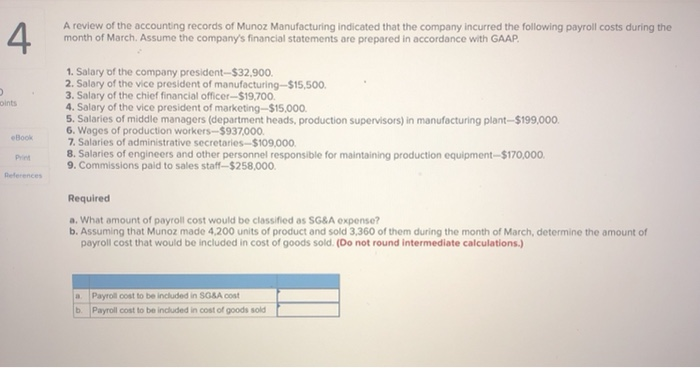

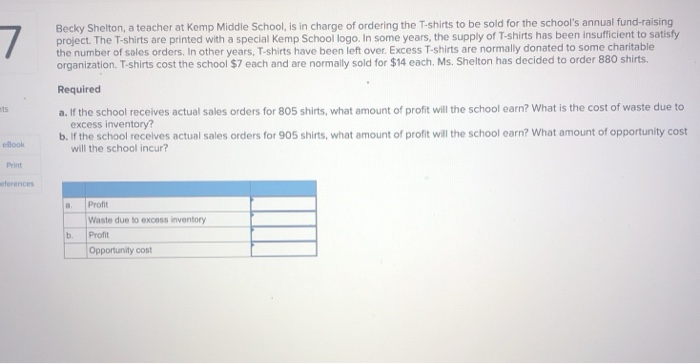

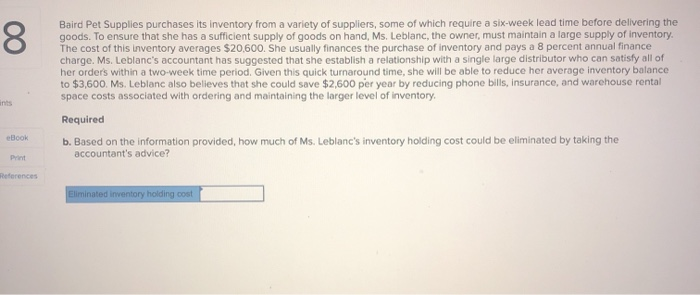

4. A review of the accounting records of Munoz Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. oints 1. Salary of the company president-$32,900. 2. Salary of the vice president of manufacturing-S15,500. 3. Salary of the chief financial officer-$19,700. 4. Salary of the vice president of marketing-$15,000. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$199,000. 6. Wages of production workers-5937,000. 7. Salaries of administrative secretaries-$109,000 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$170,000, 9. Commissions paid to sales staff-$258,000 Book References Required a. What amount of payroll cost would be classified as SG&A expense? b. Assuming that Munoz made 4,200 units of product and sold 3,360 of them during the month of March, determine the amount of payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.) 3. Payroll cost to be included in SG&A cost b. Payroll cost to be included in cost of goods sold 7 Becky Shelton, a teacher at Kemp Middle School, is in charge of ordering the T-shirts to be sold for the school's annual fund-raising project. The T-shirts are printed with a special Kemp School logo. In some years, the supply of T-shirts has been insufficient to satisfy the number of sales orders. In other years, T-shirts have been left over. Excess T-shirts are normally donated to some charitable organization. T-shirts cost the school $7 each and are normally sold for $14 each, Ms. Shelton has decided to order 880 shirts, Required a. If the school receives actual sales orders for 805 shirts, what amount of profit will the school earn? What is the cost of waste due to excess inventory? b. If the school receives actual sales orders for 905 shirts, what amount of profit will the school carn? What amount of opportunity cost will the school incur? eBook Print werferences Profit Waste due to excess inventory Profit Opportunity cost b. 00 Baird Pet Supplies purchases its inventory from a variety of suppliers, some of which require a six-week lead time before delivering the goods. To ensure that she has a sufficient supply of goods on hand, Ms. Leblanc, the owner, must maintain a large supply of inventory The cost of this inventory averages $20,600. She usually finances the purchase of inventory and pays a 8 percent annual finance charge. Ms. Leblanc's accountant has suggested that she establish a relationship with a single large distributor who can satisfy all of her orders within a two-week time period. Given this quick turnaround time, she will be able to reduce her average inventory balance to $3,600. Ms. Leblanc also believes that she could save $2,600 per year by reducing phone bills, insurance, and warehouse rental space costs associated with ordering and maintaining the larger level of inventory Required b. Based on the information provided, how much of Ms. Leblanc's inventory holding cost could be eliminated by taking the accountant's advice? Book Print References Eliminated inventory holding cost 9 The CFO of the Fanning Microscope Corporation intentionally misclassified a downstream transportation expense in the amount of $680,800 as a product cost in an accounting period when the company made 9,200 microscopes and sold 6,600 microscopes. Fanning rewards its officers with bonuses that are based on net earnings Required a. Indicate whether the elements on the financial statements (ie, assets. liabilities, stockholders' equity, revenue, expense, and net income) would be overstated or understated as a result of the misclassification of the downstream transportation expense. Determine the amount of the overstatement or understatement for each element. (If there is no effect select "Not affected" from the dropdown provided. Enter all answers as positive values.) Wints Book Print References Assets Liabilities Retained earings Revenue Expense Net income