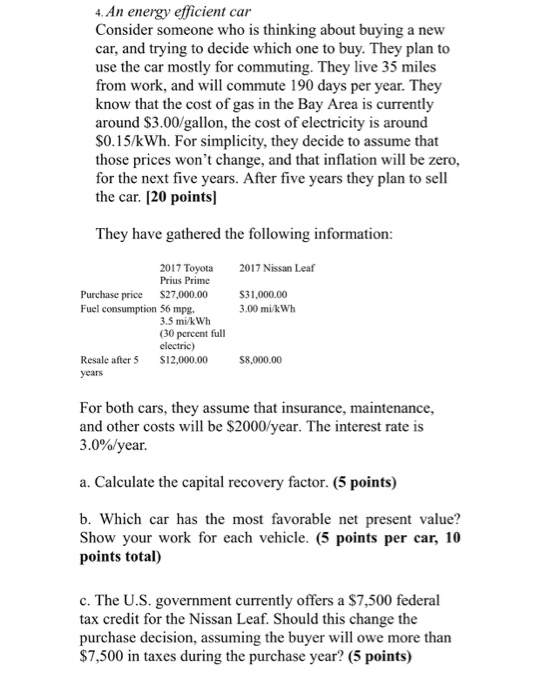

4. An energy efficient car Consider someone who is thinking about buying a new car, and trying to decide which one to buy. They plan to use the car mostly for commuting. They live 35 miles from work, and will commute 190 days per year. They know that the cost of gas in the Bay Area is currently around $3.00/gallon, the cost of electricity is around $0.15/kWh. For simplicity, they decide to assume that those prices won't change, and that inflation will be zero, for the next five years. After five years they plan to sell the car. [20 points) They have gathered the following information: 2017 Nissan Leaf $31,000.00 3.00 mi/kWh 2017 Toyota Prius Prime Purchase price $27,000.00 Fuel consumption 56 mpg. 3.5 mi/kWh (30 percent full electric) Resale after 5 S12,000.00 years $8.000.00 For both cars, they assume that insurance, maintenance, and other costs will be $2000/year. The interest rate is 3.0%/year. a. Calculate the capital recovery factor. (5 points) b. Which car has the most favorable net present value? Show your work for each vehicle. (5 points per car, 10 points total) c. The U.S. government currently offers a $7,500 federal tax credit for the Nissan Leaf. Should this change the purchase decision, assuming the buyer will owe more than $7,500 in taxes during the purchase year? (5 points) 4. An energy efficient car Consider someone who is thinking about buying a new car, and trying to decide which one to buy. They plan to use the car mostly for commuting. They live 35 miles from work, and will commute 190 days per year. They know that the cost of gas in the Bay Area is currently around $3.00/gallon, the cost of electricity is around $0.15/kWh. For simplicity, they decide to assume that those prices won't change, and that inflation will be zero, for the next five years. After five years they plan to sell the car. [20 points) They have gathered the following information: 2017 Nissan Leaf $31,000.00 3.00 mi/kWh 2017 Toyota Prius Prime Purchase price $27,000.00 Fuel consumption 56 mpg. 3.5 mi/kWh (30 percent full electric) Resale after 5 S12,000.00 years $8.000.00 For both cars, they assume that insurance, maintenance, and other costs will be $2000/year. The interest rate is 3.0%/year. a. Calculate the capital recovery factor. (5 points) b. Which car has the most favorable net present value? Show your work for each vehicle. (5 points per car, 10 points total) c. The U.S. government currently offers a $7,500 federal tax credit for the Nissan Leaf. Should this change the purchase decision, assuming the buyer will owe more than $7,500 in taxes during the purchase year? (5 points)