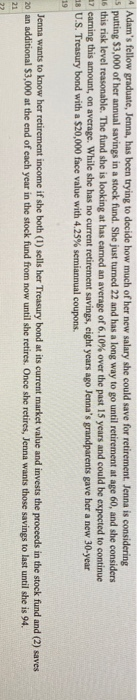

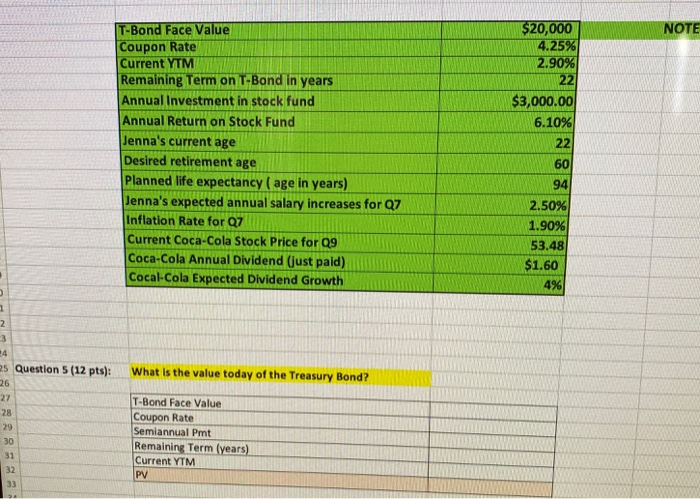

4 Adam's fellow graduate, Jenna, has been trying to decide how much of her new salary she could save for retirement Jenna is considering 5 putting $3,000 of her annual savings in a stock fund. She just turned 22 and has a long way to go until retirement at age 60, and she considers 6 this risk level reasonable. The fund she is looking at has earned an average of 6.10% over the past 15 years and could be expected to continue az caring this amount, on average. While she has no current retirement savings, eight years ago Jenna's grandparents gave her a new 30-year 18 U.S. Treasury bond with a $20,000 face value with 4.25% semiannual coupons. Jenna wants to know her retirement income if she both (1) sells her Treasury bond at its current market value and invests the proceeds in the stock fund and (2) saves 20 an additional $3,000 at the end of each year in the stock fund from now until she retires. Once she retires, Jenna wants those savings to last until she is 94. WWWWWWWWWY NOTE $20,000 4.25% 2.90% $3,000.00 6.10% T-Bond Face Value Coupon Rate Current YTM Remaining Term on T-Bond in years Annual Investment in stock fund Annual Return on Stock Fund Jenna's current age Desired retirement age Planned life expectancy ( age in years) Jenna's expected annual salary increases for Q7 Inflation Rate for Q7 Current Coca-Cola Stock Price for 09 Coca-Cola Annual Dividend (just paid) Cocal-Cola Expected Dividend Growth 2.50% 1.90% 53.48 $1.60 4% ONS 25 Question 5 (12 pts): What is the value today of the Treasury Bond? T-Bond Face Value Coupon Rate Semiannual Pmt Remaining Term (years) Current YTM PV Question (12 pts Treasury Bond PV Number orareve me van Step 1: Find how much money will by the time she retires OOSSEX Step 1 FV of saving from age 22-63 SE ZA withdrawal amount beginning age Step 2: Orke you know how much lena saves by retirement, this will become leme PV that are Find payment withdrawal Jenna gets each war la retirement Question 7(12 pts): Step 1: Find Cash flow for Jenna from now until retirement Return on stock fundir, X) S Step 2: Find FV at Retirement Step 3: les 4 Adam's fellow graduate, Jenna, has been trying to decide how much of her new salary she could save for retirement Jenna is considering 5 putting $3,000 of her annual savings in a stock fund. She just turned 22 and has a long way to go until retirement at age 60, and she considers 6 this risk level reasonable. The fund she is looking at has earned an average of 6.10% over the past 15 years and could be expected to continue az caring this amount, on average. While she has no current retirement savings, eight years ago Jenna's grandparents gave her a new 30-year 18 U.S. Treasury bond with a $20,000 face value with 4.25% semiannual coupons. Jenna wants to know her retirement income if she both (1) sells her Treasury bond at its current market value and invests the proceeds in the stock fund and (2) saves 20 an additional $3,000 at the end of each year in the stock fund from now until she retires. Once she retires, Jenna wants those savings to last until she is 94. WWWWWWWWWY NOTE $20,000 4.25% 2.90% $3,000.00 6.10% T-Bond Face Value Coupon Rate Current YTM Remaining Term on T-Bond in years Annual Investment in stock fund Annual Return on Stock Fund Jenna's current age Desired retirement age Planned life expectancy ( age in years) Jenna's expected annual salary increases for Q7 Inflation Rate for Q7 Current Coca-Cola Stock Price for 09 Coca-Cola Annual Dividend (just paid) Cocal-Cola Expected Dividend Growth 2.50% 1.90% 53.48 $1.60 4% ONS 25 Question 5 (12 pts): What is the value today of the Treasury Bond? T-Bond Face Value Coupon Rate Semiannual Pmt Remaining Term (years) Current YTM PV Question (12 pts Treasury Bond PV Number orareve me van Step 1: Find how much money will by the time she retires OOSSEX Step 1 FV of saving from age 22-63 SE ZA withdrawal amount beginning age Step 2: Orke you know how much lena saves by retirement, this will become leme PV that are Find payment withdrawal Jenna gets each war la retirement Question 7(12 pts): Step 1: Find Cash flow for Jenna from now until retirement Return on stock fundir, X) S Step 2: Find FV at Retirement Step 3: les