Answered step by step

Verified Expert Solution

Question

1 Approved Answer

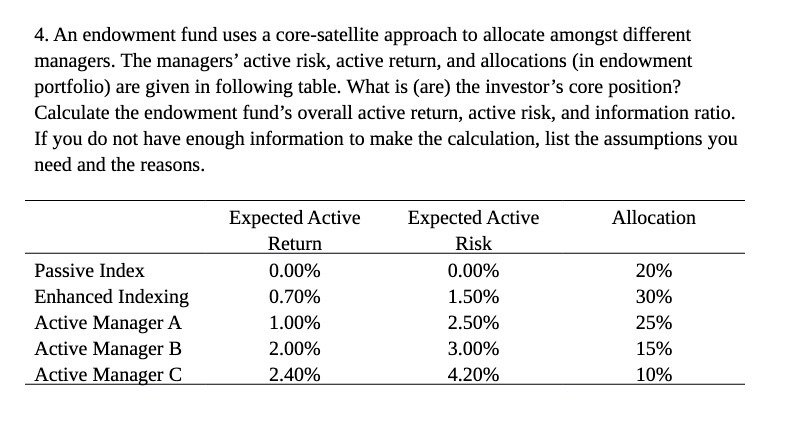

4. An endowment fund uses a core-satellite approach to allocate amongst different managers. The managers' active risk, active return, and allocations (in endowment portfolio)

4. An endowment fund uses a core-satellite approach to allocate amongst different managers. The managers' active risk, active return, and allocations (in endowment portfolio) are given in following table. What is (are) the investor's core position? Calculate the endowment fund's overall active return, active risk, and information ratio. If you do not have enough information to make the calculation, list the assumptions you need and the reasons. Passive Index Enhanced Indexing Active Manager A Active Manager B Active Manager C Expected Active Return 0.00% 0.70% 1.00% 2.00% 2.40% Expected Active Risk 0.00% 1.50% 2.50% 3.00% 4.20% Allocation 20% 30% 25% 15% 10%

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a table of information about an endowment fund that uses a coresatellite approach to allocate assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started