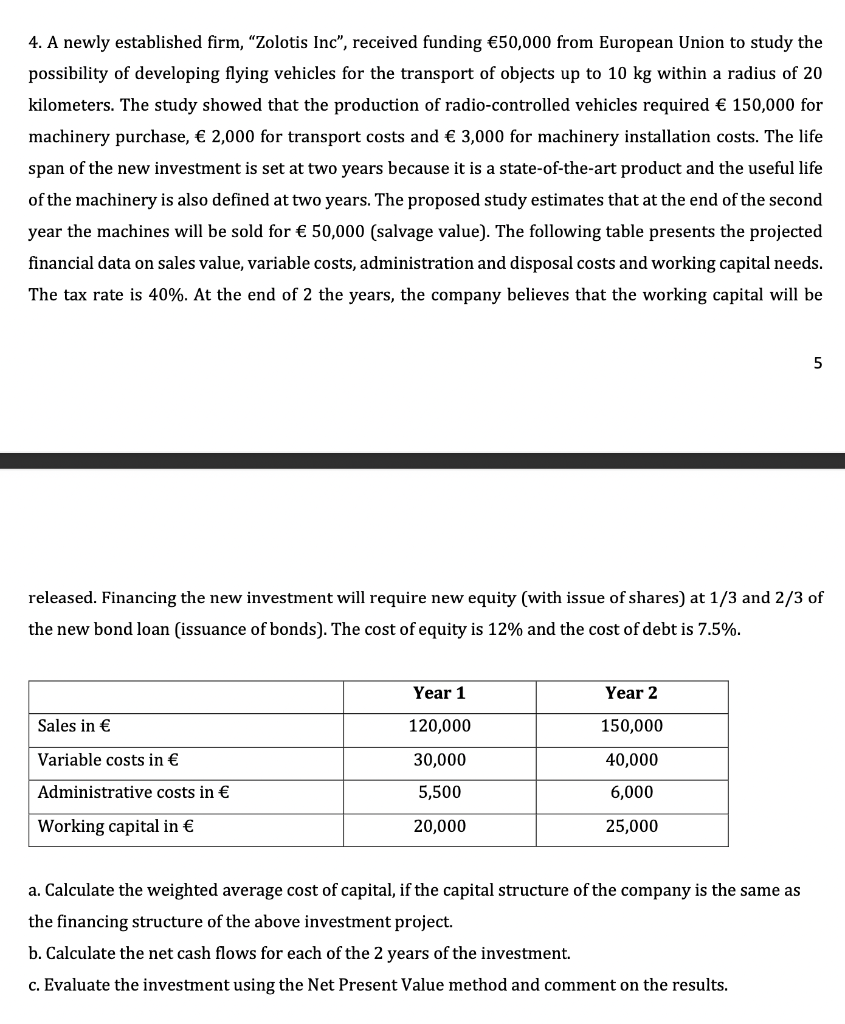

4. A newly established firm, "Zolotis Inc", received funding 50,000 from European Union to study the possibility of developing flying vehicles for the transport of objects up to 10 kg within a radius of 20 kilometers. The study showed that the production of radio-controlled vehicles required 150,000 for machinery purchase, 2,000 for transport costs and 3,000 for machinery installation costs. The life span of the new investment is set at two years because it is a state-of-the-art product and the useful life of the machinery is also defined at two years. The proposed study estimates that at the end of the second year the machines will be sold for 50,000 (salvage value). The following table presents the projected financial data on sales value, variable costs, administration and disposal costs and working capital needs. The tax rate is 40%. At the end of 2 the years, the company believes that the working capital will be 5 released. Financing the new investment will require new equity (with issue of shares) at 1/3 and 2/3 of the new bond loan (issuance of bonds). The cost of equity is 12% and the cost of debt is 7.5%. Year 1 Year 2 Sales in 120,000 150,000 Variable costs in 30,000 40,000 Administrative costs in 5,500 6,000 Working capital in 20,000 25,000 a. Calculate the weighted average cost of capital, if the capital structure of the company is the same as the financing structure of the above investment project. b. Calculate the net cash flows for each of the 2 years of the investment. c. Evaluate the investment using the Net Present Value method and comment on the results. 4. A newly established firm, "Zolotis Inc", received funding 50,000 from European Union to study the possibility of developing flying vehicles for the transport of objects up to 10 kg within a radius of 20 kilometers. The study showed that the production of radio-controlled vehicles required 150,000 for machinery purchase, 2,000 for transport costs and 3,000 for machinery installation costs. The life span of the new investment is set at two years because it is a state-of-the-art product and the useful life of the machinery is also defined at two years. The proposed study estimates that at the end of the second year the machines will be sold for 50,000 (salvage value). The following table presents the projected financial data on sales value, variable costs, administration and disposal costs and working capital needs. The tax rate is 40%. At the end of 2 the years, the company believes that the working capital will be 5 released. Financing the new investment will require new equity (with issue of shares) at 1/3 and 2/3 of the new bond loan (issuance of bonds). The cost of equity is 12% and the cost of debt is 7.5%. Year 1 Year 2 Sales in 120,000 150,000 Variable costs in 30,000 40,000 Administrative costs in 5,500 6,000 Working capital in 20,000 25,000 a. Calculate the weighted average cost of capital, if the capital structure of the company is the same as the financing structure of the above investment project. b. Calculate the net cash flows for each of the 2 years of the investment. c. Evaluate the investment using the Net Present Value method and comment on the results