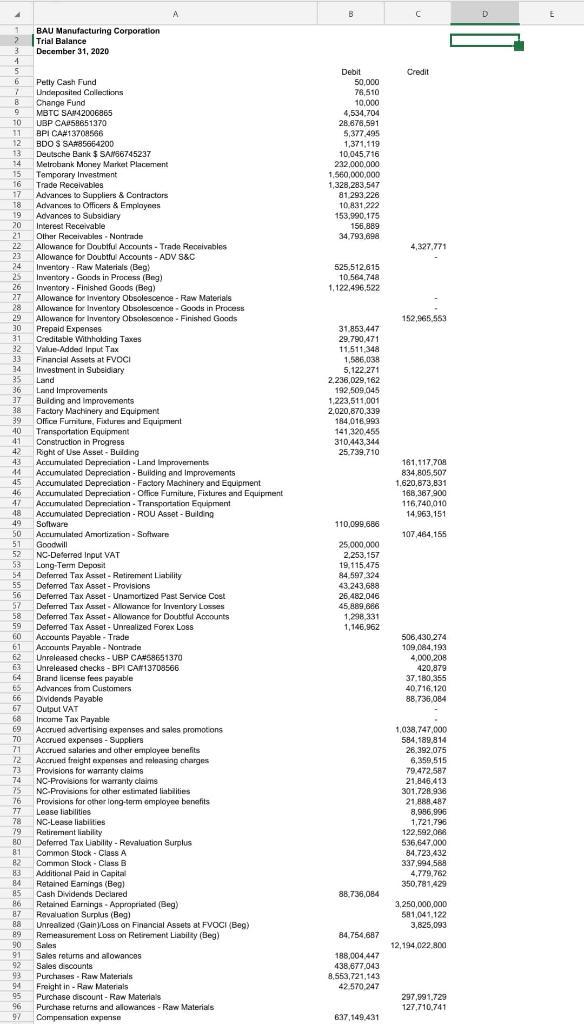

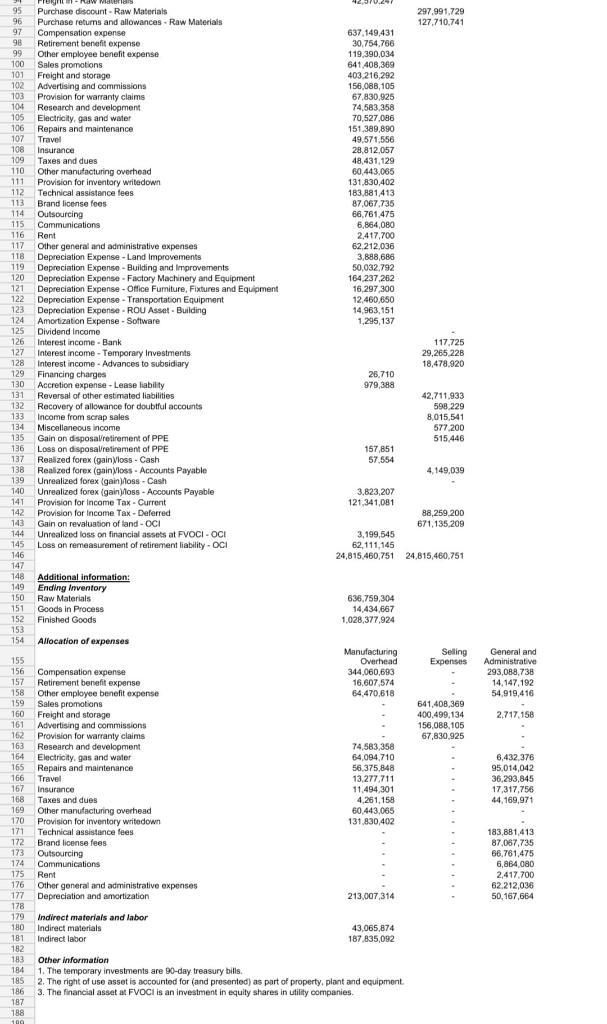

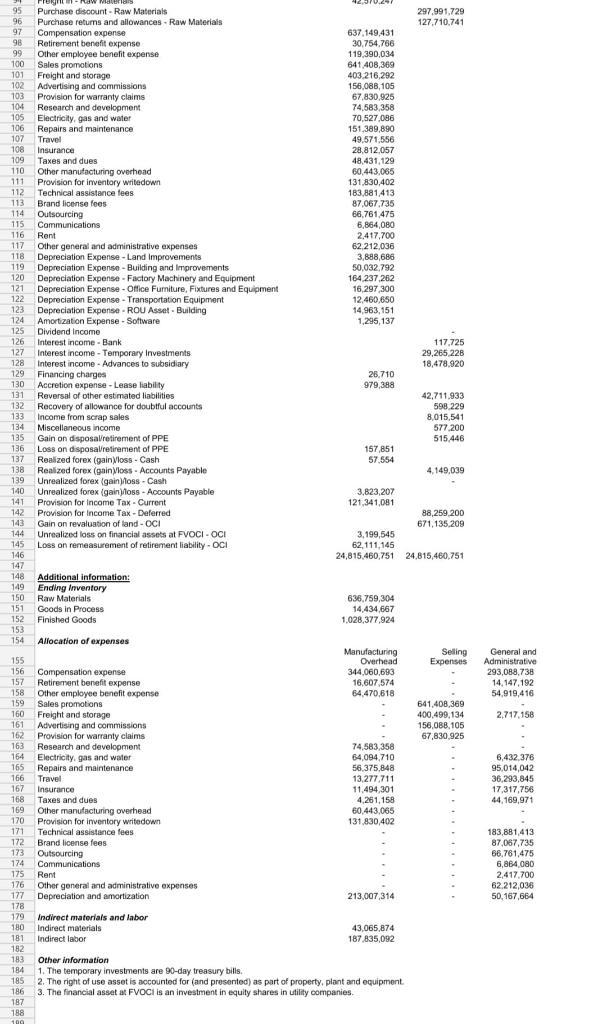

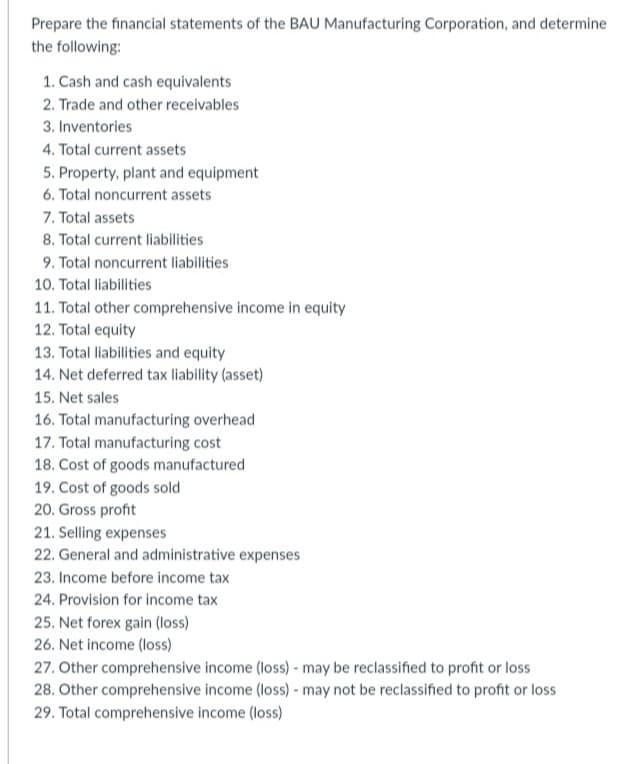

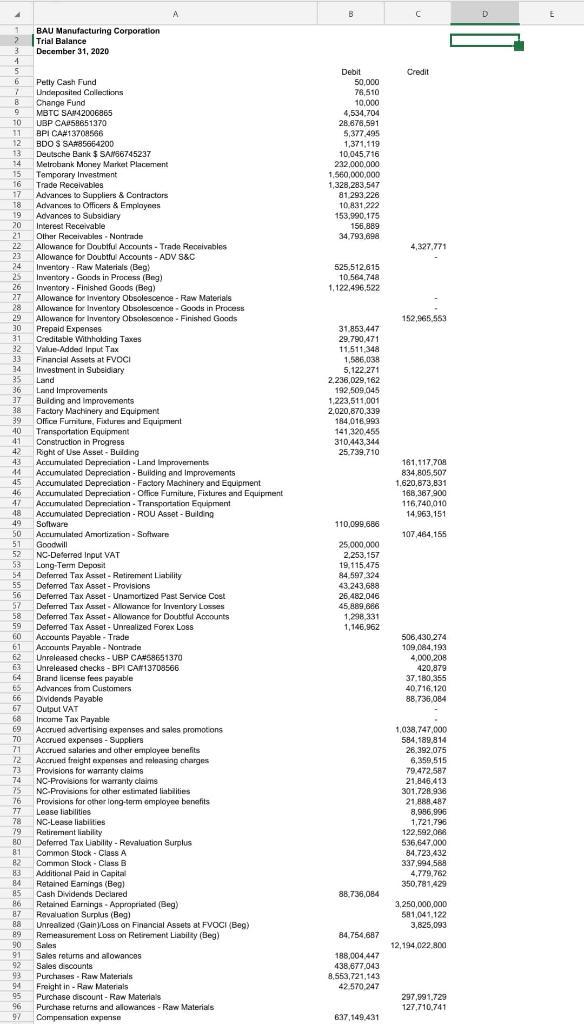

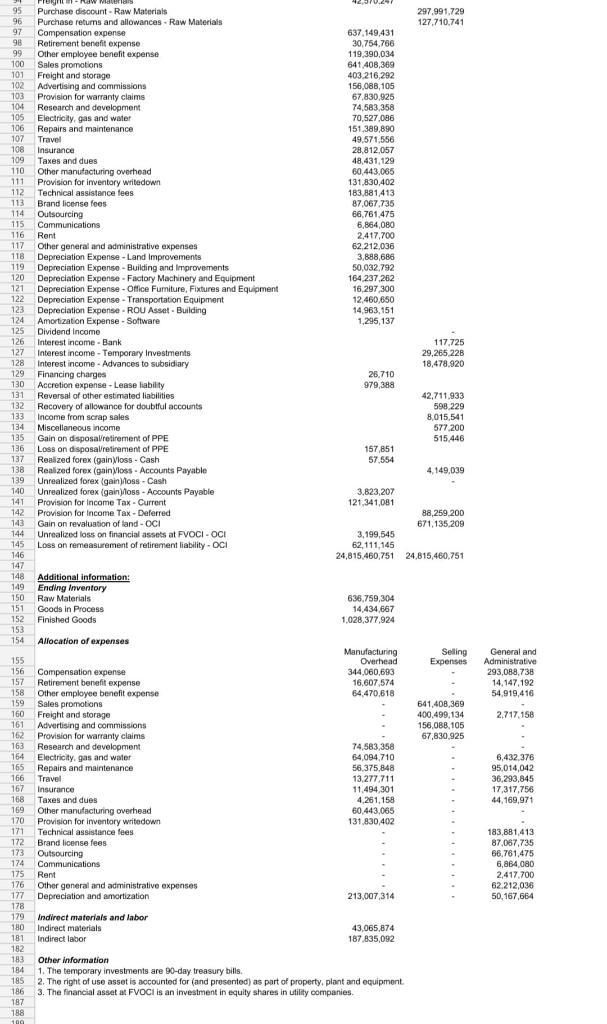

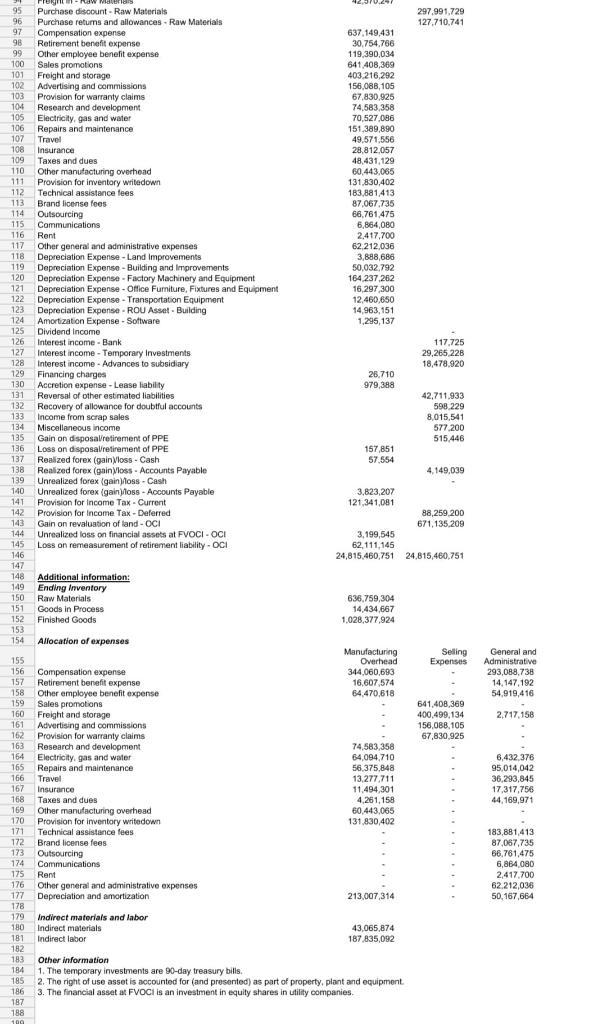

4 A B C BAU Manufacturing Corporation Trial Balance December 31, 2020 ameno Credit Debit 50,000 76,510 10,000 4,534,704 28.678,591 5,377.495 1,371,119 10.045,716 232,000,000 1,560,000,000 1,328,283,547 81 293 226 10.831 222 153,990.175 156.889 34 793 698 4,327.771 525,512.615 10.564.748 1,122,496,522 152,965.552 31.853,447 29.790,471 11,511,348 1,586,038 5,122.271 2,238,029,162 192,509.045 1,223,511,001 2,020,870,339 184,016.993 141,320.455 310,443,344 25.739.710 161,117,708 834.805 502 1.620,873,831 168,367 900 116,740010 14.963.151 1 2 3 4 S 6 7 B 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 24 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 SO 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 12 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 110,099.685 107 464.155 Pelly Cash Fund Undeposited Collections Change Fund MBTC SA142006865 UBP CA258651370 BPI CA#13708566 BDO S SAR85664200 45237 S Deutsche Bank $ SAX66745237 Metrobank Money Market Placement Temporary Investment Trade Receivables Advances to Suppliers & Contractors Advanons to Officers & Emplaynes Advances to Subsidiary Interest Receivable Other Receivables - Nontrade Allowance for Doubtful Accounts - Trade Receivables Allowance for Doubtful Accounts - ADV S&C Inventory- Raw Materials (Beg) Inventory. Goods in Process (Beg) Inventory - Finished Goods (Bog) Allowance for inventory Obsolescence - Raw Materials Allowance for inventory Obsolescence - Goods in Process Allowance for Inventory Obsolescence - Finished Goods Prepaid Expenses Creditable Withholding Taxes Value Added Input Tax Financial Assets at FVOCI Investment in Subsidiary Land Land Improvements Building and improvements Factory Machinery and Equipment Office Furniture, Fixtures and Equipment