Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. A shock to aggregate supply will also have different outcomes when there are different assumptions about the formation of the level of expected

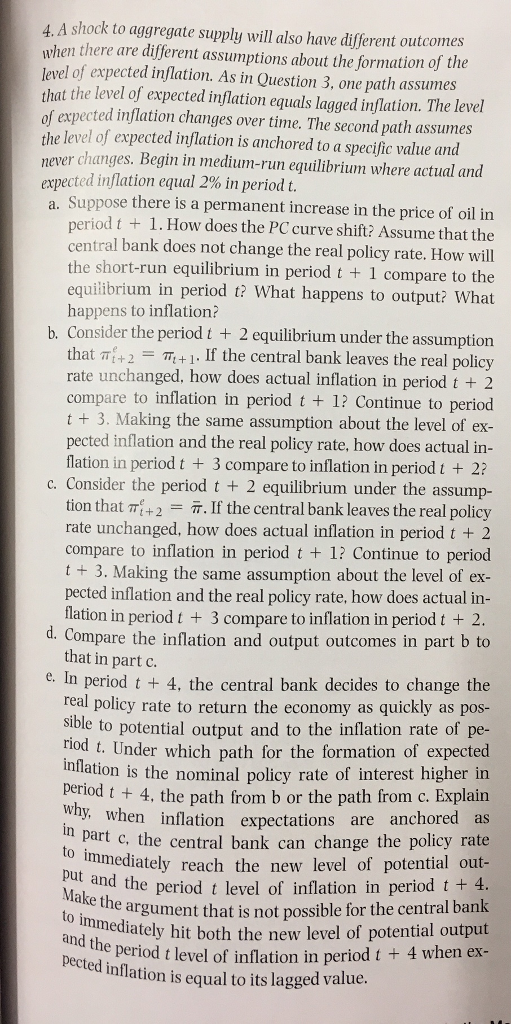

4. A shock to aggregate supply will also have different outcomes when there are different assumptions about the formation of the level of expected inflation. As in Question 3, one path assumes that the level of expected inflation equals lagged inflation. The level of expected inflation changes over time. The second path assumes the level of expected inflation is anchored to a specific value and never changes. Begin in medium-run equilibrium where actual and expected inflation equal 2% in period t. a. Suppose there is a permanent increase in the price of oil in period t + 1. How does the PC curve shift? Assume that the central bank does not change the real policy rate. How will the short-run equilibrium in period t + 1 compare to the equilibrium in period t? What happens to output? What happens to inflation? b. Consider the period t + 2 equilibrium under the assumption that +2 +1. If the central bank leaves the real policy rate unchanged, how does actual inflation in period t + 2 compare to inflation in period t + 1? Continue to period t + 3. Making the same assumption about the level of ex- pected inflation and the real policy rate, how does actual in- flation in period t + 3 compare to inflation in period t + 2? c. Consider the period t + 2 equilibrium under the assump- tion that +2 = 7. If the central bank leaves the real policy rate unchanged, how does actual inflation in period t + 2 compare to inflation in period t + 1? Continue to period t + 3. Making the same assumption about the level of ex- pected inflation and the real policy rate, how does actual in- flation in period t + 3 compare to inflation in period t + 2. d. Compare the inflation and output outcomes in part b to that in part c. e. In period t + 4, the central bank decides to change the real policy rate to return the economy as quickly as pos- sible to potential output and to the inflation rate of pe- riod t. Under which path for the formation of expected inflation is the nominal policy rate of interest higher in period t + 4, the path from b or the path from c. Explain why, when inflation expectations are anchored as in part c, the central bank can change the policy rate to immediately reach the new level of potential out- put and the period t level of inflation in period t + 4. Make the argument that is not possible for the central bank to immediately hit both the new level of potential output and the period t level of inflation in period t + 4 when ex- pected inflation is equal to its lagged value.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution Quiz a If there is permanent rise in oil prices then all the sectors input cost will be increased immediately because energy is very integral ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started