Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Albion and Blaze share profits and losses equally. Albion and Blaze receive salary allowances of $20,000 and $30,000, respectively, and both partners receive

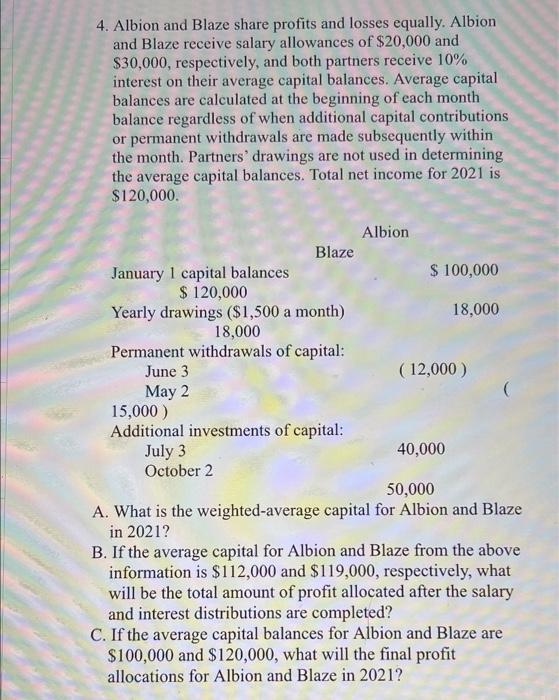

4. Albion and Blaze share profits and losses equally. Albion and Blaze receive salary allowances of $20,000 and $30,000, respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are calculated at the beginning of each month balance regardless of when additional capital contributions or permanent withdrawals are made subsequently within the month. Partners' drawings are not used in determining the average capital balances. Total net income for 2021 is $120,000. January 1 capital balances $ 120,000 Yearly drawings ($1,500 a month) 18,000 Permanent withdrawals of capital: June 3 May 2 Blaze 15,000) Additional investments of capital: July 3 October 2 Albion $ 100,000 18,000 (12,000) 40,000 50,000 A. What is the weighted-average capital for Albion and Blaze in 2021? B. If the average capital for Albion and Blaze from the above information is $112,000 and $119,000, respectively, what will be the total amount of profit allocated after the salary and interest distributions are completed? C. If the average capital balances for Albion and Blaze are $100,000 and $120,000, what will the final profit allocations for Albion and Blaze in 2021?

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a StepbyStep explanation Weighted average capital Albion 11...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started