Transportation Equipment Construction in Progress Right of Use Asset - Building Accumulated Depreciation. Land Improvements Accumulated Depreciation - Building and Improvements Accumulated Depreciation - Factory Machinery and Equipment Accumulated Depreciation - Office Fumiture, Fixtures and Equipment Accumulated Depreciation - Transportation Equipment Accumulated Depreciation - ROU Asset - Building Software Accumulated Amortization - Software Goodwill NC-Deferred Input VAT Long-Term Deposit Daforrest Tax Asset - Retirement Liability Deferred Tax Asset - Provisions Deferred Tax Asset - Unamortized Past Service Cost Deferred Tax Asset Allowance for Inventory Les Deferred Tax Asset - Allowance for Doubtful Accounts Deferred Tax Asset - Unrealized Forex Loss Accounts Payable - Trade Accounts Payable - Nontrade Unreleased checks - UBP CAN 58651370 Unreleased checks - BPI CA#13708566 Brand license fees payable Advances from Customers Dividends Payable Output VAT Income Tax Payable Accrued advertising expenses and sales promotions Accrued expenses - Suppliers Accrued salaries and other employee benefits Accrued freight expenses and releasing charges Provisions for warranty claims NC-Provisions for warranty claims NC-Provisions for other estimated liabilities Provisions for other long-term employee benefits Lease liabilities NC-Lease liabilities Retirement liability Deferred Tax Lability - Revaluation Surplus Common Stock - Class A Common Stock - Class 3 Additional Paid in Capital Retained Earnings (Bog) Cash Dividends Declared Retained Earnings - Appropriated (Beg) Ravaluat on Surplus (Bog) Unrealized (Gainy Loes on Financial Assets at FVOCI (Beg) Remeasurement Loss on Retirement Liability (Beg) Sales Sales returns and allowances Sales discounts Purchases - Raw Materials Freight in - Raw Materials Purchase discount - Rew Materials Purchase returns and allowances - Raw Materials Compensation expense 25,000,000 2,253,157 19.115 475 84,597 324 43.243.688 26.482.046 45,889,888 1.298,331 1,146.962 506,430.274 109,084.193 4,000.208 420.879 