Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4) (a) Helix Incorporation uses a general ledger and a factory ledger. The following transactions took place: Dec. 1. Purchased materials for the factory,

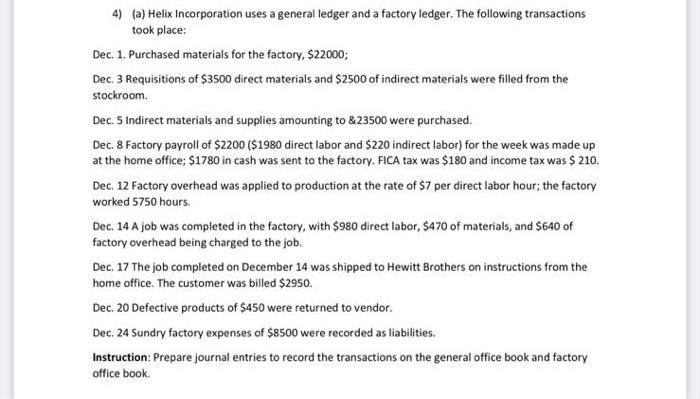

4) (a) Helix Incorporation uses a general ledger and a factory ledger. The following transactions took place: Dec. 1. Purchased materials for the factory, $22000; Dec. 3 Requisitions of $3500 direct materials and $2500 of indirect materials were filled from the stockroom. Dec. 5 Indirect materials and supplies amounting to &23500 were purchased. Dec. 8 Factory payroll of $2200 ($1980 direct labor and $220 indirect labor) for the week was made up at the home office; $1780 in cash was sent to the factory. FICA tax was $180 and income tax was $ 210. Dec. 12 Factory overhead was applied to production at the rate of $7 per direct labor hour; the factory worked 5750 hours. Dec. 14 A job was completed in the factory, with $980 direct labor, $470 of materials, and $640 of factory overhead being charged to the job. Dec. 17 The job completed on December 14 was shipped to Hewitt Brothers on instructions from the home office. The customer was billed $2950. Dec. 20 Defective products of $450 were returned to vendor. Dec. 24 Sundry factory expenses of $8500 were recorded as liabilities. Instruction: Prepare journal entries to record the transactions on the general office book and factory office book.

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries of Factory office book Date Dec 1 Dec 3 Dec 5 Dec 8 Dec 8 Dec 12 Dec 14 Dec 17 Dec 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started