Answered step by step

Verified Expert Solution

Question

1 Approved Answer

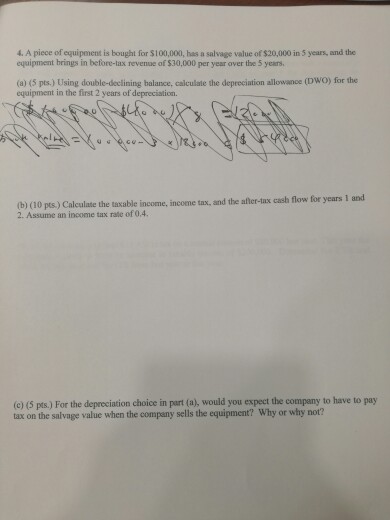

4. A piece of equipement is bought for $100,000, has a salvage value of $20,000 in 5 years, and the equipment brings in before-lax revenne

4. A piece of equipement is bought for $100,000, has a salvage value of $20,000 in 5 years, and the equipment brings in before-lax revenne of $30,000 per year over the 5 years. (o) (5 pts.) Using double-declining balance, calculate the depreciation allowance (DWo) for the equipment in the first 2 years of depreciation. after-tax cash flow for years 1 and (b) (10 pts.) Calculate the taxable income, income tax, and the 2. Assume an income tax rate of 0.4. (e) (5 pts.) For the depreciation choice in part (a), would you expect the company to have to pay tax on the salvage value when the company sells the equipment? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started