37.180.355 40,716.120 88.736,084 1.038,747,000 584,189.814 26,392.075 6,359,515 79,472,587 21.848.413 301,728,936 21 888.487 8,986,996 1.721.796 122,592,068 536.647,000 84.723.432 337,994,588 4,779,762 350.781.429 88.738084 3,250,000,000 581,041,122 3,825,093 84.754,687 12, 194,022.800 188,004,447 438,677,043 8,553,721,143 42.570,247 297,991,729 127,710,741 637,149 431 FO 95 Purchase discount - Raw Materials 297,991,729 96 Purchase returns and allowances - Raw Materials 127.710.741 97 Compensation expense 637.149.431 98 Retirement benefit expense 30,754,766 99 Other employee benefit expense 119,390,034 100 Sales promotions 641 408,369 101 Freight and storage 403,216,292 102 Advertising and commissions 156,088,105 103 Provision for warranty claims 67,830,925 104 Research and development 74,583 358 105 Electricity, gas and water 70,527,086 106 Repairs and maintenance 151,389,890 107 Travel 49.571 556 108 Insurance 28,812,057 109 Taxes and dues 48,431,129 110 Other manufacturing overhead 60.443.065 111 Provision for inventory writedown 131,830,402 112 Technical assistance fees 183,881,413 113 Brand license fees 87,067.735 114 Outsourcing 66,761,475 115 Communications 6,864,080 116 Rent 2,417,700 117 Other general and administrative expenses 62.212,036 118 Depreciation Expense - Land Improvements 3,888,686 119 Depreciation Expense - Building and improvements 50.032.792 120 Depreciation Expense - Factory Machinery and Equipment 164 237 262 121 Depreciation Expense - Office Furniture, Fixtures and Equipment 16,297,300 122 Depreciation Expense - Transportation Equipment 12.460.650 123 Depreciation Expense - ROU Asset - Building 14,963,151 124 Amortization Expense - Software 1.295,137 125 Dividend Income 126 Interest income - Bank 117,725 127 Interest income - Temporary Investments 29,265,228 128 Interest income - Advances to subsidiary 18,478.920 129 Financing charges 26.710 130 Accretion expense - Lease liability 979,388 131 Reversal of other estimated liabilities 42.711.933 132 Recovery of allowance for doubtful accounts 598 229 133 