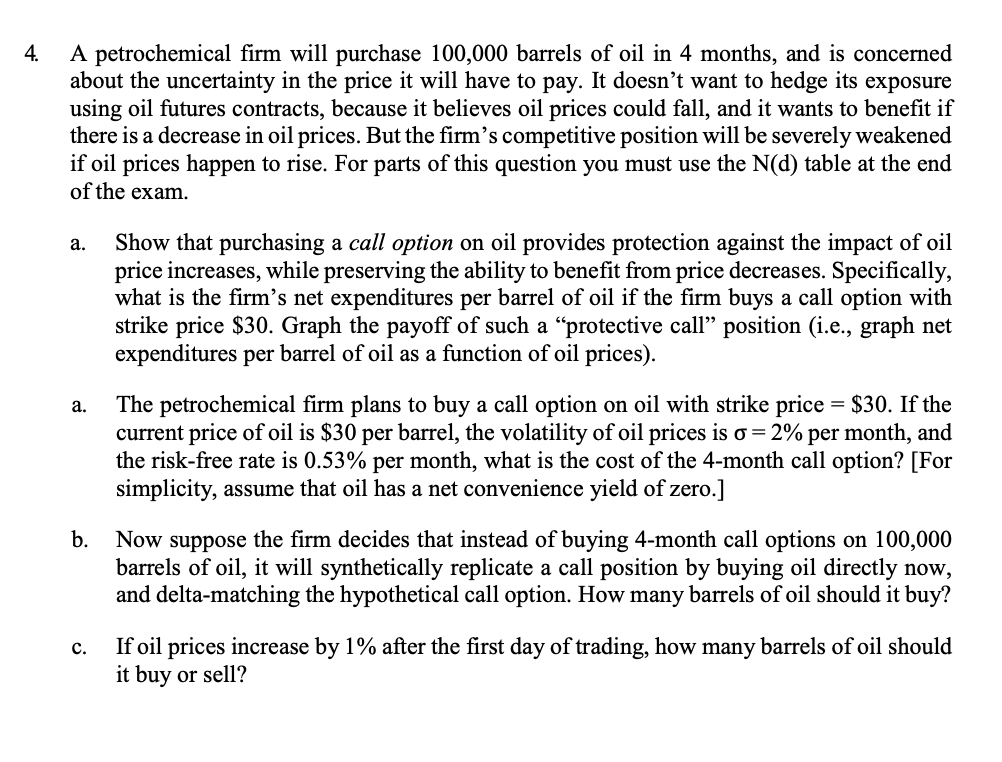

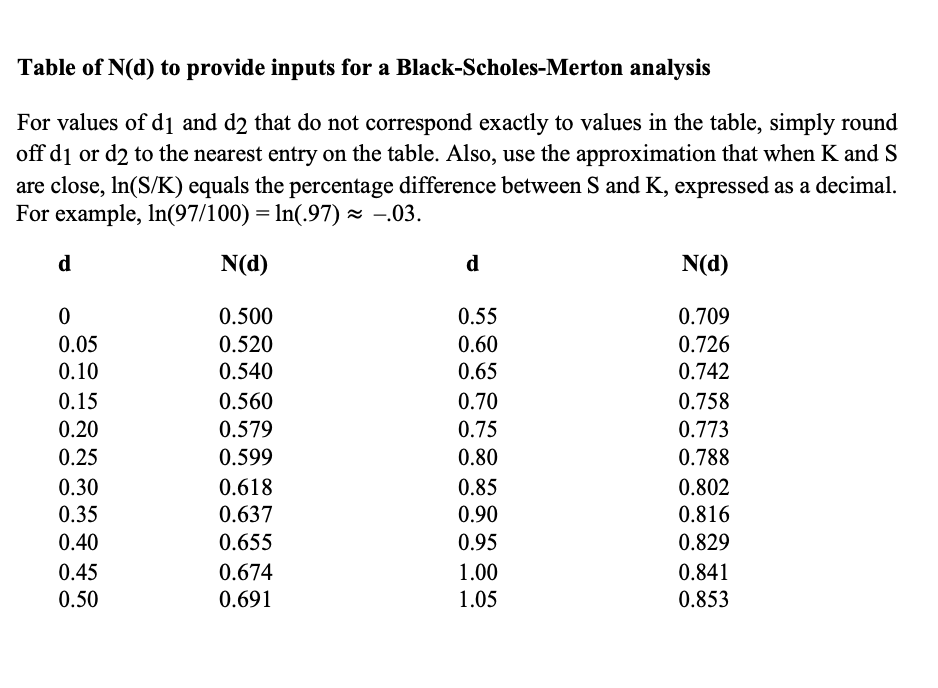

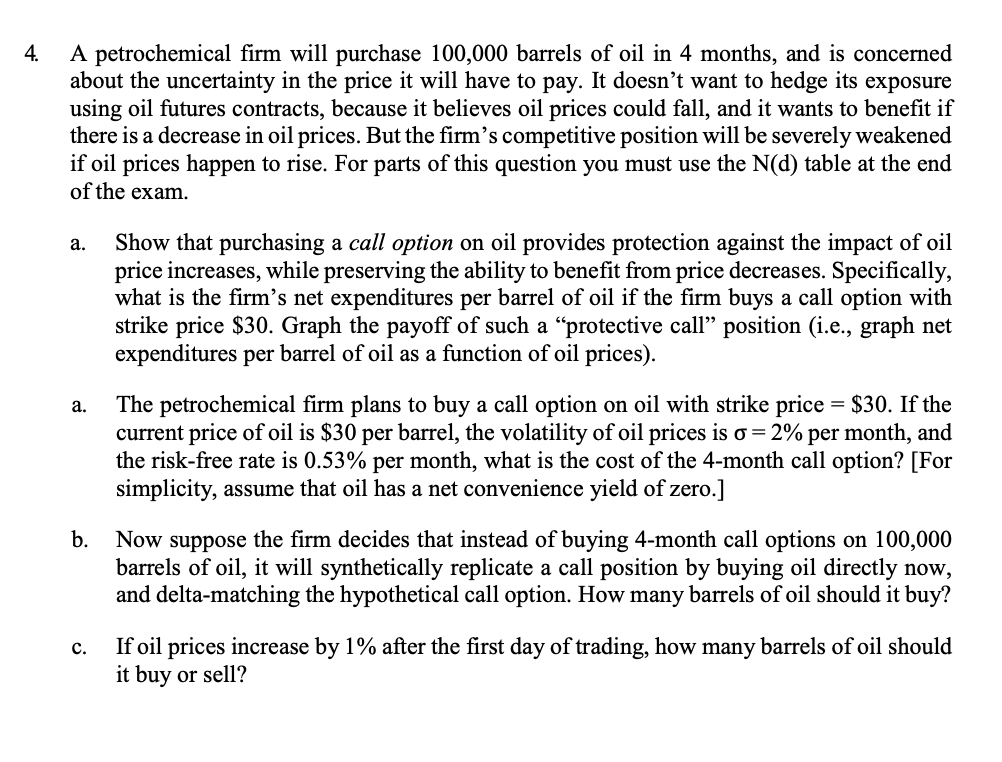

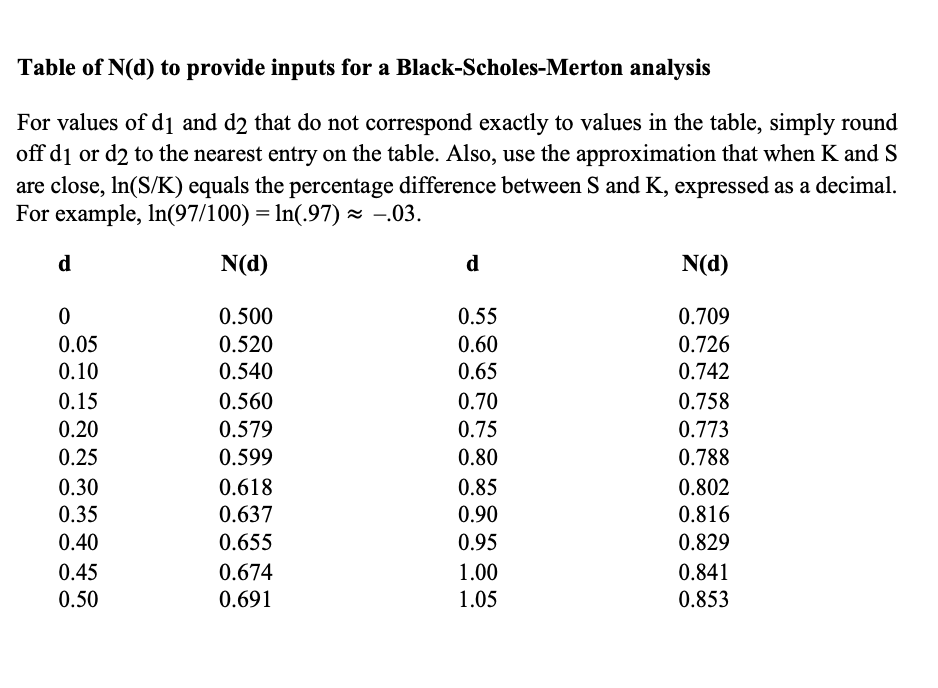

4. A petrochemical firm will purchase 100,000 barrels of oil in 4 months, and is concerned about the uncertainty in the price it will have to pay. It doesn't want to hedge its exposure using oil futures contracts, because it believes oil prices could fall, and it wants to benefit if there is a decrease in oil prices. But the firm's competitive position will be severely weakened if oil prices happen to rise. For parts of this question you must use the N(d) table at the end of the exam. a. Show that purchasing a call option on oil provides protection against the impact of oil price increases, while preserving the ability to benefit from price decreases. Specifically, what is the firm's net expenditures per barrel of oil if the firm buys a call option with strike price $30. Graph the payoff of such a protective call position (i.e., graph net expenditures per barrel of oil as a function of oil prices). a. The petrochemical firm plans to buy a call option on oil with strike price = $30. If the current price of oil is $30 per barrel, the volatility of oil prices is o=2% per month, and the risk-free rate is 0.53% per month, what is the cost of the 4-month call option? simplicity, assume that oil has a net convenience yield of zero.] b. Now suppose the firm decides that instead of buying 4-month call options on 100,000 barrels of oil, it will synthetically replicate a call position by