Answered step by step

Verified Expert Solution

Question

1 Approved Answer

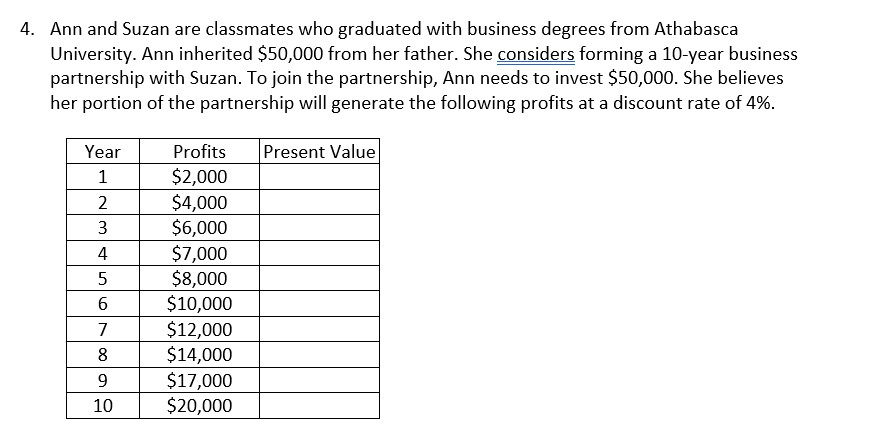

4. Ann and Suzan are classmates who graduated with business degrees from Athabasca University. Ann inherited $50,000 from her father. She considers forming a

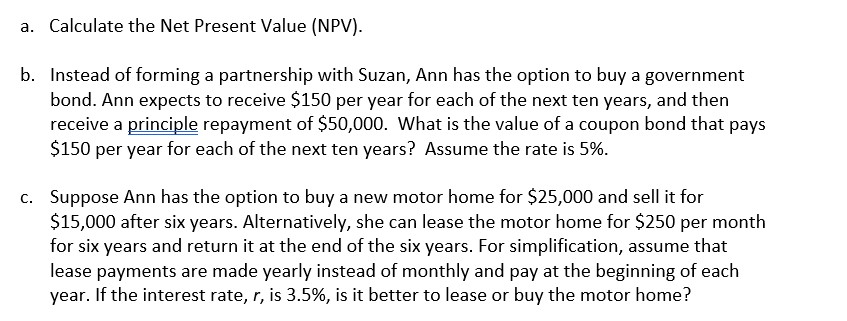

4. Ann and Suzan are classmates who graduated with business degrees from Athabasca University. Ann inherited $50,000 from her father. She considers forming a 10-year business partnership with Suzan. To join the partnership, Ann needs to invest $50,000. She believes her portion of the partnership will generate the following profits at a discount rate of 4%. Present Value Year Profits 1 $2,000 2 $4,000 3 $6,000 4 $7,000 5 $8,000 6 $10,000 7 $12,000 8 $14,000 9 $17,000 10 $20,000 a. Calculate the Net Present Value (NPV). b. Instead of forming a partnership with Suzan, Ann has the option to buy a government bond. Ann expects to receive $150 per year for each of the next ten years, and then receive a principle repayment of $50,000. What is the value of a coupon bond that pays $150 per year for each of the next ten years? Assume the rate is 5%. c. Suppose Ann has the option to buy a new motor home for $25,000 and sell it for $15,000 after six years. Alternatively, she can lease the motor home for $250 per month for six years and return it at the end of the six years. For simplification, assume that lease payments are made yearly instead of monthly and pay at the beginning of each year. If the interest rate, r, is 3.5%, is it better to lease or buy the motor home?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started