Income from scrap sales 8,015,541 134 Miscellaneous income 577.200 135 Gain on disposa retirement of PPE 515 446 136 Loss on disposal retirement of PPE 157 851 137 Realized forex (gain loss - Cash 57,554 138 Realized forex (gainyloss. Accounts Payable 4,149,039 139 Unrealized forex (gainoss-Cash 140 Unrealized forex (gainos - Accounts Payable 3,823,207 141 Provision for Income Tax - Current 121,341,081 142 Provision for Income Tax-Deferred 88,259,200 143 Gain on revaluation of land - OCI 671,135,209 144 Unrealized loss on financial assets at FVOCI - OCI 3,199,545 145 Loss on remeasurement of retirement liability - OCI 62,111,145 146 24,815,460,751 24,815,460,751 147 148 Additional information: 149 Ending Inventory 150 Raw Materials 636,759,304 151 Goods in Process 14,434 667 152 Finished Goods 1,028,377,924 153 154 Allocation of expenses Manufacturing Selling 155 Overhead Expenses 156 Compensation expense 344,060,693 157 Retirement benefit expense 16,607,574 158 Other employee benefit expense 64 470,618 159 Sales promotions 641.408,369 160 Freight and storage 400,499,134 161 Advertising and commissions 156,088,105 162 Provision for warranty claims 67,830,925 163 Research and development 74,583,358 164 Electricity, gas and water 84,094,710 165 Repairs and maintenance 56,375,848 166 Travel 13,277,711 167 Insurance 11.494,301 168 Taxes and dues 4,261,158 169 Other manufacturing overhead 60.443.065 170 Provision for inventory writedown 131.830,402 171 Technical assistance fees 172 Brand license fees 173 Outsourcing 174 Communications 175 Rent 176 Other general and administrative expenses 177 Depreciation and amortization 213,007,314 178 179 Indirect materials and labor 180 Indirect materials 43,065,874 181 Indirect labor 187,835,092 182 183 Other Information 184 1. The temporary investments are 90-day treasury bills. 