buying oil directly now, and delta-matching the hypothetical call option. How many barrels of oil should it buy? c. If oil prices increase by 1% after the first day of trading, how many barrels of oil should it buy or sell? Table of N(d) to provide inputs for a Black-Scholes-Merton analysis For values of dj and d2 that do not correspond exactly to values in the table, simply round off dj or d2 to the nearest entry on the table. Also, use the approximation that when K and S are close, In(S/K) equals the percentage difference between S and K, expressed as a decimal. For example, In(97/100) = ln(.97) -.03. d N(d) d N(d) 0 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 0.500 0.520 0.540 0.560 0.579 0.599 0.618 0.637 0.655 0.674 0.691 0.55 0.60 0.65 0.70 0.75 0.80 0.85 0.90 0.95 1.00 1.05 0.709 0.726 0.742 0.758 0.773 0.788 0.802 0.816 0.829 0.841 0.853 4. A petrochemical firm will purchase 100,000 barrels of oil in 4 months, and is concerned about the uncertainty in the price it will have to pay. It doesn't want to hedge its exposure using oil futures contracts, because it believes oil prices could fall, and it wants to benefit if there is a decrease in oil prices. But the firm's competitive position will be severely weakened if oil prices happen to rise. For parts of this question you must use the N(d) table at the end of the exam. a. Show that purchasing a call option on oil provides protection against the impact of oil price increases, while preserving the ability to benefit from price decreases. Specifically, what is the firm's net