance on the building that she has constructed on the easternmost 25,000 square feet of property. What is the developer's adjusted tax basis in this property after accounting for all of this activity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started