185 2. The right of use asset is accounted for (and presented) as part of property, plant and equipment 186 3. The financial asset at FVOCI is an investment in equity shares in utility companies 187 188 109 General and Administrative 293,088.738 14,147,192 54,919,416 2,717,158 6,432,376 95,014,042 36.293,845 17,317.756 44,169,971 183,881,413 87,067,735 66,761,475 6,864.080 2,417,700 62.212,036 50.167,664 FO 95 Purchase discount - Raw Materials 297,991,729 96 Purchase returns and allowances - Raw Materials 127.710.741 97 Compensation expense 637.149.431 98 Retirement benefit expense 30,754,766 99 Other employee benefit expense 119,390,034 100 Sales promotions 641 408,369 101 Freight and storage 403,216,292 102 Advertising and commissions 156,088,105 103 Provision for warranty claims 67,830,925 104 Research and development 74,583 358 105 Electricity, gas and water 70,527,086 106 Repairs and maintenance 151,389,890 107 Travel 49.571 556 108 Insurance 28,812,057 109 Taxes and dues 48,431,129 110 Other manufacturing overhead 60.443.065 111 Provision for inventory writedown 131,830,402 112 Technical assistance fees 183,881,413 113 Brand license fees 87,067.735 114 Outsourcing 66,761,475 115 Communications 6,864,080 116 Rent 2,417,700 117 Other general and administrative expenses 62.212,036 118 Depreciation Expense - Land Improvements 3,888,686 119 Depreciation Expense - Building and improvements 50.032.792 120 Depreciation Expense - Factory Machinery and Equipment 164 237 262 121 Depreciation Expense - Office Furniture, Fixtures and Equipment 16,297,300 122 Depreciation Expense - Transportation Equipment 12.460.650 123 Depreciation Expense - ROU Asset - Building 14,963,151 124 Amortization Expense - Software 1.295,137 125 Dividend Income 126 Interest income - Bank 117,725 127 Interest income - Temporary Investments 29,265,228 128 Interest income - Advances to subsidiary 18,478.920 129 Financing charges 26.710 130 Accretion expense - Lease liability 979,388 131 Reversal of other estimated liabilities 42.711.933 132 Recovery of allowance for doubtful accounts 598 229 133 Income from scrap sales 8,015,541 134 Miscellaneous income 577.200 135 Gain on disposa retirement of PPE 515 446 136 Loss on disposal retirement of PPE 157 851 137 Realized forex (gain