expenditures per barrel of oil if the firm buys a call option with strike price $30. Graph the payoff of such a protective call position (i.e., graph net expenditures per barrel of oil as a function of oil prices). a. The petrochemical firm plans to buy a call option on oil with strike price = $30. If the current price of oil is $30 per barrel, the volatility of oil prices is o=2% per month, and the risk-free rate is 0.53% per month, what is the cost of the 4-month call option? simplicity, assume that oil has a net convenience yield of zero.] b. Now suppose the firm decides that instead of buying 4-month call options on 100,000 barrels of oil, it will synthetically replicate a call position by buying oil directly now, and delta-matching the hypothetical call option. How many barrels of oil should it buy? c. If oil prices increase by 1% after the first day of trading, how many barrels of oil should it buy or sell? Table of N(d) to provide inputs for a Black-Scholes-Merton analysis For values of dj and d2 that do not correspond exactly to values in the table, simply round off dj or d2 to the nearest entry on the table. Also, use the approximation that when K and S are close, In(S/K) equals the percentage difference between S and K, expressed as a decimal. For example, In(97/100) = ln(.97) -.03. d N(d) d N(d) 0 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 0.500 0.520 0.540 0.560 0.579 0.599 0.618 0.637 0.655 0.674 0.691 0.55 0.60 0.65 0.70 0.75 0.80 0.85 0.90 0.95 1.00 1.05 0.709 0.726 0.742 0.758 0.773 0.788 0.802 0.816 0.829 0.841 0.853