Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. (a) (i) Explain carefully the difference between selling a put option and buying a call option. Write down the two payoffs and draw their

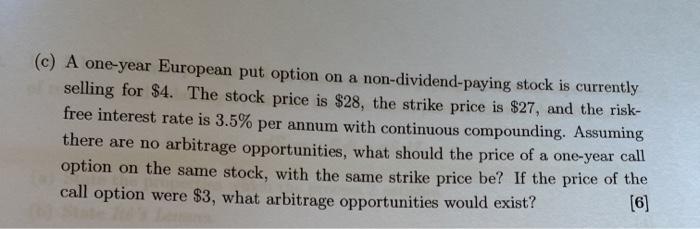

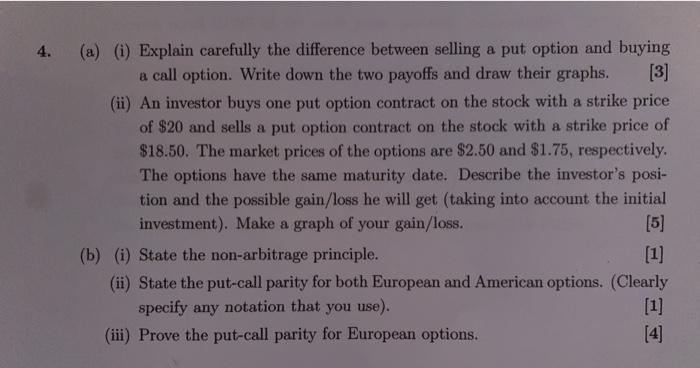

4. (a) (i) Explain carefully the difference between selling a put option and buying a call option. Write down the two payoffs and draw their graphs. [3] (i) An investor buys one put option contract on the stock with a strike price of $20 and sells a put option contract on the stock with a strike price of $18.50. The market prices of the options are $2.50 and $1.75, respectively. The options have the same maturity date. Describe the investor's posi- tion and the possible gain/loss he will get taking into account the initial investment). Make a graph of your gain/loss. [5] (b) (i) State the non-arbitrage principle. (ii) State the put-call parity for both European and American options. (Clearly specify any notation that you use). [1] (iii) Prove the put-call parity for European options. [4] (c) A one-year European put option on a non-dividend-paying stock is currently selling for $4. The stock price is $28, the strike price is $27, and the risk- free interest rate is 3.5% per annum with continuous compounding. Assuming there are no arbitrage opportunities, what should the price of a one-year call option on the same stock, with the same strike price be? If the price of the call option were $3, what arbitrage opportunities would exist? [6] (c) A one-year European put option on a non-dividend-paying stock is currently selling for $4. The stock price is $28, the strike price is $27, and the risk- free interest rate is 3.5% per annum with continuous compounding. Assuming there are no arbitrage opportunities, what should the price of a one-year call option on the same stock, with the same strike price be? If the price of the call option were $3, what arbitrage opportunities would exist? [6]

4. (a) (i) Explain carefully the difference between selling a put option and buying a call option. Write down the two payoffs and draw their graphs. [3] (i) An investor buys one put option contract on the stock with a strike price of $20 and sells a put option contract on the stock with a strike price of $18.50. The market prices of the options are $2.50 and $1.75, respectively. The options have the same maturity date. Describe the investor's posi- tion and the possible gain/loss he will get taking into account the initial investment). Make a graph of your gain/loss. [5] (b) (i) State the non-arbitrage principle. (ii) State the put-call parity for both European and American options. (Clearly specify any notation that you use). [1] (iii) Prove the put-call parity for European options. [4] (c) A one-year European put option on a non-dividend-paying stock is currently selling for $4. The stock price is $28, the strike price is $27, and the risk- free interest rate is 3.5% per annum with continuous compounding. Assuming there are no arbitrage opportunities, what should the price of a one-year call option on the same stock, with the same strike price be? If the price of the call option were $3, what arbitrage opportunities would exist? [6] (c) A one-year European put option on a non-dividend-paying stock is currently selling for $4. The stock price is $28, the strike price is $27, and the risk- free interest rate is 3.5% per annum with continuous compounding. Assuming there are no arbitrage opportunities, what should the price of a one-year call option on the same stock, with the same strike price be? If the price of the call option were $3, what arbitrage opportunities would exist? [6]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started