loss - Cash 57,554 138 Realized forex (gainyloss. Accounts Payable 4,149,039 139 Unrealized forex (gainoss-Cash 140 Unrealized forex (gainos - Accounts Payable 3,823,207 141 Provision for Income Tax - Current 121,341,081 142 Provision for Income Tax-Deferred 88,259,200 143 Gain on revaluation of land - OCI 671,135,209 144 Unrealized loss on financial assets at FVOCI - OCI 3,199,545 145 Loss on remeasurement of retirement liability - OCI 62,111,145 146 24,815,460,751 24,815,460,751 147 148 Additional information: 149 Ending Inventory 150 Raw Materials 636,759,304 151 Goods in Process 14,434 667 152 Finished Goods 1,028,377,924 153 154 Allocation of expenses Manufacturing Selling 155 Overhead Expenses 156 Compensation expense 344,060,693 157 Retirement benefit expense 16,607,574 158 Other employee benefit expense 64 470,618 159 Sales promotions 641.408,369 160 Freight and storage 400,499,134 161 Advertising and commissions 156,088,105 162 Provision for warranty claims 67,830,925 163 Research and development 74,583,358 164 Electricity, gas and water 84,094,710 165 Repairs and maintenance 56,375,848 166 Travel 13,277,711 167 Insurance 11.494,301 168 Taxes and dues 4,261,158 169 Other manufacturing overhead 60.443.065 170 Provision for inventory writedown 131.830,402 171 Technical assistance fees 172 Brand license fees 173 Outsourcing 174 Communications 175 Rent 176 Other general and administrative expenses 177 Depreciation and amortization 213,007,314 178 179 Indirect materials and labor 180 Indirect materials 43,065,874 181 Indirect labor 187,835,092 182 183 Other Information 184 1. The temporary investments are 90-day treasury bills. 185 2. The right of use asset is accounted for (and presented) as part of property, plant and equipment 186 3. The financial asset at FVOCI is an investment in equity shares in utility companies 187 188 109 General and Administrative 293,088.738 14,147,192 54,919,416 2,717,158 6,432,376 95,014,042 36.293,845 17,317.756 44,169,971 183,881,413 87,067,735 66,761,475 6,864.080 2,417,700 62.212,036 50.167,664